Global stock markets are at record highs, reviving fears of a bubble. Yet many fund managers remain calm, arguing that strong earnings and easing expectations justify current valuations.

Stocks have powered ahead in 2025, led once again by a small group of heavyweight tech names at the heart of the artificial intelligence (AI) revolution. Yet the narrow rally in recent years has sparked concerns about stretched valuations and an overreliance on a handful of companies to drive returns.

The International Monetary Fund recently warned that investors may be underestimating key risks, including trade tensions, fiscal imbalances and high asset prices. It said these factors could combine to trigger a disorderly correction, particularly as financial stability risks remain elevated.

Market strength has so far shrugged off these warnings, aided by resilient corporate earnings and expectations of rate cuts in major economies. However, some fund managers are beginning to question how long the current momentum can last.

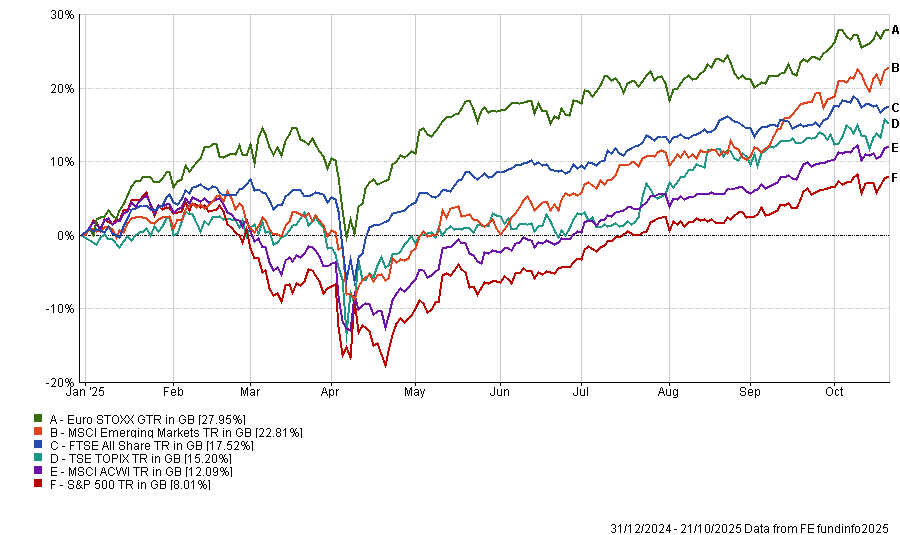

Performance of equities in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 21 Oct 2025.

Mark Hawtin, head of Liontrust’s global equities team, is one of the investors worried that markets are in bubble territory.

The so-called Magnificent Seven tech stocks (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla) have surged in recent years and now account for 40% of the S&P 500’s market capitalisation, the manager noted. However, he reckons the rest of 2025 will be about “differentiated and diversified returns” in equity markets.

“While, thematically, we remain positive on the potential for AI and for short-term infrastructure investments, we are concerned that we are in the throes of a bubble. The recent trend of vendor financing highlights this risk and, while in the early stages, acts as a warning sign,” Hawtin said.

“Trying to predict the impact of this factor and what the outcome will be is tough but experience is a vital asset; it is surely more valuable to have lived through the boom/bust dynamics of a bubble than merely to have read about them.”

The manager also identified several themes that could provide diversification from the concentrated and pricey US market, including European defence spending, the catch-up trade in Chinese tech/AI versus the US, Japanese digitalisation and emerging markets equities on the back of a weaker US dollar.

Laura Cooper, senior macro strategist at Nuveen, said it is “too soon” to call a bubble in AI and associated stocks as the boom is based on “real demand for cloud computing and data-centre infrastructure - not leverage or hype”.

She added that there is more risk of ‘valuation fatigue’, or investors tiring of paying ever-richer premiums for AI returns that do not materialise quickly enough, than a stock market bubble bursting.

And when asked if US equities can continue rallying, Cooper said: “In short, yes. The Fed’s easing cycle, still-solid US growth and resilient corporate earnings create a powerful mix for year-end performance, particularly with Q4’s seasonal tailwinds.

“But resilience doesn’t mean complacency. Dispersion is wide, valuations are elevated at roughly 23x forward earnings for the S&P 500 and further upside depends on earnings delivery rather than multiple expansion. Our equity team also emphasises that defending or potentially expanding margins will be crucial.

“Leadership remains concentrated in mega-cap tech, while sectors such as energy and staples face softer demand and margin pressure. So, selectivity remains key: quality balance sheets, visible cash flow and pricing power will be the differentiators as the cycle matures. For now: keep calm, rally on.”

Mark Ellis, manager of the Nutshell Growth fund, believes tech stocks such as Microsoft, Alphabet and even Nvidia (which is trading on a price/earnings ratio of more than 50) are fairly valued when compared to their potential growth.

“I remember the late 90s. When people are talking about a bubble, they're usually years too early. Alan Greenspan, the Fed governor, was talking about irrational exuberance in 1997 and he was three years early,” he added.

“I don't think we're anywhere near a bubble at the moment. When you see a real bubble, you will know about it because prices will be truly exponential and it will be very different to how it's feeling at the moment.”

However, Ellis is more concerned about the “very frothy” valuations in some of the non-profitable smaller to medium-sized names in the tech space as they are unproven, speculative and lack a track record.

“We never touch a story. We deal in numbers,” he explained. “We never buy a company, because this and this and this might happen in 10 years’ time and it might be worth X. We work in a world of numbers and facts, not stories.”

Bubble or not, there is still the risk that markets could be toppled from their lofty heights. Dan Coatsworth, head of markets at AJ Bell, suggested three potential catalysts that could trigger a market correction: slower AI adoption, a banking crisis and a US recession.

“Money is being ploughed into the AI space at an incredible pace. But is anyone using it on a large scale?” he said.

“There are growing fears in some circles that companies are spending big, yet staff are not using the technology either because they don’t trust it or don’t know how to get the best from it.”

On a new banking crisis, recent events reminded how “ultra-sensitive” markets can be to potential issues in the banking sector.

Stocks dipped last week when investors started to worry about risk management and lending standards in the private credit market at a handful of US banks. Although markets have already calmed down, banks will be closely watched during the looming earnings season.

“Last week’s market wobble was also a red flag regarding liquidity issues in the US. There are fears the Federal Reserve has drained liquidity from the financial system through its quantitative tightening programme, which involved letting bonds and mortgage securities mature without buying replacements,” Coatsworth added.

Finally, some US data is starting to worry investors despite the US economy being more resilient than many expected.

For example, the NFIB Small Business Optimism index fell for the first time in three months in September while the Conference Board Expectations index – which measures consumers’ short-term outlook for income, business and labour market conditions – fell by 1.3 points to 73.4. Weak small business and consumer confidence has historically been a recessionary signal.

Coatsworth added that he sees little reason for investors to dump their holdings in a panic but reminded them of the importance of diversification across multiple sectors, geographies and asset classes to spread risk.

“Even if we get a correction, history suggests that time in the market is better than timing the market,” he said. “Quite often people will sell after a crash and then miss the rebound, which can happen fast and hard. Staying put might take a bit of nerve, but it puts you in the right place to ride any recovery.”

Coatsworth suggested that investors looking to reduce risk after the market’s strong run could start by locking in profits from areas that have performed well, such as defence stocks, banks and large technology firms.

Money market funds, he noted, offer a temporary home for capital, aiming to deliver modest returns above cash while avoiding the volatility of equities. Gold remains a traditional safe haven, though it has already seen significant gains.

He also pointed to defensive and capital-preservation funds as potential options. These tend to lag in rising markets but can provide stability when conditions become more challenging.