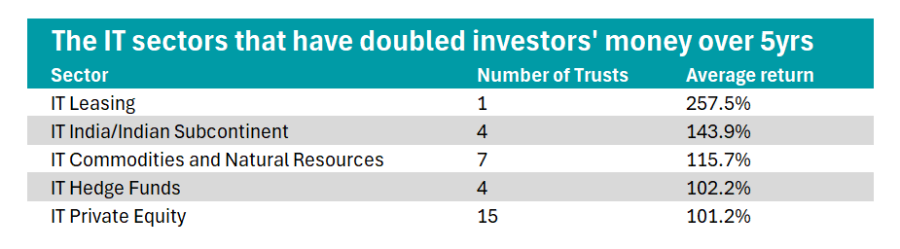

Five investment trust sectors have delivered an average return of more than 100% in the past five years, Trustnet research has found.

For this study, we removed all trusts without a five-year track record from the data, leading to one less portfolio in the IT Private Equity and IT Leasing peer groups than are currently in the peer groups.

Source: FE Analytics. Returns in sterling to the end of July

Analysts noted that some sectors came with caveats that investors should be aware of. For example, IT leasing was the clear winner, partially because only one trust had the full track record: Amedeo Air Four Plus.

Ryan Lightfoot-Aminoff, senior trust analyst at Kepler, attributed its strong performance to a surge of “revenge spending” towards airlines after the pandemic, as travel resumed.

Further down the table, IT Hedge funds are up 102% on average, but analysts at Winterflood flagged that this was driven by the £10.6m Alternative Liquidity Limited trust, which surged 244%.

By comparison, no other trust in the peer group delivered a return above 77%, so the sector did not double investors' money if stripping out this anomalous contributor.

Below, experts highlight the other sectors on the table.

India

Firstly, we turn to the IT India/Indian Subcontinent peer group, where the average trust was up 143.8%. In the past five years, three of the four trusts have made a return above 100%, with abrdn New India Trust narrowly falling short with a total return of 96%.

For Anthony Leatham, head of investment companies research at Peel Hunt, these strong performances are due to positive macro tailwinds.

“The powerhouse of Asia is one of the very few economies with the combination of real growth, pro-reform government policies, favourable demographics, rapid digitalisation and rising income levels,” he said.

At a stock-picking level, Leatham argued there are rich opportunities in small and mid-caps that Indian trusts have been taking advantage of.

For example, he flagged Ashoka India Equity Investment Trust’s 54% allocation to small caps and its “differentiated and proprietary investment approach” as one of the main reasons for its 168% return.

Alex Trett, analyst at Winterflood, added that Indian equities have benefited from the “emergence of a more multi-polar world”.

Foreign interest has been on the rise, particularly as investors sought alternatives to China due to its economic outlook and divergence from the West. “Against this backdrop, the constituents of the India investment trust peer group have delivered strong returns”, Trett concluded.

Commodities

Up next, the average trust in the IT Commodities and Natural Resources sector made a 115% total return, with Kepler’s Lightfoot-Aminoff noting that much of this return is likely to have come from one source: gold.

The yellow metal has posted a remarkable run over the past few years, he continued, partially because investors treat it “as a hedge against absolutely anything that could go wrong”.

However, Winterflood analyst Ashley Thomas noted that gold has not been the only story in the commodities sector over the past five years.

For example, Thomas flagged the BlackRock Energy and Resources Income trust, which is up 135%. This was attributed to its exposure to electrification securities in a period of rising power demand, as well as a “bounce back in traditional oil and gas holdings”.

Private equity

Private equity was another lucrative area. Across 15 trusts, the average return was 102.2%.

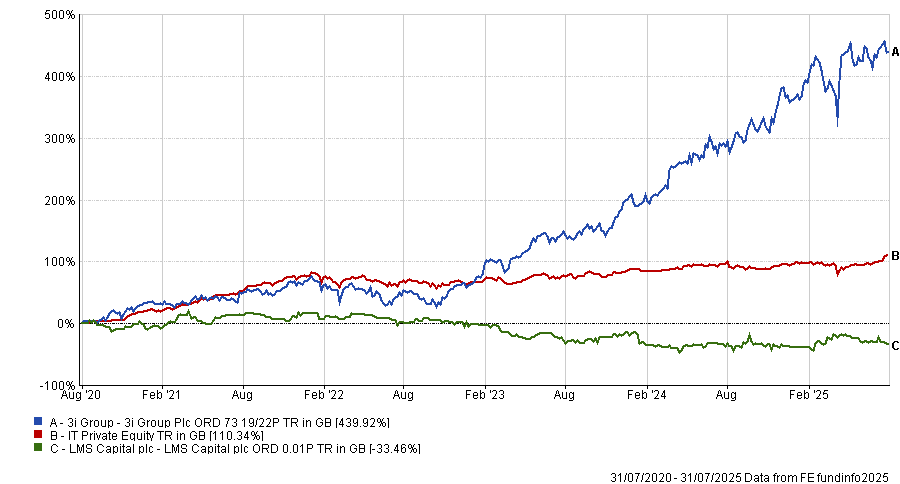

Much of the spectacular returns come from 3i Group, which is up more than 439%. This is primarily due to its allocation towards retailer Action, which has surged in value over the past five years.

There was a significant discrepancy in the returns of private equity strategies, with the worst trust, LMS Capital, down by 33.5% in comparison.

Performance of trusts vs sector over the past 5yrs

Source: FE Analytics

However, Shavar Halberstadt, senior analyst at Winterflood, noted that even when 3i Group was removed from the study, the sector still averaged a “respectable 78% total return”.

He said that investors should not be surprised by the success of many private equity trusts, because they aim to compound at rates of 20% per year, more than enough to double an investor's money over this period.

The sector is full of “highly diversified” strategies with exposure to top-quality private equity managers.

With the “excessive discrepancy” between share prices and fund returns declining in recent years, due to the emphasis on buybacks, the trusts are well-positioned to benefit from upticks in mergers and acquisitions and initial public offerings, he concluded.

Peel Hunt’s Leatham agreed, noting that we are entering a “turning point in market conditions” for private equity.

With many of the “fastest growing businesses in the world” remaining private for longer, private equity is set to continue delivering outsized returns.