Diversification is an important tool investors can use to mitigate risk, but simply owning different top-performing funds may not give investors the safety they crave.

As such, in this new series Trustnet looks at top-performing funds that are lowly correlated with other portfolios making strong returns.

To do this, we have used the FE fundinfo Crown Rating system, compiling all funds in an asset class with the highest score of five. This means they represent the top 10% of funds in the Investment Association (IA) universe.

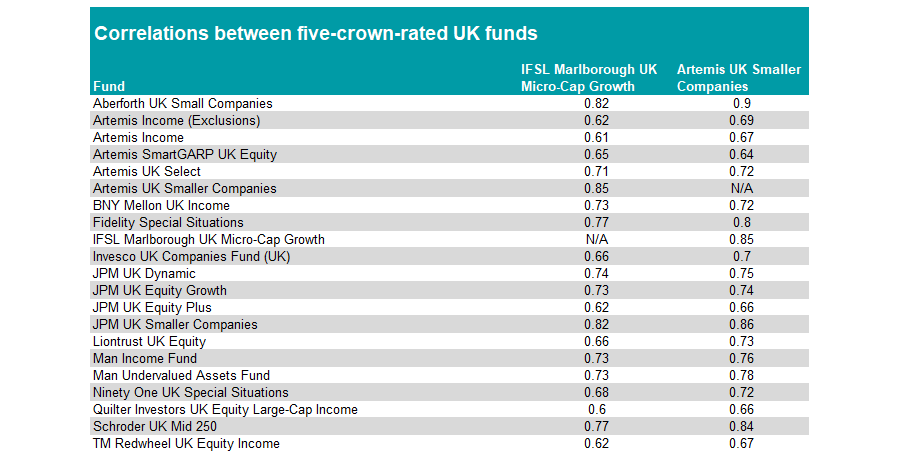

We then ran a correlation table to see which funds have performed differently from one another. A score of 1 shows the funds are perfectly correlated (meaning they move up and down at the same time). Most portfolios in the same asset class have high scores but some stand out. Here, we have judged a correlation of below 0.7 as having a sufficiently low correlation.

Across the IA UK All Companies (11 five-crown-rated funds), IA UK Equity Income (6) and IA UK Smaller Companies (4) sectors, just two funds are consistently below this threshold.

Both are small-cap portfolios and typically diversify from their large-cap peers, but investors should note that the other two small-cap funds on the list failed to garner a single correlation below 0.7.

The fund with the least crossover to other top-ranked UK portfolios is IFSL Marlborough UK Micro-Cap Growth. It has a correlation of less than 0.7 to nine other five-crown rated funds: Artemis Income (and its sister fund that applies exclusions), Artemis SmartGARP UK Equity, Invesco UK Companies Fund (UK), JPM UK Equity Plus, Liontrust UK Equity, Ninety One UK Special Situations, Quilter Investors UK Equity Large-Cap Income and TM Redwheel UK Equity Income.

Managed by Guy Feld and Eustace Santa Barbara, the £470m portfolio sits in the IA UK Smaller Companies sector and typically invests in stocks with a market capitalisation below £1bn, making it a differentiated offering to many of the large-cap and income funds in the table below.

Investing domestically has been a lucrative trade so far in 2025, with the FTSE All Share up 17.2% versus the broader MSCI World’s 10.7% gain, reversing a medium- and long-term trend in which global markets (led by the US mega-cap tech stocks) have trounced UK stocks.

However, the disparity between the best and worst areas of the market has been stark. The FTSE 100, for example, is up 18.6%, while the mid-cap FTSE 250 and small-cap Deutsche Numis Smaller Companies (ex ITs) indices have made less than half this return.

The Marlborough fund sits in the second quartile of the small-cap peer group this year, up 5.5%, and has been the worst performer of the four top-rated smaller companies funds over the past three years.

However, investors may wish to consider it as a diversifier to any large-cap funds they own, as its 23.1% weighting to industrials and 21.5% position in technology stocks give it a different profile to much of the UK market.

Analysts at FundCalibre gave the fund an ‘Elite’ rating, stating it is “one of the standout funds in the sector”.

“The Hargreave Hale team is renowned for its small-cap expertise and has delivered exceptional performance for investors over a very long period. The team has a proven capability of adding value through stock selection as a result of company meetings and diligent research,” they said.

Source: FE Analytics

The only other fund with a correlation of below 0.7 to other five-crown-rated funds is Artemis UK Smaller Companies.

Run by Mark Niznik and William Tamworth, the managers of the £573m fund prefer consumer discretionary stocks, with the sector making up 31.3% of the total portfolio.

It has made 4.1% so far in 2025, a second-quartile return in the peer group but the weakest of the four small-cap funds with a five-crown rating. However, its three-year figures are better, with a 31.8% return being a top-quartile effort in the sector.

The fund has a correlation of below 0.7 with six funds in the table above: Artemis Income (and the same fund with exclusions), Artemis SmartGARP UK Equity, JPM UK Equity Plus, Quilter Investors UK Equity Large-Cap Income and TM Redwheel UK Equity Income.

Rated by researchers at RSMR, they said the fund “offers an ideal starting point for investing in UK small-caps, managed by a team with great experience and knowledge of the sector”.

The managers’ approach avoids companies where there is a degree of speculation or difficulty in predicting results and targets those where growth is visible and can be self-financed.

“This approach might be expected to generate lower returns, but this is not the case, and through steadily building performance, the fund has generated competitive returns,” they said.