FE fundinfo Alpha Manager Nick Train has said the past few years have been “among the most disappointing of my career” after his £2.1bn WS Lindsell Train UK Equity fund dropped to the second quartile over 10 years for the first time in its almost two-decade history.

For 108 straight months between July 2016 and June 2025 the fund boasted a top-quartile 10-year return among its IA UK All Companies peers. However, in July 2025 it slipped to the second quartile, where it remained in August.

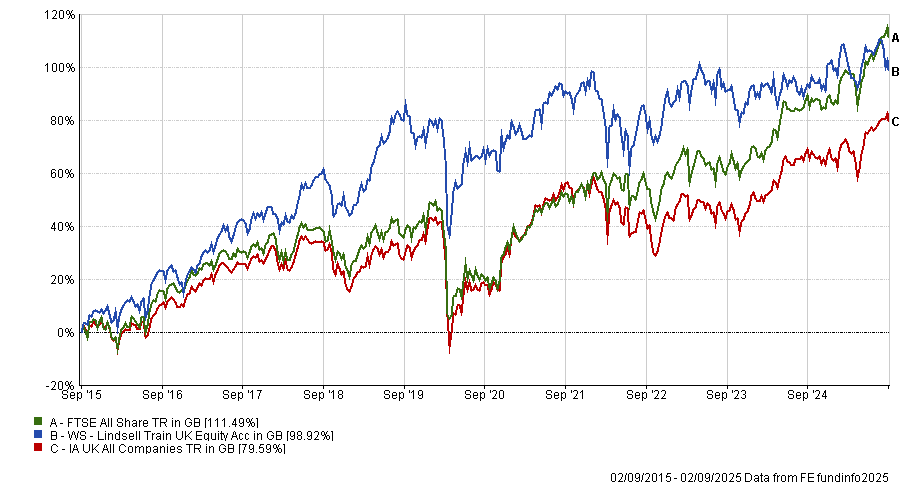

It comes after a disappointing run over the past half-decade, in which the portfolio has made just 20.3%, a fourth-quartile return in the sector.

This is some 33.5 percentage points behind the average peer and 57.4 percentage points below the FTSE All Share benchmark. It leaves WS Lindsell Train UK Equity around 12 percentage points behind the index over 10 years, although still 16 percentage points ahead of the average peer.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The manager has repeatedly apologised to investors in recent years for his fund’s underperformance, with many reasons given for his recent poor returns.

Speaking to Trustnet, Train said: “The reasons for our underperformance are simply stated. Our UK Equity fund has always had a concentrated portfolio, focused on companies we believe have the potential to be long-term winners – an approach that helped the fund deliver strong absolute and relative returns up until 2021.

“Looking back over the past five years, not enough of our big positions have worked for the fund for a variety of reasons.”

One headwind has been the dominance of value strategies, which have benefited from a resurgent oil price and (more recently) a rapid rise in the price of gold. The WS Lindsell Train UK Equity fund has no exposure to either oil majors or mining companies, both of which have shone during this time.

However, while his ‘growth-oriented’ strategy has come under pressure, Train conceded that “this simple statement only tells part of the story”.

The Alpha Manager explained that he has conducted a “significant and deliberate shift” to his portfolio, which “it is fair to say that this shift has not yet produced the returns we hope for”.

In 2020, almost half of the fund was invested in consumer brands & franchises, a weighting which he admitted was “probably too high” and has since come down to nearer 30%.

Although he still believes world-class consumer companies “are a great way to protect and grow wealth over time”, especially those with exposure to premium or luxury brands, he thinks there are other investment themes in the UK stock market that offer “even better prospects”. “In recent years we have tilted the portfolio towards them,” he explained.

For example, when looking back at 2020, Train now believes the fund had insufficient exposure to companies whose services are becoming more relevant as the 21st century progresses.

Specifically, he noted there were not enough ‘digital winners’, such as data, software and technology platform companies.

“Over the past few years we have sought to rectify that and today our exposure to UK-listed digital winners stands at around 60%,” he said, highlighting credit score company Experian, financial institution London Stock Exchange Group, analytics firm Relx, online estate agent Rightmove, payments software specialist Sage, online car supermarket Autotrader and shipping service provider Clarkson.

“We believe investors may be underestimating the extent to which earnings growth will accelerate for [these] companies, as they apply new analytical tools and capabilities to their data assets and provide deeper and wider-reaching utility to their customers,” said Train.

However, this does not mean he has given up on consumer stocks. While drinks brand Diageo – known for owning Guinness, Smirnoff and Johnnie Walker – has been one of his worst performers in recent times, he continues to keep faith.

“One of the companies that has weighed on performance more recently has been Diageo, which we believe offers exceptional value at these levels and we have added to it where we can,” he said.

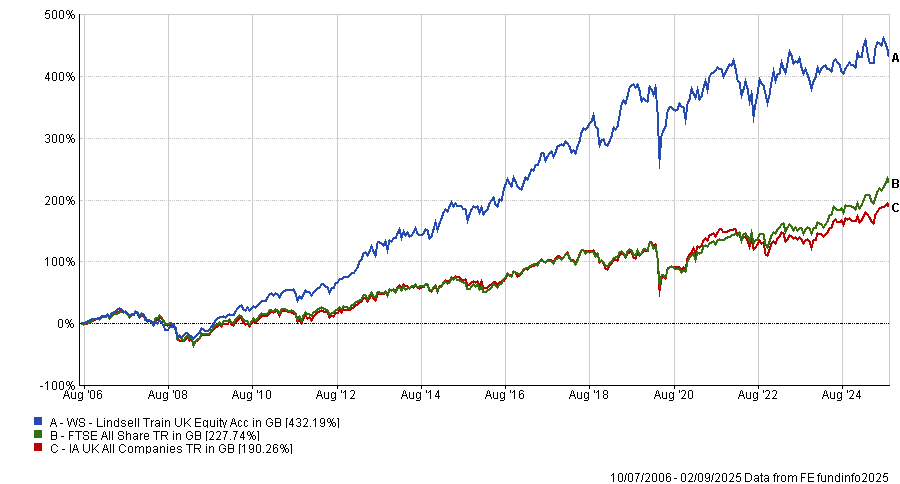

Overall, the manager said he was “proud” of WS Lindsell Train UK Equity’s long-term track record. Indeed, since its launch in 2006 it has made 432.2%, more than double the average peer and more than 200 percentage points ahead of the FTSE All Share index.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

And he remains optimistic for the future, despite the past few years being “among the most disappointing” of his career.

“I can remember few times that I have been so excited by the prospects for the portfolio, comprised of companies with multi-decade growth opportunities at more than reasonable valuations in my view,” he concluded.