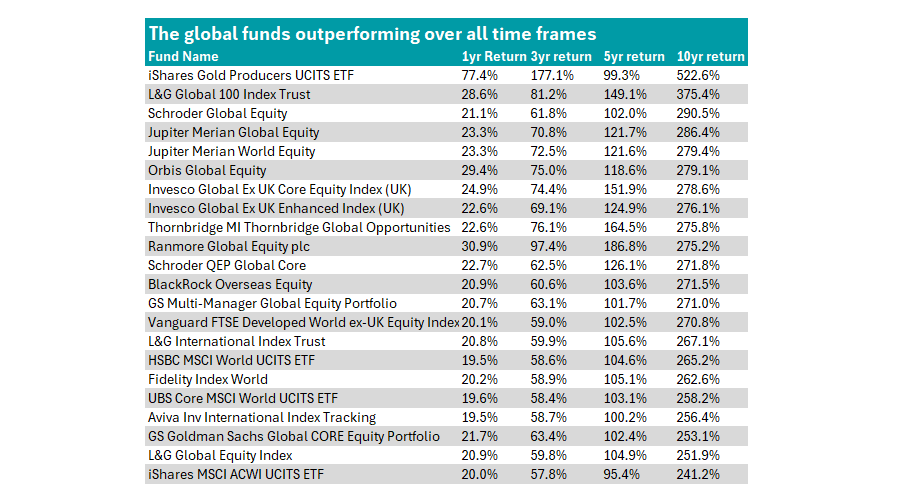

Very few strategies in the 574-strong IA Global sector have been able to maintain a standout performance across different market environments, with only 22 funds achieving top-quartile returns across all standard time periods (one, three, five, and 10 years), according to Trustnet research.

Over the past decade, the top option has been the iShares Gold Producers UCITS ETF, an exchange-traded fund that tracks companies involved in the exploration and production of gold. Helped by the gold rally this year, it has a 10-year return of 522.6% – the best performance in the IA Global sector – and beat its nearest competitor by 147 percentage points.

Source: FE Analytics. Data accurate to the end of October. Data is sorted by 10-year returns.

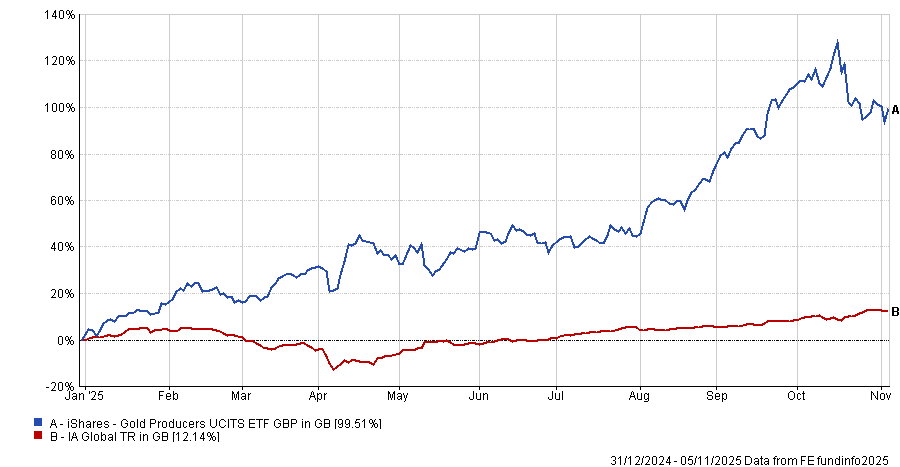

While the fund is in the top quartile over the other standard time frames, it did not consistently deliver strong performances. In four of the past 10 calendar years, it ranked as a bottom-quartile strategy in the IA Global peer group.

However, good returns in other years helped cover for these periods of underperformance. For example, it is the top fund in the sector so far this year, rising by 99.5% with the next closest fund up just 69% by comparison.

Performance of fund vs sector YTD

Source: FE Analytics.

Other passive funds performed well over multiple timeframes, with 11 trackers delivering top-quartile returns.

In theory, active funds should have the potential to outperform passives over the long term due to manager skill and the ability to avoid downturns, but this has not always been the case in the IA Global sector during this period.

Global markets are highly concentrated, with 20% of the MSCI ACWI invested in the ‘Magnificent Seven’. As these stocks have surged in recent years, any fund with high exposure to them, such as a tracker, has done very well, while active managers who were underweight struggled to keep up.

The MSCI ACWI (used here to represent the average passive fund) is up 237.2% while the average fund in the IA Global sector is up 179.2%, according to Trustnet data.

However, 10 actively managed strategies were able to deliver top returns over one, three, five and 10 years.

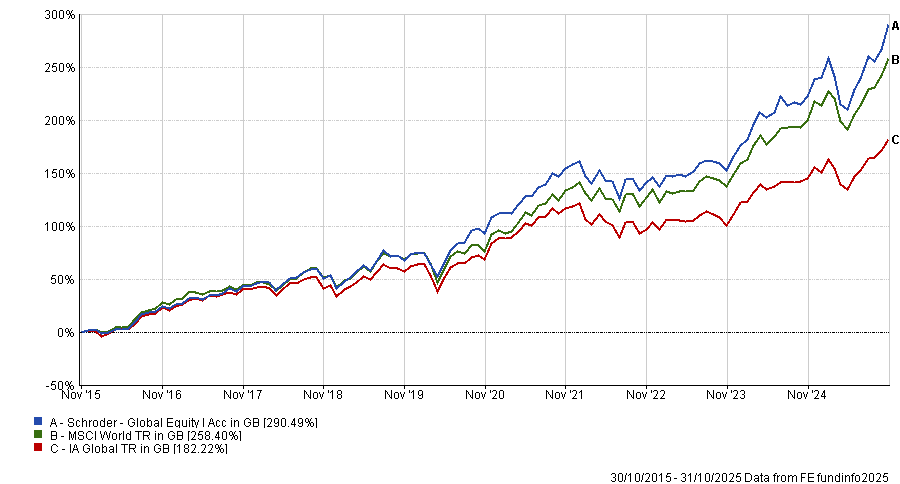

We start with FE fundinfo Alpha Manager Alex Tedder’s Schroder Global Equity fund, which has a total return of 290.5% in the past decade.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics.

It benefits from a high allocation to the top-performing tech stocks, with six of the Magnificent Seven featured in its top 10, although some are slightly underweight compared to the MSCI World.

The fund has beaten the sector average each calendar year over the past decade other than 2016, when it fell into the third quartile.

However, active funds did not have to invest in the most popular stocks to outperform, with some value-driven strategies also posting top returns in this period.

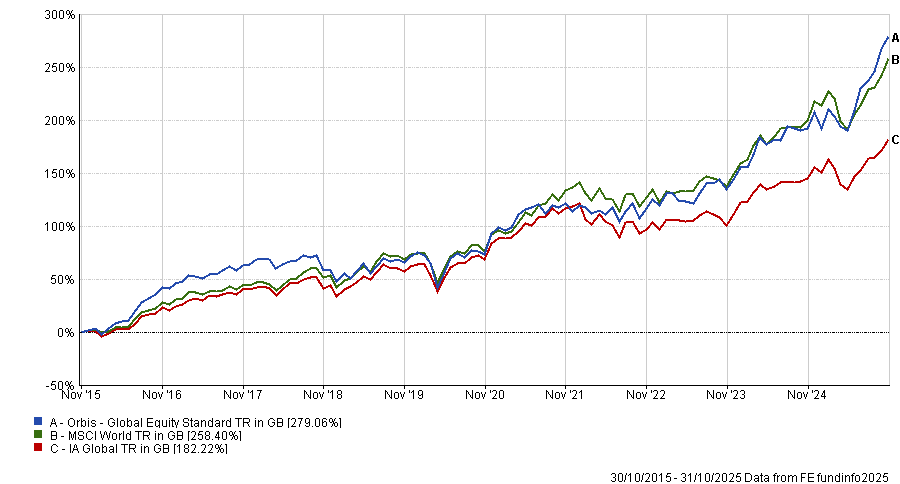

For instance, the Orbis Global Equity fund surged 279.1% over the past decade and has delivered further top-quartile returns in more recent time frames, despite holding no Magnificent Seven stocks within its top 10.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics.

It currently runs a 15% underweight in tech compared to the MSCI World and 41% of the fund is allocated towards the US, compared to 72% in the benchmark.

While this more contrarian approach has paid off in periods where growth struggled, such as earlier this year after the announcement of tariffs or during 2022’s bear market, it has resulted in some volatility in returns. For instance, in 2018, 2019 and 2021, the fund slid into the bottom quartile.

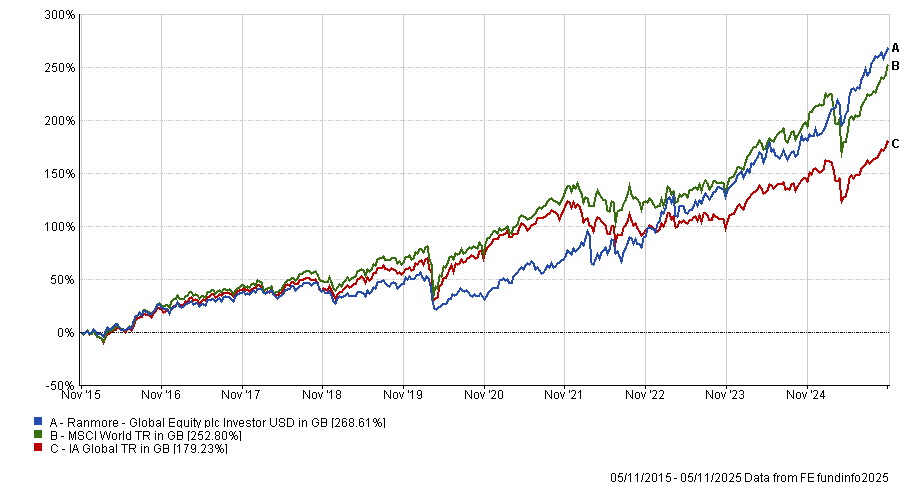

Sean Peche’s Ranmore Global Equity fund also made the list. However, this is primarily the result of a handful of strong recent performances. Before 2020, the fund’s style was out of favour, with bottom-quartile or third-quartile results each calendar year. Since 2021, the strategy has rallied with multiple top-quartile yearly returns, boosting the fund’s overall track record.

It is significantly underweight in the US, with just 21% of the assets invested in the region with Peche favouring Europe and Asia instead.

This approach has resulted in a 275.2% return over the past decade and further top-quartile returns over five, three and one years.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics.

This article is part of an ongoing series examining the funds in each market that have outperformed over all standard time frames. Previously in this series, we have looked at Europe.