Investors have been paying more attention to UK equity income, European equity and flexible investment trusts in 2025, as uncertain markets and a rotation from the US broaden their horizons.

The research activity of the thousands of private and professional investors who use Trustnet provides useful clues about market sentiment and the factors shaping it.

This article focuses on the research directed toward investment trusts within the Association of Investment Companies universe during 2025 to date. By comparing this with a baseline from all of 2024, we can highlight how investor interest has shifted this year.

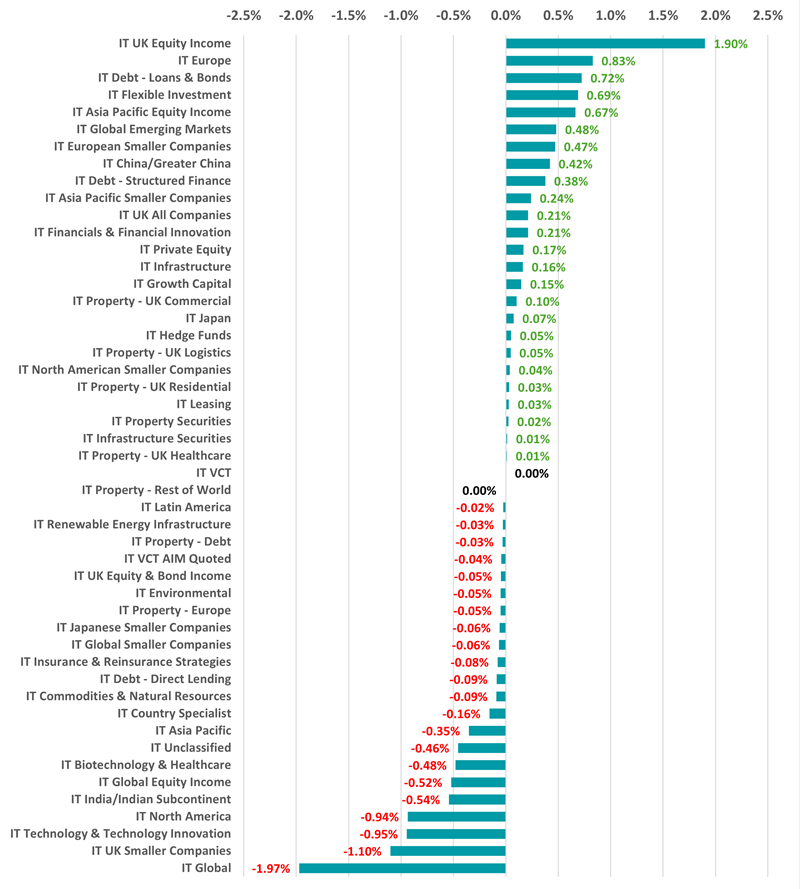

Change in trust sector research share in 2025

Source: Trustnet, Google Analytics

The largest uptick in interest has been towards trusts in the IT UK Equity Income sector, which has accounted for 12.6% of the AIC universe factsheet views on Trustnet over 2025 so far. This is 1.9 percentage points more than the 10.7% share these trusts accrued last year.

UK equities have been unloved for a number of years but have started to catch investors’ eyes more recently thanks to attractive valuations and a move earlier in 2025 to rotate portfolios away from the US.

Similar factors have contributed to an increase in research into European stocks. Continental markets rallied hard in 2025 as investors looked for opportunities outside of the US, while European nations announced increased defence and infrastructure spending.

The share of research in IT Europe trust has increased from 2.8% in 2024 to 3.6% over the year to date.

Investors have also become more interested in IT Flexible Investment trusts, reflecting the desire for diversification and protection in uncertain markets, and emerging markets, which are outperforming developed markets this year.

As the chart above shows, the largest fall in research was in the IT Global sector, with Alliance Witan, Scottish Mortgage Investment Trust and Brunner Investment Trust being those with the largest drops in views. The peer group’s share of research has fallen from 14.9% to 13%.

There’s also been less interest in the IT UK Smaller Companies, IT Technology & Technology Innovation, IT North America and IT India/Indian Subcontinent sectors, all of which have struggled relative to other areas for most of 2025 so far.

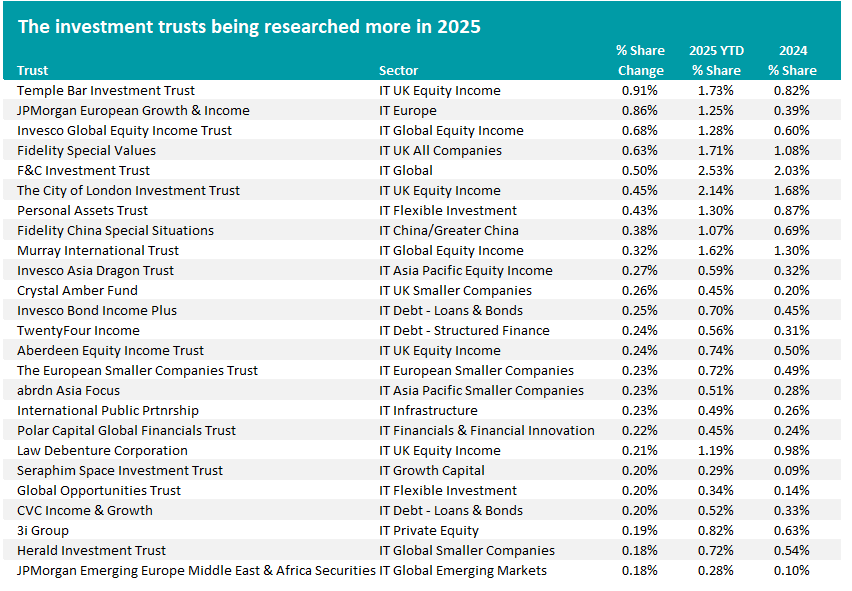

Source: Trustnet, Google Analytics

The individual trust that has been getting more investor attention this year compared with 2024 is Temple Bar. Last year it accounted for 0.8% of all trust factsheet views but this has grown to 1.7% this year; it was the 27th most-researched investment company on Trustnet but has now moved into sixth place.

Over 2025 to 24 September, the trust had made a 33.4% total return, versus 13% from its average peer and 15% from the FTSE All Share. This makes it the best performing member of the IT UK Equity Income sector; in both 2023 and 2024 it was the second-best trust in the peer group.

In a recent Association of Investment Companies roundtable, Temple Bar manager Ian Lance explained why he is confident in the trust’s outlook from here: “We believe that valuation is the best guide to future returns, with low valuation usually preceding a period of above average returns.

“Today the UK equity market appears to be very undervalued relative to its long-run history and other equity markets and within the UK, the dispersion in valuation between value and growth is also close to its widest point for 50 years. Both factors suggest that the trust can continue to enjoy strong returns.”

Other UK equity income trusts that investors are researching more this year include City of London, Aberdeen Equity Income, Law Debenture, CT UK High Income Trust and Edinburgh Investment Trust.

JPMorgan European Growth & Income has also made an impressive jump up the research rankings this year, moving from being the 73rd most viewed trust in 2024 to 12th place today. The trust focuses on companies with improving operational momentum, quality characteristics and lower valuations.

Managed by Alexander Fitzalan Howard since 2006 (he was joined by Tim Lewis and Zenah Shuhaiber in 2020), the trust made 32.7% over 2025 to 24 September. This is the highest return of the IT Europe sector (where the average trust made 21.1%) and beat the 18.4% gain in the MSCI Europe ex UK index.

Earlier this year, the managers outlined their reasons for being optimistic about the outlook for European equities: “The recent change to German fiscal policy is a sign that Europe may be starting to change direction. The scale of the potential spend on both defence and infrastructure is dramatic and if delivered will lift economic growth and create investment opportunities.

“Moreover, there is scope for the European Central Bank to continue cutting interest rates to mitigate the negative impact of increased trade tariffs if they materialise.”

Invesco Global Equity Income Trust is another jumping up the research rankings. It garnered 0.6% of 2024’s trust pageviews but this increased to 1.3% this year; this equates to moving from being the 44th most-popular trust to the 11th.

It’s another trust at the top of its sector this year, with its 26.5% total return far outpacing the 4.6% made by its average IT Global Equity Income peer. It aims to invest in quality companies at attractive prices that can grow cash flows.

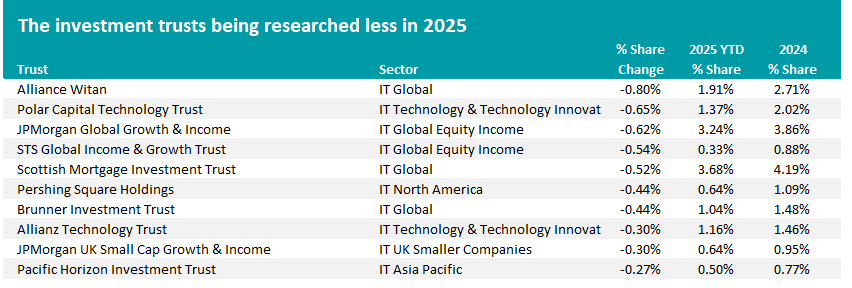

Source: Trustnet, Google Analytics

When it comes to the trusts capturing a smaller research share this year, Alliance Witan has suffered the most. In 2024, it made up 2.7% of research into investment companies but this declined to 1.9% this year.

It has returned 2.4% over 2025, putting it in the third quartile of the IT Global sector (where the average trust is up 8.2%). That said, it remains a popular trust, being the fifth most popular on Trustnet this year and running a total of £5.5bn.