Platform best-buy lists are designed to help investors allocate assets by highlighting the funds with the potential to stay ahead of the competition.

Every fund is judged for its ability to deliver on its investment goal and to add diversification to portfolios, but performance is also an important factor to consider.

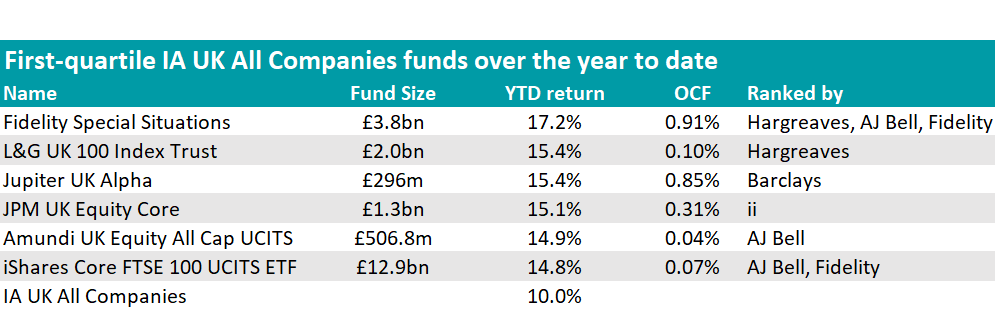

In this series, Trustnet is analysing the year-to-date performance of the funds currently backed by the main investment platforms in the UK – today, it’s the turn of the IA UK All Companies sector.

The platform with the highest number of outperformers was AJ Bell, which ranked three first-quartile performers: Fidelity Special Situations (17.2% year to date), Amundi UK Equity All Cap (14.9%) and iShares Core FTSE 100 UCITS ETF (14.8%).

Of the three, Fidelity Special Situation is the only actively managed strategy, with FE fundinfo Alpha Manager Alex Wright at the helm, supported by Jonathan Winton. Their strategy is to look in unloved areas of the UK market for stocks with the potential to rerate.

Ranked by analysts at Fidelity and Hargreaves Lansdown as well, AJ Bell added the fund to its list in 2024.

AJ Bell analysts said “investors are well served by this contrarian investment approach”, which looks for overlooked or unloved companies with a catalyst for change that hasn’t been factored in by the market.

At the helm is the “experienced” Alex Wright, who has a long tenure at Fidelity investing in this style.

The strategy had a negative 2023 but was able to turn things around and closed 2024 in seventh position out of 215 peers. It has carried that outperformance over to 2025.

Investors have seemingly been taking a closer look at the UK this year, with the FTSE 100 breaking record highs throughout 2025.

This explains the dominance of the iShares and Amundi tracker funds, which were able to achieve first-quartile returns (the latter was also a recent addition for AJ Bell, which added it to its Favourite Funds list in 2024).

Hargreaves’ and Fidelity’s best-buy lists followed a similar pattern to AJ Bell. Both had two top-quartile funds in their rankings – Fidelity Special Situation was one of them, complimented a FTSE-100 tracker, as shown in the table below.

Source: Trustnet

Interactive investor (ii) and Barclays only had one top-quartile performer so far this year – JPM UK Equity Core and Jupiter UK Alpha, respectively.

The former is a benchmark-aware strategy, meaning that it broadly holds the same shares as the index, ii analysts noted. However, it takes slight bets on shares and sectors that are viewed as having the highest potential to outperform.

“The fund is clearly managed as a core UK equity offering, with deviations from the FTSE All-Share Index closely monitored, and should not therefore be expected to produce high levels of outperformance,” they said.

“However, the process has shown its ability to deliver relatively consistent alpha over time, net of the competitive fund-level fees.”

The Jupiter UK Alpha fund is co-managed by Ed Meier and Errol Francis, who are known for their high-conviction and contrarian approach, typically buying a large number of shares in a few names, Barclays analysts said.

“The hope is that this can lead to stronger returns because the fund manager has fewer stocks to focus on. The flip side is potentially higher volatility, because poor performance of an individual holding can have a bigger impact than in it would if the portfolio was more diverse.”

They stressed investors need to be “prepared to hold their nerve” and invest in this fund for the long term as returns over the short term can be volatile.

Finally, among the underperformers, Liontrust UK Growth stood out.

Hargreaves, AJ Bell and Fidelity all rank it in their best-buy lists, making it one of the most platform-recommended funds in 2025 despite its recent underperformance.

So far this year, it has returned a mere 2.5% versus a sector-average of 10% (it ranked 199th in the 219-strong sector), but it also performed poorly in 2024 and 2023 (ninth decile against its peers). In the longer term, the numbers are more positive, with a second-quartile return over 10 years.

The portfolio is more invested in mid- and small-caps (around 30% of the fund), which have languished versus their large-cap peers in recent years and may have contributed to this relative slide in performance.

Hargreaves analysts continue to rank manager Anthony Cross “highly” and praised his “astute stock picking” and “robust investment process, which has served investors well over the years”.

Cross ran the fund with long-time co-manager Julian Fosh, before the latter’s retirement from fund management at the start of this year.