When trying to build a portfolio for any type of market, investors need to ensure they have not put “all their eggs in one basket”, according to Ian Jensen-Humphreys, manager of Quilter’s multi-asset Cirilium range.

“We’re conscious that growth is expensive – it has been that way for a while. While we don’t want to call the top of the market, we do need to be prepared for anything,” he said.

As a result, he and the Quilter team have looked beyond growth strategies to find opportunities elsewhere this year, with Jensen-Humphreys pointing to flexible strategies in Europe and more defensive bond funds as compelling options.

Below, he highlighted the five funds that the Quilter team has added to this year to help achieve a more resilient portfolio.

M&G Japan

One fund that he has increased his allocation to this year is M&G Japan, led by FE fundinfo Alpha Manager Carl Vine and Dave Perrett.

“We like Vine’s team because it is so focused on corporate engagement and sees real value in being well-informed holders of companies.”

As a result, the fund is well-positioned to take advantage of the current corporate reform story in Japan, the Quilter manager said.

Corporate engagement in Japan is more “respectful and nudging” than in other countries. Vine’s team can count on consultants in Japan who help them “frame their engagement in the right way”.

This gives them an advantage over many other Japanese funds, leading to the strategy delivering a 95.4% total return under the manager's tenure.

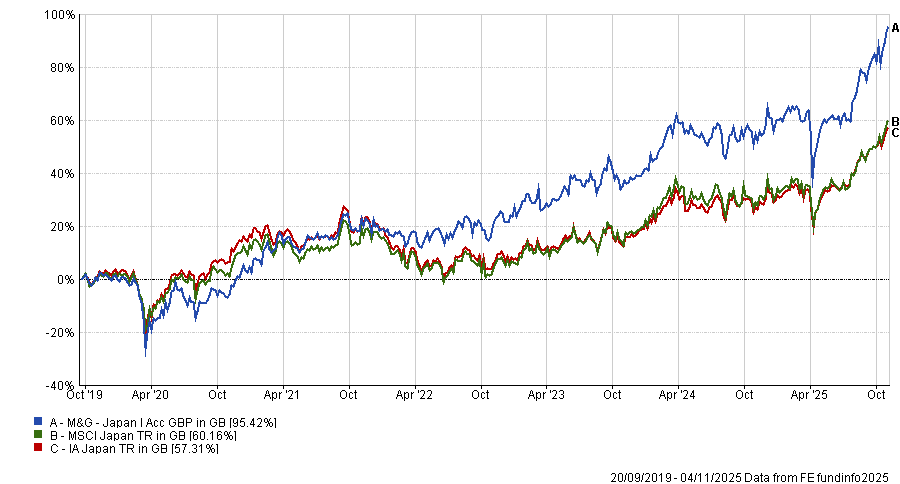

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics.

Liontrust GF-Pan European Dynamic

Quilter also initiated a position in the Liontrust GF-Pan European Dynamic fund, which follows the same core process as its stablemate, the Liontrust European Dynamic fund, with a broader universe of stocks.

The strategy is focused on buying companies with high-quality earnings and stable cash flows. The managers adjust the portfolio to be more or less defensive depending on the macro situation, enabling them to outperform in a variety of conditions.

This approach has resulted in a return of 21.6% over the past year, outpacing the MSCI Europe.

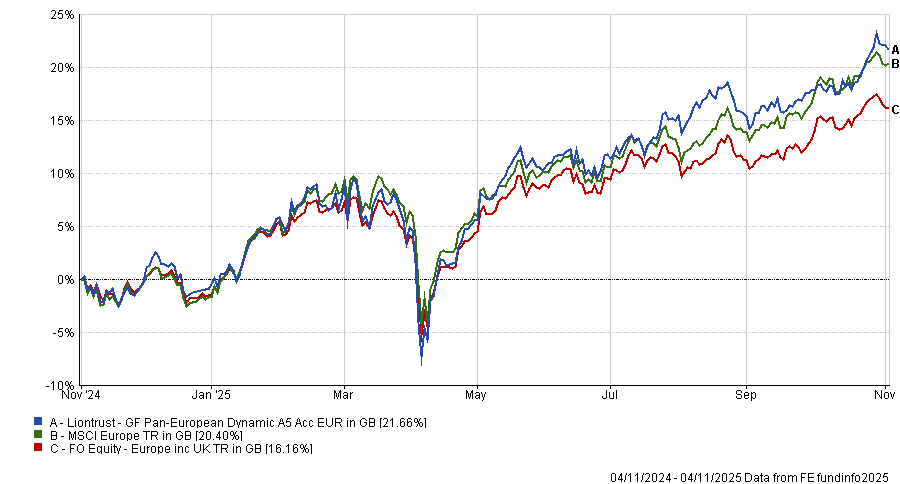

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics.

“They are one of the few managers that can successfully combine a rigorous bottom-up process with a top-down macro overlay”, making it a fantastic choice for investors' core exposure in the region, he said.

Federated Hermes MDT US Equity

Quilter also added to Federated Hermes MDT US Equity, a quantitative fund established in July this year.

It screens stocks based on valuation, quality, sentiment and momentum, but combines them to try and create an all-weather US portfolio.

The managers believe that markets reward different characteristics at different times, and so in cases where momentum stocks are dominating, strategies should reflect that.

“Some managers will never own an expensive company that continues to do very well because their process says they can’t,” Jensen-Humphrey noted. For example, since the ‘Magnificent Seven’ are such large components of the index, “almost every manager starts with an underweight to them”, which has made it challenging for them to keep up.

By contrast, MDT US Equity is “not afraid of being benchmark aware” and so will own the Magnificent Seven because there is “no reason” to be structurally underweight these stocks in their view. This will allow the fund to perform well even if this growth-focused market persists, Jensen-Humphreys said.

Schroder Strategic Bond

Fixed income also has a place in a truly all-weather portfolio, and here, Jensen-Humphreys added to Schroder Strategic Bond.

The fund tends to favour higher quality parts of the market, giving a risk profile that “feels more like an investment-grade fund”.

The strategy is also very nimble, with a team of experienced credit analysts and a manager who is willing to pivot the portfolio “quite aggressively” to take advantage of short-term opportunities.

“When spreads are tight, as they are at this moment, having this sort of nimbleness is very important,” Jensen-Humphreys said.

Owning this strategy has paid off in recent years, with top-quartile returns in the IA Sterling Strategic Bond sector over one, three and five years.

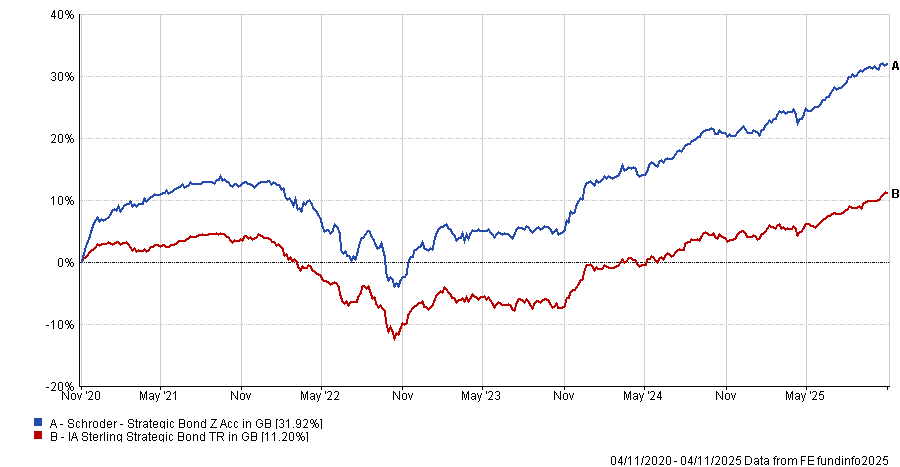

Performance of fund vs sector over 5yrs

Source: FE Analytics.

AXA US Short Duration High Yield

The Quilter team has also found attractive opportunities in the high-yield market through the AXA US Short Duration High Yield fund.

“The credit space is getting expensive, but there are still pockets where the risk/reward is advantageous, and short-dated high yield is one of those spaces”.

A bond at the top of the high-yield universe is not “materially any different than something at the bottom of investment grade”, but is often underestimated by investors, according to the Quilter team.

The AXA fund is positioned to take advantage of this by being “on the relatively conservative side of high yield”, focusing more on being risk-averse and avoiding defaults. This makes it a relatively low-risk option that should be able to navigate a “muddled economic environment” while still delivering a return better than cash.

Over three and five years, this risk-averse approach has led to second-quartile returns in the IA Specialist Bond sector.

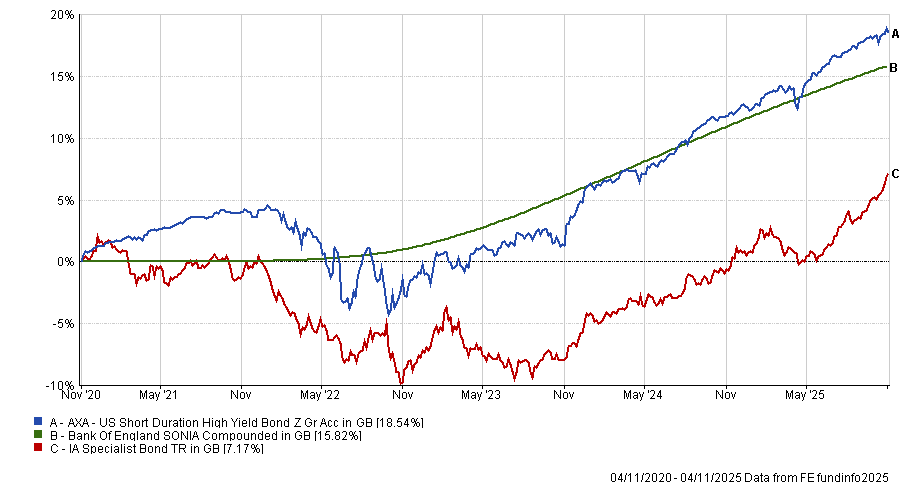

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics.