Investing comes with risk, even among funds that are designed to limit the downside. As such, combining low-risk funds to create diversification can add another layer of protection.

In this series, we have looked at correlations between funds with a top FE fundinfo Crown Rating of five in different sectors. A score of 0.7 or below means they are sufficiently lowly correlated to one another.

For the ultra-cautious, Ninety One Diversified Income is a standout pick in the IA Mixed Investment 0-35% Shares sector, with a low correlation to two other top performers.

Managed by John Stopford and Jason Borbora-Sheen, the £761m portfolio aims to generate a 4% yield while limiting risk by being at least 50% less volatile than the FTSE All Share index.

It does it by investing in a mixture of equities, bonds and alternatives, with analysts at FE Investments noting it provides a “strong solution to investors with an income target only”.

“Due to its mixed-asset – but also defensive – approach, we have been impressed by the capacity of the fund to generate this stream of income, irrespective of the directions of equity and bond markets. This is a key differentiator to its peers, which have relied too much on equity markets to generate income and capital returns.”

It is lowly correlated to both the £38m EF New Horizon Cautious and £22m VT Freedom Defensive, with correlations of 0.67 and 0.68 respectively.

These are the only combinations of top-rated funds to score below our 0.7 correlation threshold in the sector, which holds 10 portfolios with a five-crown rating.

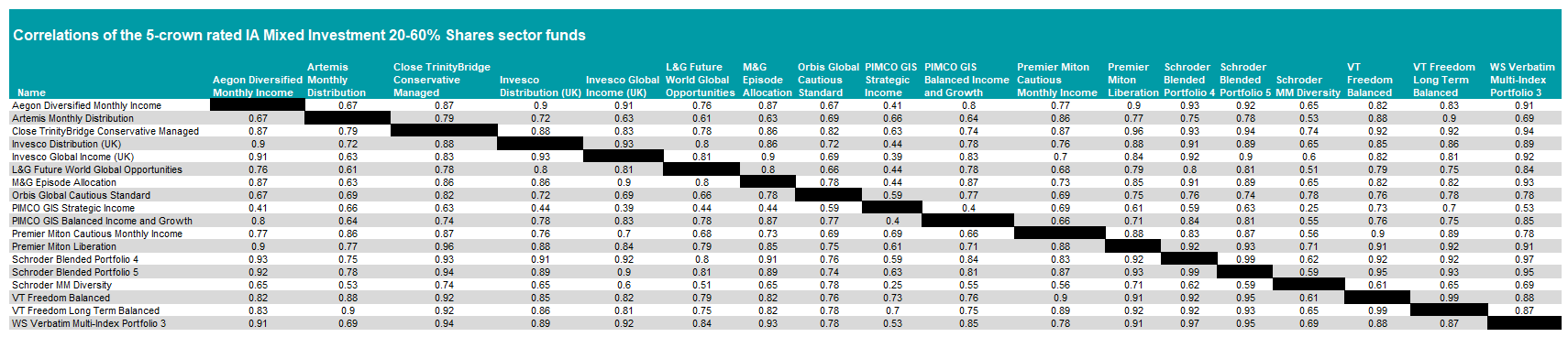

Moving up the risk scale slightly, in the IA Mixed Investment 20-60% Shares there are a plethora of combinations among the 18 funds with a five-crown rating that have a correlation below 0.7.

The only fund to do this across every fund included in the study is the £1.7bn PIMCO GIS Strategic Income fund, managed by FE fundinfo Alpha Manager Daniel Ivascyn.

It invests primarily in bonds and dividend-paying stocks, giving it an income tilt. It has been a top long-term performer, more than doubling investors’ money over the past decade, although its three-year numbers to the end of October are weaker, up 20.8% - one of the worst in the peer group.

At present, it sits at the lower end of the equity allocation spectrum, with just 24.4% in stocks and 71.7% in bonds.

The fund has an average correlation score to all other top-performing funds of 0.53, although its lowest score is to the £533m Schroder MM Diversity fund (0.29).

Run by Robin McDonald, Joe Le Jéhan and Geoffrey Challinor, the latter is more equity heavy (33.2%) but also invests 32.5% in alternatives and has some 17.9% in cash.

Recommended by analysts at RSMR, they said it is “a good solution for investors looking to build a diversified cautious portfolio that can provide income and capital growth ahead of inflation over the longer term, whilst maintaining some protection during market downturns”.

Schroder MM Diversity was the next-best in terms of correlation with other top-ranked funds. It scored less than 0.7 to 14 of the 17 funds in the table below, with an average correlation of 0.6.

In third place, with a lower correlation to eight of the 17 other top-rated funds, is Artemis Monthly Distribution. The £1.4bn portfolio is run by the four-strong team of Jacob de Tusch-Lec, James Davidson, David Ennett and Jack Holmes, although the former is the only member of the team to have worked on the fund prior to 2021.

Included in interactive investor’s ‘Super 60’ best-buy list, analysts at the firm said that the managers, despite not working together formally for long, are “well-established within their respective teams and have long track records within their asset class specialism”.

“The focus on income leads to above-average allocations to riskier fixed income assets, such as high yield, which may result in greater drawdowns during periods of economic weakness, but performance remains impressive even when adjusted for higher than average risk.”

Orbis Global Cautious is the only other fund on the list with a correlation of below 0.7 to five or more funds (six). Managed by Alpha Manager Alec Cutler, RSMR analysts said its “active hedging and flexible asset allocation make it a compelling option for investors seeking active management beyond a traditional 60/40 portfolio, with three-to-five-year investment horizon”.

There are many other combinations of funds with low correlations, however, and we have included the full table below.

Source: FE Analytics

This is the fourth article in our series looking at lowly correlated top-rated funds. Previously, we have looked at the US, UK sectors and the IA Global peer group.