Investors have an “overplayed fear” of value traps, which is holding many of them back, according to Schroders’ Andrew Lyddon.

“As a value investor, you must make peace with the fact that you will get involved in some value traps. It’s impossible to get things 100% right, all the time,” the manager explained.

However, many investors are unwilling to accept this and have become overly cautious, looking for value traps where they do not exist and refusing to take risks on some more exciting companies.

Lyddon said: “The market has started to treat value traps almost like recessions and overestimate how many there are. In fact, maybe about three or four of the next 10 companies the market has identified as value traps are unsalvageable.”

Very few companies are 100% structurally challenged, with many having strong fundamental business models that are being hidden by short-term weakness. Often, a change in manager and strategy can cause a turnaround in businesses that many people would consider uninvestable, he said.

“We’re always happy to invest in companies that are high risk because if there’s a good core business within, we think we’re going to benefit when the good bits of the company finally get separated from the bad,” Lyddon said.

While owning these companies can feel embarrassing in the moment, value investors should not let it prevent them from taking risks. He said: “If you behave as though you don’t want the embarrassment of being involved in a value trap, you’ll never buy anything exciting.”

Indeed, he explained that many of the best performers in his Schroder European Recovery fund would have been considered value traps two years ago, that “most would have refused to touch with a barge pole”.

He flagged European bank Société Générale (Soc Gen) as a key example of this. Despite European banks rallying in recent years as the outlook for the asset class improved, Soc Gen remained relatively unloved.

“Soc Gen’s shares languished for a long time while those of its peers were rallying, as the bank was deemed a low-quality value trap with lower returns on equity and too much dependence on investment banking revenue.”

As a result, all it needed was a “tiny little push” through better earnings and a “credible path to more normal returns on equity”, leading to a sharp rally that many investors were unprepared for, he said.

Over the past year, Soc Gen has become one of the best performers in the Schroder European Recovery portfolio, up 145%. This demonstrates how “fast-moving” these recoveries can be.

Share price of Société Générale over the past year

Source: Google Finance

He also pointed to oil and gas contractor Tecnicas Reunidas as another example of a former value trap that has become a top performer.

It is a company in an “unglamorous” industry that operates in a fiercely competitive market, which investors had dismissed as unimpressive until recently, he explained.

However, these energy contractors are mostly cyclical, so have started to rally more recently as energy companies have rapidly increased their investment.

“As one of the financially stronger contractors, Tecnicas has secured a lot of work in a supportive environment for margins,” Lyddon explained.

Over the past year, the share price has climbed 99%.

Share price of Tecnicas Reunidas over the past year

Source: Google Finance

While owning a value trap can be difficult to stomach, examples like Soc Gen demonstrate that, in many cases, investors are being held back by “irrational fears” over certain companies.

He conceded that while no one wants to be left owning a value trap (and most managers would struggle to justify it) investors should not be terrified of owning one either.

“It’s only by being a little brave and being willing to accept that you’ll probably be wrong and buy some value traps that you enable yourself to access the business that will eventually recover. Over time, those will more than offset the ones that do badly.”

Investors should remember to think in averages – taking risks as a value investor means “we’ll probably underperform three years out of five, but we’ll make that back with a couple of impressive years”. While this may be difficult to stomach at first, over the long term, it will deliver impressive returns for investors, Lyddon said.

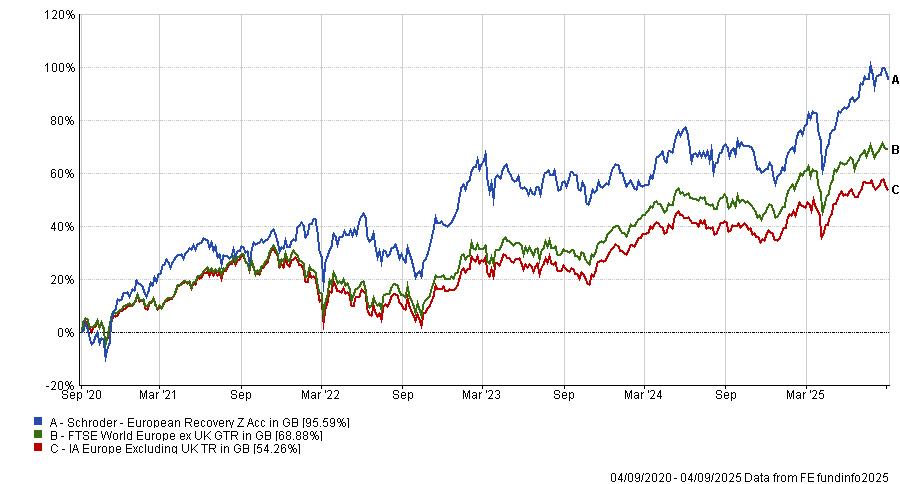

This approach has paid off for the Schroder European Recovery fund, which has delivered top-quartile returns in the IA Europe ex UK sector over the past five years, despite being one of the worst funds in the peer group in 2024.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics