Investors who sold out of gilts earlier this year expecting another ‘Liz Truss’ mini-Budget crisis have reduced their allocation for the “wrong reasons”, according to veteran bond investor David Roberts.

The 30-year gilt yield hit 5.73% in September, the highest level since 1998, following concerns about chancellor Rachel Reeves’ position and the credibility of the government’s fiscal plan, leading some to question whether a 2022-style sell-off could be approaching.

However, for Roberts, this was a buying opportunity that many investors underestimated. He boosted his UK interest rate risk from near zero at the start of the year to 10%, an overweight compared to his benchmark (the Bloomberg Global Aggregate Bond hedged index).

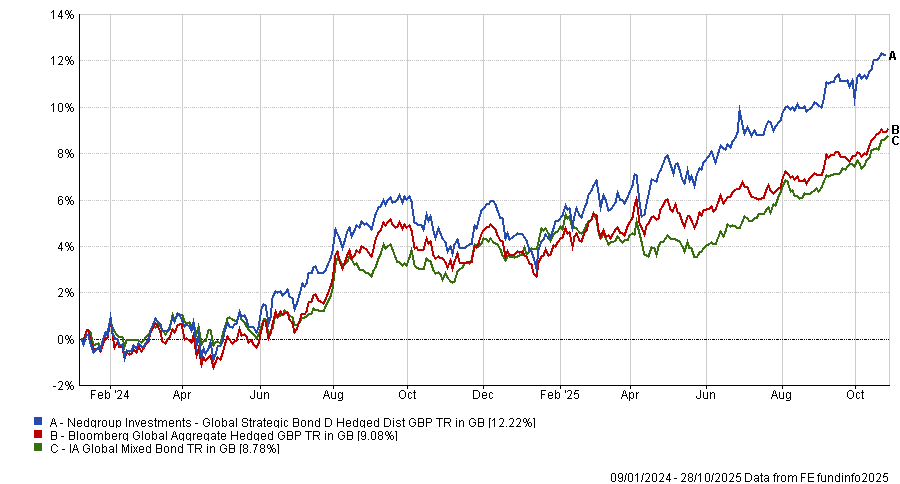

This has contributed to the fund’s strong performance, with the Nedgroup Global Strategic Bond fund up 12.2% since it launched in March 2024, outperforming both its average peer in the IA Global Mixed Bond sector and its benchmark.

Performance of fund vs sector and benchmark since fund start

Source: FE Analytics.

He pivoted into UK gilts this year, partially because he felt many investors were “overreacting” to the news and overselling in response to short-term events.

“We had to ask ourselves, did people sell out of gilts for a good reason or a bad reason? If it is for a good reason, we wouldn’t touch it, but everyone sold out for the wrong reason,” Roberts said.

Investors had become “panicked” about Reeves’ approach, with some investors arguing that the government’s lack of a viable fiscal plan had caused them to lose almost all credibility.

However, Roberts argued this is an overreaction and overestimates how bad the UK’s position is. While the fiscal rules and manifesto pledges have placed constraints on how the government can choose to raise money, this is “not the disastrous position” that it initially seems.

Nominal growth has remained relatively positive and certain aspects of volatility, such as sticky inflation, could become more manageable over the short-to-medium term.

“The market is technically oversold, piles of people are running away from it, but the fundamentals aren’t actually all that bad.”

Additionally, while the government’s fiscal plan is “believed to be bad” by many investors, this is far better than some of the unsustainable plans of the other G7 countries.

For example, Germany plans to expand fiscal spending, while France and Italy “desperately try to rein it in”, and America “is taking as much money as it can and throwing it at people”.

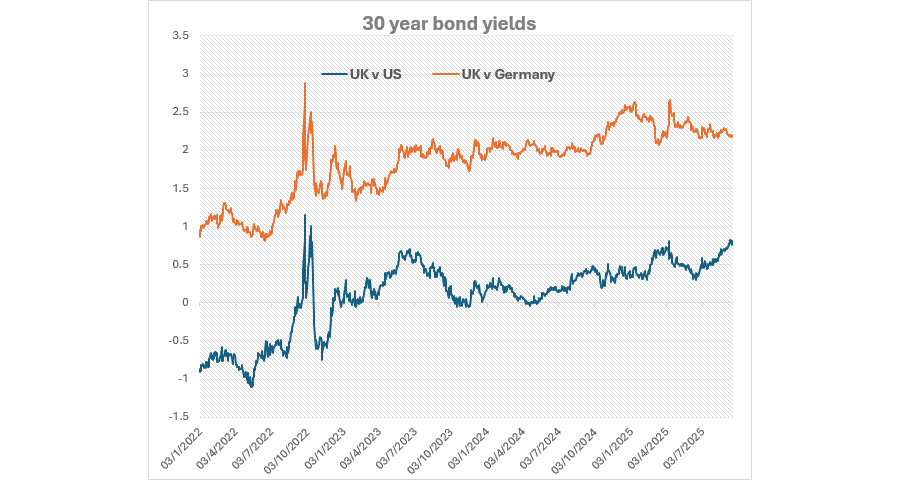

This has caused government bond yields to swell across the G7 this year, he noted, as demonstrated by the fact that they are far more correlated in 2025 than they were in 2022.

Source: AJ Bell, LSEG Refinitiv. Data as of 19 September.

“It’s easy to see the UK as a bit of a basket case this year, but the playground for bond investors is much better than it initially looks,” Roberts said.

The value in gilts

There is still a lot to like in gilts, particularly their high starting yield, which currently provides an income above growth expectations, he said.

Based on recent data from the International Monetary Fund, inflation is predicted to fall to “around 2% next year”. Meanwhile, the real rate of growth is expected to decline to around 1.5%, leading to expected nominal growth of 3.5% for the UK in 2026, he continued.

“If you think you’ve got an economy where the yield on government bonds is both quite a bit higher than inflation and quite a bit higher than the rate of nominal growth, that’s usually a great opportunity for investors.”

On a relative basis, gilts also look appealing when compared to bonds in other markets, Roberts continued.

At 4.7%, the gilt yield is roughly 0.6 percentage points above the average yield from US treasuries this year. While this may not seem like a lot on the surface, over time, getting a consistent “half a percentage point over competitors will start to pay off”.