Three funds have surged by more than 50% over the past five months, FE Analytics shows, as investors returned to large-tech stocks after the earlier tariff sell-off.

The early months of 2025 were challenging for US equities, with the market tanking after Donald Trump spent the first weeks of his presidency unveiling a series of new policies, including trade tariffs on most countries.

Between the start of the year and 21 April, the S&P 500 fell 17.8% (in sterling terms) – underperforming the 12.6% decline in the MSCI AC World index. During this time, investors started to rotate away from the US and towards areas such as Europe and emerging markets.

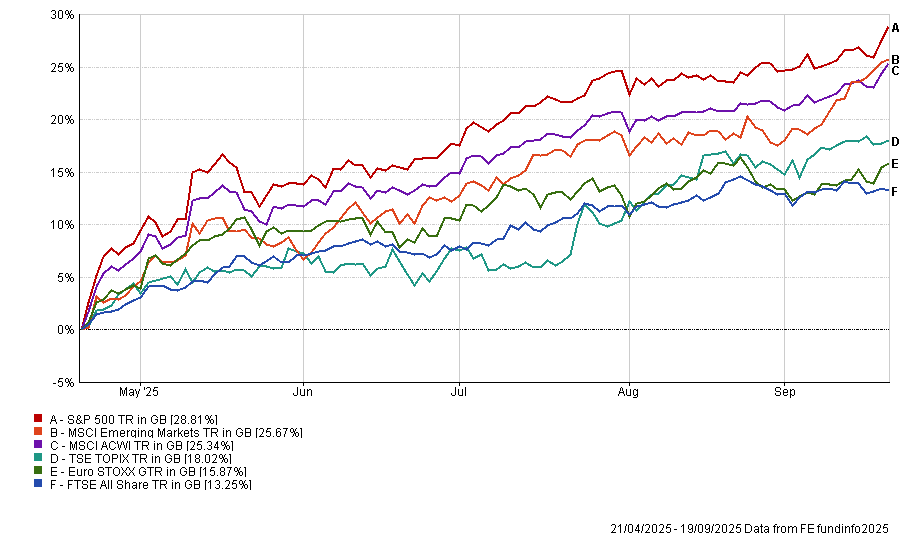

However, US stocks have been on an upswing in the five months since then and recently reached new record highs. Since 21 April, the S&P 500 has gained 28.8% compared with the MSCI AC World’s 25.3% gain.

Performance of US stocks vs other indices since 21 April

Source: FE Analytics. Total return in sterling between 21 Apr and 22 Sep 2025

On Friday, the S&P 500, Nasdaq and Dow Jones all reached new record highs. Hargreaves Lansdown senior equity analyst Matt Britzman said: “The Fed’s pivot toward rate cuts, even against a backdrop of sticky inflation, has markets betting on a softer landing rather than a policy misstep.

“A strong earnings season, free of major shocks, has only added fuel to the rally, leaving little on the near-term horizon to spoil the mood.”

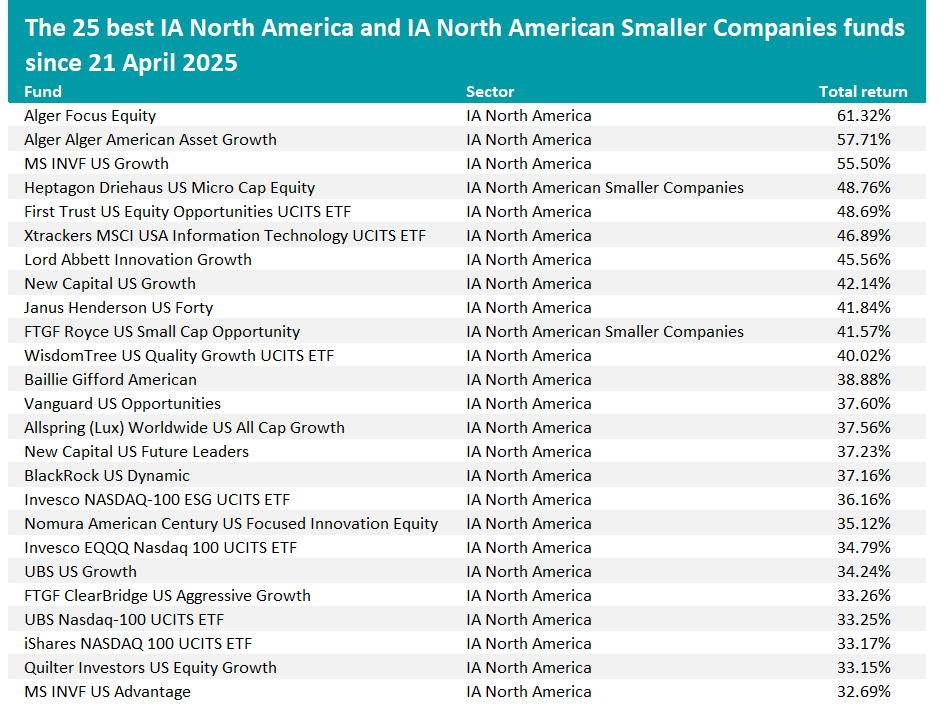

Against this backdrop, some IA North America and IA North American Smaller Companies funds have made spectacular returns in recent months. It might depend on the bullishness or bearishness of the individual reader on whether this is a positive or a negative indicator, however.

The best-performing US fund over the past five months has been Alger Focus Equity, which has made a 61.3% total return. When combined with its 19.3% loss at the start of the year, the fund has made 30.3% over 2025 to date – the second-best performance in the IA North America sector.

Run by Patrick Kelly and Ankur Crawford (both of whom hold FE fundinfo Alpha Manager status), the fund is a concentrated portfolio of around 50 stocks. Many of the fund’s holdings are large growth companies, which have led the market for an extended period but were among the hardest hit in the early 2025 sell-off.

Alger Focus Equity’s largest holdings include Nvidia, Microsoft, Amazon, Meta, Apple and Alphabet. These are six of the so-called Magnificent Seven, which have surged in recent years thanks to their exposure to the artificial intelligence (AI) megatrend.

However, the fund also has a significant weighting to AppLovin, which helps mobile app and game developers acquire users through mobile ads and then monetise those users. The company is up close to 185% since 21 April and joined the S&P 500 yesterday (22 September).

Tech (which has driven the recent outperformance across US funds) is a key theme of the portfolio, with information technology and communication services companies accounting for almost two-thirds of the fund’s assets.

At the end of 2025’s second quarter, Kelly and Crawford said: “We continued to observe secular themes that we believe are creating attractive investment opportunities – corporations are digitising their operations, cloud computing is growing and supporting innovation, and AI is at an inflexion point, potentially enabling significant increases in productivity.”

Source: FE Analytics. Total return in sterling between 21 Apr and 22 Sep 2025

FE fundinfo data shows that two additional IA North America funds have achieved total returns of more than 50% over the past five months: MS INVF US Growth (up 55.5%) and Alger American Asset Growth (up 57.7%).

MS INVF US Growth, managed by Dennis Lynch and his team, also focuses on US large-cap growth stocks but has slightly less in information technology and communication services than Alger Focus Equity – just over half of the portfolio.

Tesla is the only member of the Magnificent Seven among its top 10 holdings. Among the fund’s biggest positions are significant overweights to IT service management company Cloudflare, video game developer Roblox and AppLovin.

It is the strongest fund in the IA North America sector over 2025 so far, with a total return of 38.8%. Many constituents of the table above dropped into the fourth quarter when US markets sold off in the earlier part of the year, but MS INVF US Growth’s 10.8% loss was among the top quartile.

Alger American Asset Growth is run with the same approach as Alger Focus Equity (it is managed by Kelly and Crawford, who are joined by Dan Chung) but tends to invest in a larger number of companies.

The two funds do overlap in their top 10 holdings and broad sector allocations. However, Alger American Asset Growth has slightly less in companies with market capitalisations over $50bn (75% compared with 77.4%).

While these three funds are the only ones in the IA North America and IA North American Smaller Companies sectors that made more than 50% over the past five months, another eight are up more than 40% and a further 33 have made gains in excess of 30%.

In total, 90 funds from the two North American equity peer groups are outperforming the MSCI AC World’s 25.3% total return since 21 April.