The ability to take on debt is one of the unique distinctions that separates investment trusts from their open-ended counterparts, but some managers are more willing to use it than others. Guy Anderson, FE fundinfo Alpha Manager of the Mercantile Investment Trust, is one such manager, having pushed gearing to 15% this year, close to its record high of 17%.

High levels of leverage can be a double-edged sword for investors – if it works out, it can magnify already impressive returns, but if it doesn’t, the results can be disastrous.

This has not deterred Anderson, who said: “I hope that the fact we’re so highly geared demonstrates just how confident we are in the companies we are investing in.”

Certainly, there are some red flags on the horizon for UK equities, he noted. These include the upcoming Budget, which is set to be a “major tax event” with potentially far-reaching implications for domestic businesses.

While stocks further down the market cap spectrum may have underperformed so far this year, there are “still more attractive companies to buy than sell in the UK market”, particularly in the small and mid-cap space.

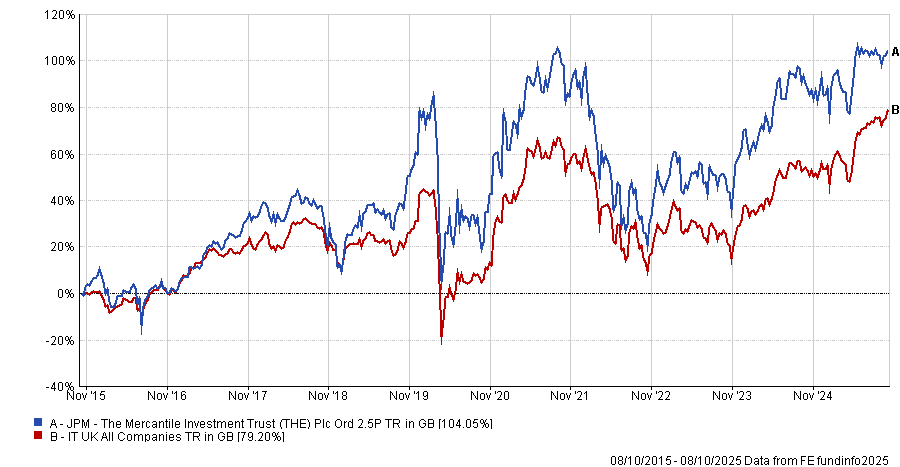

Mercantile has underperformed its peers in the IT UK Equity Income sector so far this year, but it has done much better in the longer term, with a 104.1% return over the past decade under Anderson’s tenure.

Performance of trust vs sector over past 10yrs

Source: FE Analytics

What is the process of Mercantile?

Our main objective is to deliver long-term capital growth through a portfolio of listed small-cap and mid-cap UK equities.

We try to achieve that through a bottom-up portfolio, based on individual stock selection and fundamental analysis.

Generally, we want to invest in companies with strong fundamentals and economics that are delivering growth ahead of market expectations and are trading at good valuations.

What differentiates it from its peers?

At a high level, we’re investing across the market-cap spectrum, all the way from little tiddlers at the bottom of the market to the top end of the FTSE 250.

In practice, every stock in the portfolio must have a current and valid investment thesis, and in the event that anything goes wrong, our default approach is to recycle that capital and invest it elsewhere, so we like to think it’s a disciplined process.

We’re also not forced sellers. While the portfolio is mid- and small-cap focused, we can have 15% to 20% in larger caps, usually those we have held for a while that have re-rated upwards. This has delivered a lot of value for our shareholders.

What’s been the best call in recent years?

One of the standouts has been Games Workshop. Since buying it in 2017, it's climbed into the FTSE 100 and compounded at 40% per annum, while paying a hefty income.

It was a business that was not very well understood by the market; it had some challenges, but the management had really started to reinvigorate the company and the intellectual property through several different initiatives.

It also has a very loyal customer base, who keep coming back to buy new releases, which has enabled Games Workshop to generate great profits and a lot of cash that it reinvested and returned to shareholders.

With deals such as the agreement with Amazon to create a TV series, it has a lot of potential to continue to grow the brand and it’s a stock we’re still very excited about.

And your worst?

Watches of Switzerland has been the largest individual detractor to performance over the past three years.

It sells luxury watches for brands like Rolex, which were growing their store numbers when we first bought it. Demand for these goods had proven to be almost immune to market cycle, so the initial thesis for buying it looked really simple.

What actually happened was a cyclical downturn in demand and prices had probably risen too much during the pandemic, leading to questions about how bulletproof it was.

When they issued a profit warning but kept their long-term sales targets in place, it raised questions for us about the achievability of the future targets, so we exited the position in January 2024.

The FTSE 100 has surged this year while mid and small-caps have trailed behind – has that been a challenge for the portfolio?

The UK suffers a big gap between perceptions and reality and the outlook for small and mid-caps right now is very negative.

However, while I’m not trying to diminish valid concerns, there is still a lot I’m finding encouraging in the UK. It may not be a fashionable opinion, but a lot of the companies are outperforming expectations and increasing their earnings despite all this negativity.

There is a lot of chat about companies disliking being listed in the UK or looking to list elsewhere, but that is just not the reality for most companies. For example, Rosebank Industries, which was set up by the former founders of Melrose earlier this year, listed on the Alternative Investment Market (AIM) to a £1.1bn fundraise, one of the largest initial public offerings on the AIM market.

Even despite all the pessimism, there is still real demand for the right kind of businesses among UK investors.

What do you do outside of fund management?

I have four boys, so most of my time is spent running around after them and keeping them entertained.