As markets debate the path of interest rates, Jon Mawby, co-manager of the Pictet Strategic Credit fund, is turning his attention squarely to the UK, and he does not like what he sees.

“The one market I'm very bearish on at the moment is the UK. It's a small, open economy with a political regime that seems to be falling apart, and that's not somewhere I generally want to be invested,” he said.

The turmoil the country is in, he argued, is not confined to politics but extends to the Bank of England, whose decisions tend to have global repercussions.

“What happens in our economy generally happens in the US after 18 months – it's all correlated. All my eyes are on the UK at the moment.”

To avoid disaster, he expects the monetary committee to act decisively: “The Bank of England will have to cut rates probably fairly aggressively before the end of the year, at least 75 basis points,” he said.

His projection is based on economic data (“consumer trends are going down so quickly”) but also anecdotal observations: (“I've got three kids and the cost of living is going absolutely monumental”).

If the UK is the most pressing concern, Mawby sees more stability elsewhere, for example the US.

While many are worrying about Donald Trump’s interference with the Federal Reserve, through his attempts to influence its head Jerome Powell and ouster members who are not in favour of rate cuts, Mawby sees the US as more stable ground.

“If they get rid of Powell, they will probably appoint someone who will cut rates aggressively – Trump is not going to appoint someone who will raise rates. For me the US is way more stable,” he argued, as at least there is a clear expectation for the path of rates.

Germany, meanwhile, falls somewhere in between. “Consumer demand in Germany has dropped off enormously and you have the same political maelstrom as in the UK, but they have a bigger economy and, for lack of a better term, the country is more stoic than the UK.”

Against this backdrop, the fund has been positioned defensively. At the moment, the manager is focusing on short-dated hybrids, national champions and national champion AT1 bonds, which give “the biggest yield for the lowest risk.”

That positioning reflects caution about valuations. “I'm not particularly constructive on markets at the moment and those short-dated corporate hybrids in national champion investment-grade names have a natural liquidity event in the next 12 to 18 months”.

The portfolio also carries a 10% allocation to emerging markets, particularly in hard-currency corporate bonds rather than sovereigns. In them, Mawby finds “good fundamentals, lower leverage and decent yields”.

“To me they look more attractive than a lot of developed-market credit right now.”

The strategy is designed to remain patient until more attractive opportunities arise. At present, he is looking to redeploy capital into high yield “when we get a market correction”, but has not pulled the trigger yet as this has yet to occur.

“When will it come? It's impossible to say – I've been calling for it for three years, but we're getting closer to it. Risk markets are getting more and more overpriced,” he said.

Duration, too, has been kept under control, currently at 4.5 years.

Mawby describes Pictet Strategic Credit as deliberately contrarian and value-driven. “We try to go where the value is, which is generally the contrarian part, and the value-driven part is the bottom of credit selection.”

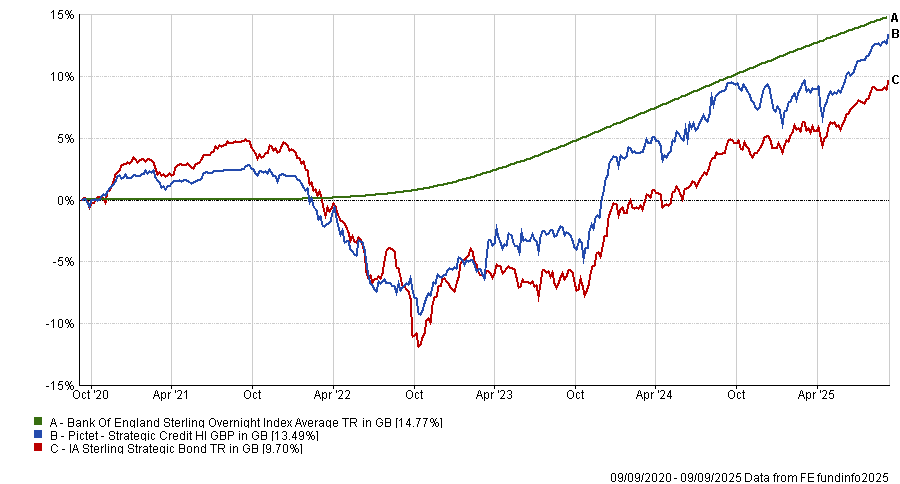

With a track record stretching five years, the fund has maintained an average second-quartile performance against its IA Sterling Strategic Bond peers across key time frames, with the exception of the past 12 months, when it slipped to the third.

Performance of fund against index and sector since start of data

Source: FE Analytics

Ultimately, Mawby views the fund’s role as a diversifier.

“We don't aim to be active beta on the upside but to be a diversifier when risk assets start to sell off,” he concluded.