The past five years has been anything but smooth for European funds, from pandemic-induced economic stagnation to increasingly uncomfortable geopolitical tensions on either side of the continent.

Yet, despite the turbulence, the IA Europe ex UK sector ranked in the top 10 among all Investment Association sectors for average returns at 55.9% – narrowly beating the IA Europe Including UK sector.

With the landscape ahead looking just as bumpy and fractured as the past half-decade, many investors are likely weighing strategies that can both capture market rallies and provide a cushion against downturns.

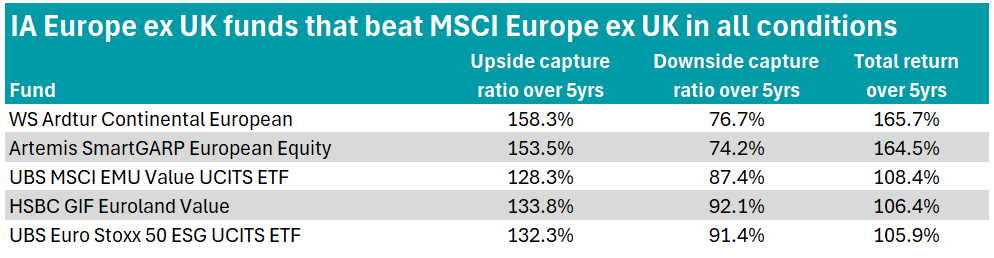

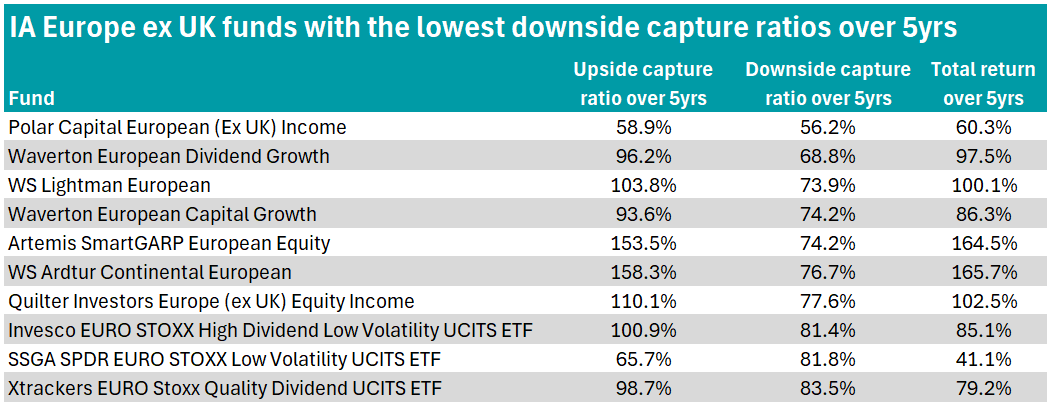

As part of an ongoing series, Trustnet identified funds in the IA Europe ex UK sector that managed the best upside and downside capture ratios and returns over the past five years. Scores were calculated against the MSCI Europe ex UK index.

An upside score greater than 100% means a fund has made more than the market when it has been rising, while the opposite is true for the downside capture ratio.

When assessing against these parameters, 57 funds were found to outperform the market across both the upside and downside capture ratios.

As such, we looked to identify those that were in the first quartile in the sector across all three parameters, narrowing it down to five.

Source: FE Analytics

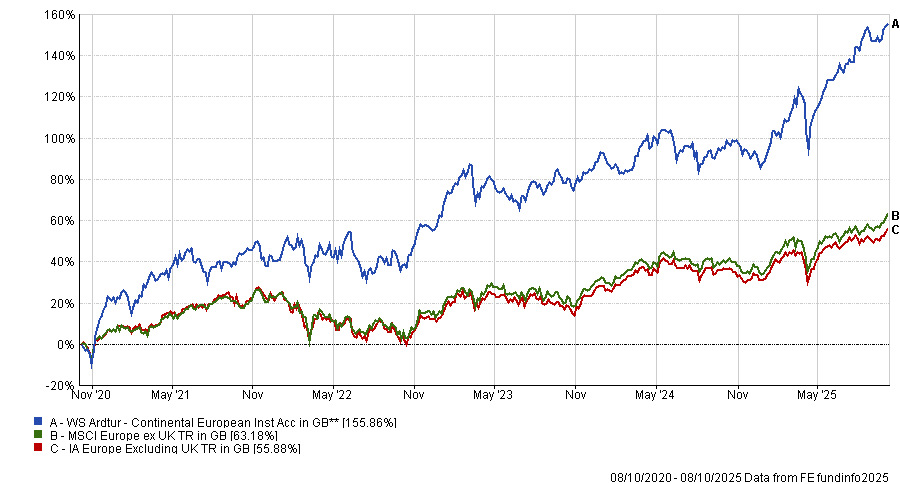

Top of the table was WS Ardtur Continental European, which logged the best upside capture ratio of the sector at 158.3% and also the strongest return over the half decade, gaining 165.7%.

The £376.5m fund also made a top 10 performance when markets fell, with a downside capture ratio of 76.7%.

Managed by Oliver Kelton since 2015, the fund aims to outperform the MSCI Daily TR Net Europe Ex UK index over any five-year period. As of August 2025, the fund outperformed the index over one, three and five years.

Around 25% of the fund is invested in financials, followed by 20% in energy. However, its top holding is French multinational telecommunications company Orange (8.9%), whose shares have increased by just shy of 40% year-to-date.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

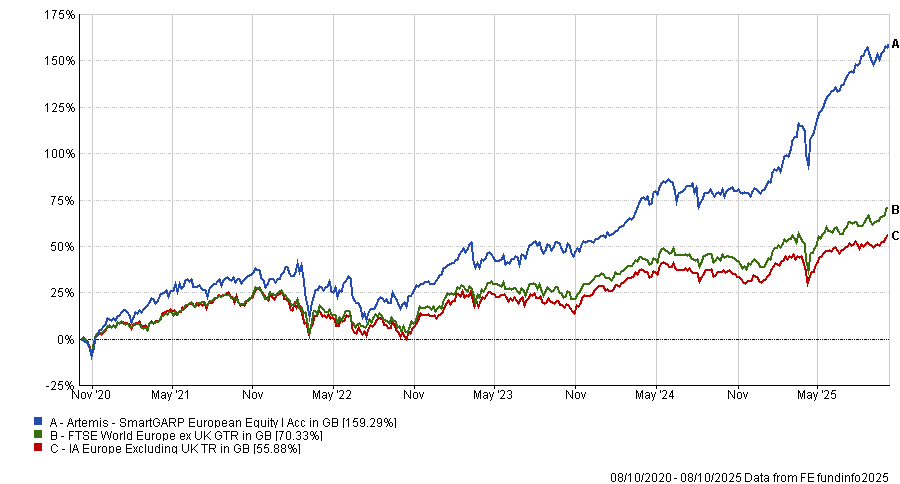

Not too far behind was Artemis SmartGARP European Equity, which lagged WS Ardtur Continental European by between one to two percentage points across the assessed criteria.

The £1.3bn fund has an FE fundinfo Crown Rating of five (out of five) and is managed by Phillip Wolstencraft.

RSMR analysts rate the fund for its investment process, and its “significant weighting” in mid-cap companies which, along with the value bias, “differentiates the approach to many of its peers”.

The Artemis fund is popular among investors and was one of the 10 most bought funds on Fidelity’s investment platform across ISAs and SIPPs in August 2025.

“The approach’s strength is founded on not overpaying for growth and recognising when the fundamentals of a company have been overlooked, suiting most market environments,” the analysts said.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

The other actively managed fund in the table of five was HSBC GIF Euroland Value, which logged an upside capture ratio of 133.8%, downside capture ratio of 92.1% and total return of 106.4%.

Managed by Samir Essafri and Jeanne Follet, the fund aims to provide long-term capital growth and income while also promoting ESG-related themes. As such, it qualifies as Article 8 under the current parameters of the EU’s Sustainable Finance Disclosure Regulation.

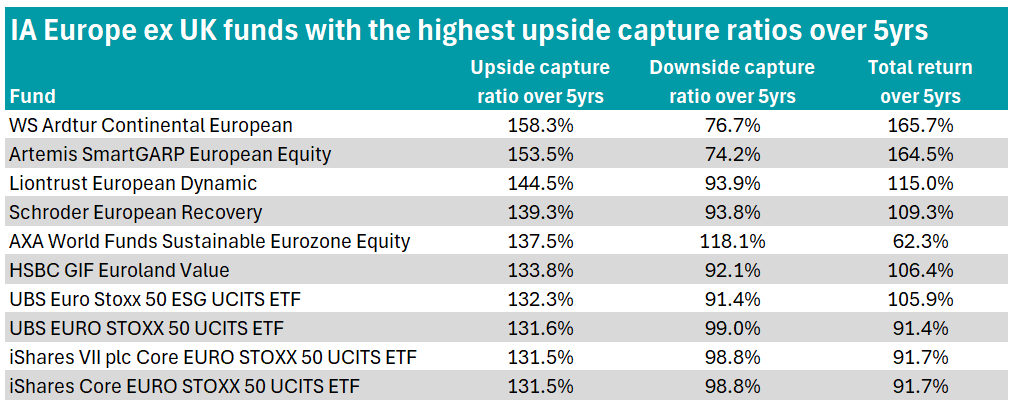

The best when markets rose

As shown in the table below, WS Ardtur Continental European and Artemis SmartGARP European Equity topped the table when markets rose.

Next in line was Liontrust European Dynamic, which managed an upside capture ratio of 144.5%.

Source: FE Analytics

The £2.1bn Liontrust fund is a concentrated portfolio of no more than 30 stocks managed by James Inglis-Jones and Samantha Gleave.

It uses Liontrust’s cashflow solution investment process, which looks to identify companies that generate enough cash internally to sustain planned growth, with the managers investing when valuations are deemed attractive. They will avoid companies that take on significant debt.

RSMR analysts said: “The performance of the fund since launch backs up the strength of the process and demonstrates the ability of the fund managers to implement it successfully.”

The fund has strong long-term performance, sitting in the sector’s first quartile for total returns over 10 years, gaining 242.7%% versus the sector average of 139.8%. It is in the second quartile over the nearer term, gaining 16.8% and 59.5% over one and three years respectively.

Rounding out the top five for when markets rose was Schroder European Recovery and AXA World Funds Sustainable Eurozone Equity. The former deploys a valued-focused investment approach, whereas the latter champions ESG-integrated growth investing.

The top downside protectors

Polar Capital European (ex UK) Income offered investors the best protection when markets fell over the past five years, with a downside capture ratio of 56.2%.

Source: FE Analytics

The fund capitalises on the compounding power of dividend yields and growth across its 25-50 positions, with around 30% invested in telecommunication services, capital goods and transportation, although the biggest holdings in the portfolio are energy companies TotalEnergies and Iberdrola, at 4.4% and 4.2% a piece.

However, the €240.1m Polar Capital fund has languished in the fourth quartile for total returns over one, three and 10 years, gaining 116.8% over the decade.

Also income-focused is Waverton European Dividend Growth, which outperformed Polar Capital European (ex UK) Income across upside capture ratio and five-year total return, managing 96.2% and 97.5% respectively.

The £166.8m fund was launched in 2005 and is managed by Alpha Managers Charles Glasse and Chris Garsten. The growth-focused Waverton European Capital Growth also featured in the top 10 for downside capture ratio, with a score of 86.3%.

Also managed by Glasse and Garsten, RSMR analysts noted that the high conviction fund “represents a compelling and differentiated offering in the European equities space”.

Third in the sector for downside capture ratio was WS Lightman European with a score of 73.9%. The fund has an FE fundinfo Crown Rating of five and measures undervalued stocks against three characteristics: high free cashflow yield, low price-to-book and price-to-earnings and positive operational momentum.

RSMR analysts said there are “very few valued-focused European equity funds available to UK retail investors, so it represents an excellent diversifying option within the asset class”.