It is a tough backdrop for investors, but Ben Conway, co-manager of the MI Hawksmoor Vanbrugh fund, is finding plenty to be optimistic about.

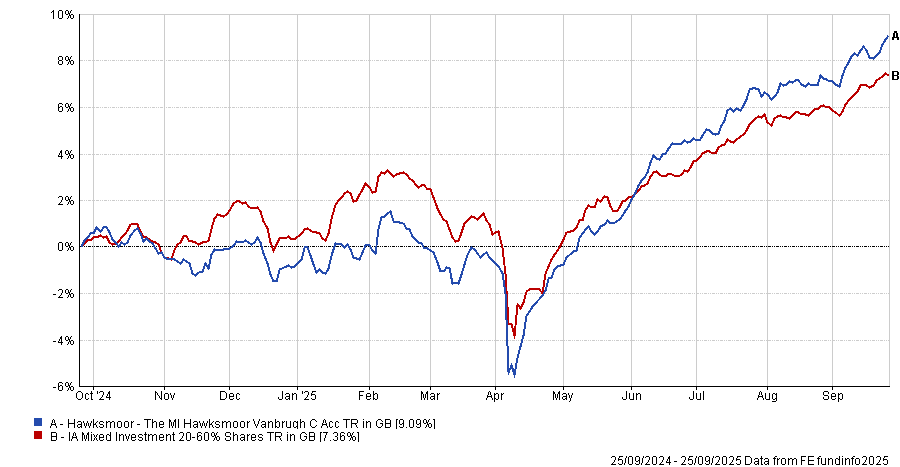

The £225m multi-asset strategy has delivered first-quartile returns over one, five and 10 years against its IA Mixed Investment 20-60% Shares peers, helped by a disciplined focus on cheap valuations and diversification.

Today, the portfolio leans on infrastructure, gold and smaller companies, while Conway highlights UK equities as “barely above-trough valuations” and ripe for active managers.

In this interview, he discusses the fund’s philosophy, his best and worst calls and where he sees opportunity next.

Performance of fund against index and sector over 1yr

Source: FE Analytics

How do you invest?

There are three key tenets to our philosophy. First, we make sure that everything we invest in has a margin of safety – a cheap valuation. We do that because we're not going to have a 100% hit rate and while we're waiting for an investment to play out, we want to limit our downside.

Second, we can't accurately forecast macroeconomic variables, so we don't do it. Our competence is in rigorous bottom-up research of assets to identify top-quality assets and top-quality managers.

Finally, we're unconstrained and diversified. Unconstrained means we don't have a benchmark – if something’s expensive, we don't want to be forced to invest in it. And for the portfolio to be robust to any macroeconomic outturn, it has to be diversified: we need assets that can perform well in some environments and others that do well in different ones.

Who is this fund for?

The investor we've got in mind is the person who wants to maximise total real return after taxes, which should be everybody. The minimum objective of Vanbrugh is to preserve wealth in real terms over at least three years. Obviously we try to do a lot better, but that’s the minimum. We are an all-weather, cautious total-return fund.

What was your best call of the year so far?

In the year to the end of August, gold equities have been our best contributor via a fund called Konwave Gold Equity, which contributed 1.6% returns from a 3.5% position – a stunning performer.

Everything clicked: the manager adding alpha and the asset class working. Gold equities have done really well because they were very cheap. They still are, even if the gold price has gone up a lot.

Does it make sense to invest in gold now?

Having a position in gold makes a huge amount of sense. We do have a position in physical gold as well. In a diversified portfolio, gold bullion makes sense in an era where currencies are likely to continue to be debased because of their positions in key economies.

Gold miners also benefit from a higher gold price, they’re managed better, and valuations are still very low. That suggests prospects for gold mining stocks in particular are still very good.

Our total exposure to the gold complex – bullion plus miners – is around 10%.

Conversely, what didn’t work out as well?

The worst contributor has been shipping, with Taylor Maritime (a 1.6% position) detracting 30 basis points.

The key thing when something disappoints is whether the investment thesis has been negated. With shipping it hasn’t, only it will take a long time to play out.

In the short term, there’s been softness in shipping rates related to cyclical concerns globally as economies have slowed. But the long-term thesis is strong. Demand is constant and the supply of good-quality ships is extremely constrained.

We’re maintaining our weighting in the trust.

Was this weakness a result of the new global trade order?

Headlines on tariffs and the end of globalisation are noise. The key factor for shipping is supply, not demand. Demand for staples carried by these ships grows with global population. Stuff always has to move from one continent to another – bananas, certain commodities. Over 80% of global trade goes by sea.

Which position would you consider a mistake?

We have a 60 basis-point position in Life Science REIT [real estate investment trust], which has been a poor investment and, in hindsight, I wish we hadn’t bought it.

We started buying some years ago at higher prices and averaged down, but it hasn’t worked. It was meant to buy life science properties – labs for biotechnology and medical science – but two things went against it: the interest rate environment and tenant demand being weaker than expected. The company has been through a strategic review and announced it is in wind-down.

It trades on a 50% discount to NAV [net asset value]. If the NAV is correct, you’re buying for 50p in the pound and doubling your money over time, but the market is sceptical about the prices it can achieve when selling properties. Even so, it would be wrong to sell today, as we should still make an acceptable return from these levels.

Where are you seeing opportunities at the moment?

We have kept our fixed income weights low because infrastructure valuations are fantastic and we think infrastructure risk is somewhat similar to fixed income.

In equities, too, there are opportunities because of the valuation dispersion. When dispersion is high, indices can look expensive, but active managers can put together cheap portfolios. That’s the shame of allocating only passively – you miss out. Even in the US, which looks expensive, below the S&P 500 and even within it, smaller companies still offer value. If you exclude loss-making companies from the Russell 2000, it’s cheaper than the S&P 500, because the big caps are so expensive.

The UK, European, Asian and Japanese markets are barely above-trough valuations, which excites us because the probability of active managers outperforming is very high. We’ve got quite high exposure to UK equities, not out of bias but because portfolios are cheap.

What do you do when you aren’t working?

I’ve got a 7-month-old and a 12- and 14-year-old, so sadly I don’t have much spare time. What I do love is going on long walks in the countryside.