Emerging markets and developed markets seem to be converging this year, as the characteristics which separate them have become more blurred, according to Raheel Altaf, manager of the Artemis SmartGARP Global Equity fund.

Theoretically, the two types of market are distinguished by levels of GDP, economic maturity and stability, but this definition has been less clear this year.

“When you look at some developed markets this year, they seem to have characteristics of emerging markets, such as political instability and currency volatility,” the FE fundinfo Alpha Manager said. One does not need to think hard to find examples, with France having gone through five different prime ministers in the past two years and the US dollar in decline.

Across the globe, governments have started to “load up on debt”, with the US having a $1.77trn national deficit.

All of these are characteristics usually associated with less mature markets, Altaf said.

By contrast, some emerging markets now have the qualities of their developed market counterparts, such as comparative economic stability and better levels of growth.

For example, many emerging markets now have much less debt than some Western countries. According to data from the International Monetary Fund (IMF), general government gross debt is 72.7% (as a percentage of GDP) in emerging markets, compared to 110.2% in advanced economies.

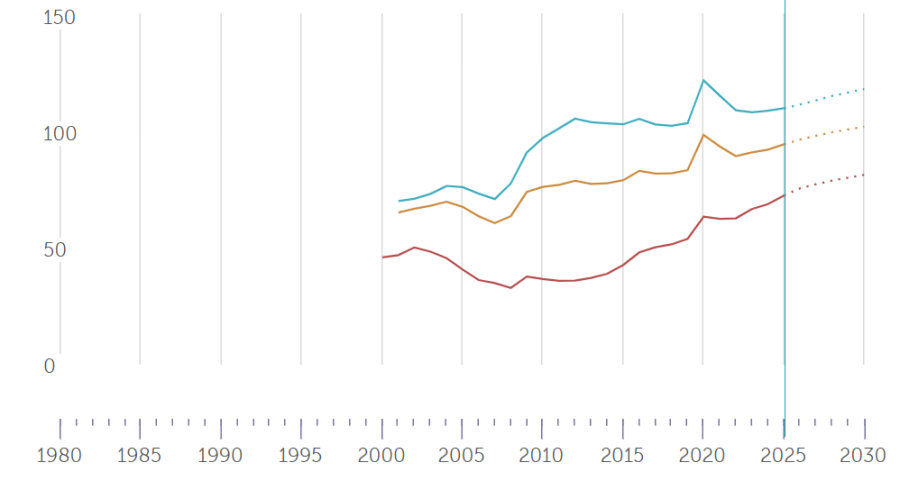

Government debt as a percentage of GDP

Source: International Monetary Fund. The red line represents emerging markets, the blue line represents advanced economies, and the yellow line represents the global average.

Many emerging market companies are also more “fundamentally sound” than investors initially think, Altaf said, as they benefit from a “benign economic backdrop”, including young working populations, urbanisation, a growing middle class and good domestic consumption.

On top of this, countries such as China are “aggressively” stimulating their economies, while others like Korea are introducing reforms to make companies more shareholder-friendly.

Some emerging countries are much less constrained in terms of monetary policy and could cut rates “quite aggressively” to promote better growth.

“This is a very different dynamic when compared to the western world, where you’ve got cost of living issues, inflationary pressures and unemployment concerns,” Altaf said.

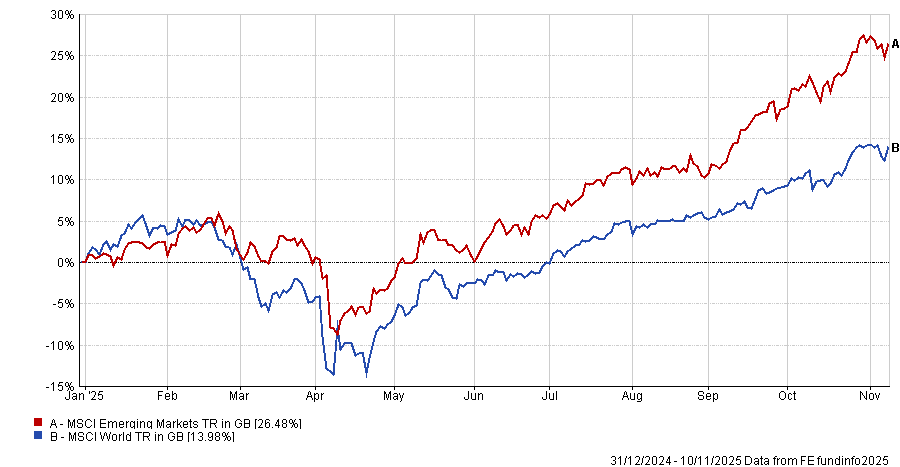

The convergence of these types of markets is part of why emerging markets seem to be finally “turning the corner”, after being among the worst places to invest for decades. Over the year to date, the MSCI Emerging Markets index is up 26.5% in sterling terms, outpacing the MSCI World, which tracks developed markets, as the chart below shows.

Performance of indices YTD

Source: FE Analytics

Altaf has remained bullish on emerging markets this year, maintaining a 27.8% allocation to the region within his portfolio. This is a relative overweight compared to its benchmark, the MSCI ACWI, which has around 10% exposure to emerging markets.

Part of Altaf’s enthusiasm for emerging markets comes from the share price of companies, which are priced in a way that “is hard to believe”. Businesses trade at substantial discounts to what similar companies are priced at elsewhere, giving several opportunities for value investors, he continued.

For example, the manager has found opportunities in Taiwan this year, which is one of the emerging markets that “is closest to being a developed market”.

He holds semiconductor manufacturer TSMC as one of his top 10 holdings and recently added to Elite Material, which makes components for data centres, giving it a “meaningful role” in the artificial intelligence trend.

Both trade on discounts to other tech stocks, with TSMC on a 23.9x price-to-earnings (P/E) ratio and Elite Material on 35x compared to Nvidia’s 54.7x P/E ratio, according to Google Finance.

Chinese businesses have several tailwinds this year, including being better positioned for tariffs than many investors think.

After the first Trump presidency, Chinese companies understood they were “in the firing line” of another wave of tariffs and so took measures to reduce their US exposure, Altaf said. This included focusing more on the domestic market and other emerging markets so that now, just “3% of their revenues are directly exposed to the US”.

Chinese cobalt producer CMOC Group was one of the portfolio’s best-performing holdings this year.

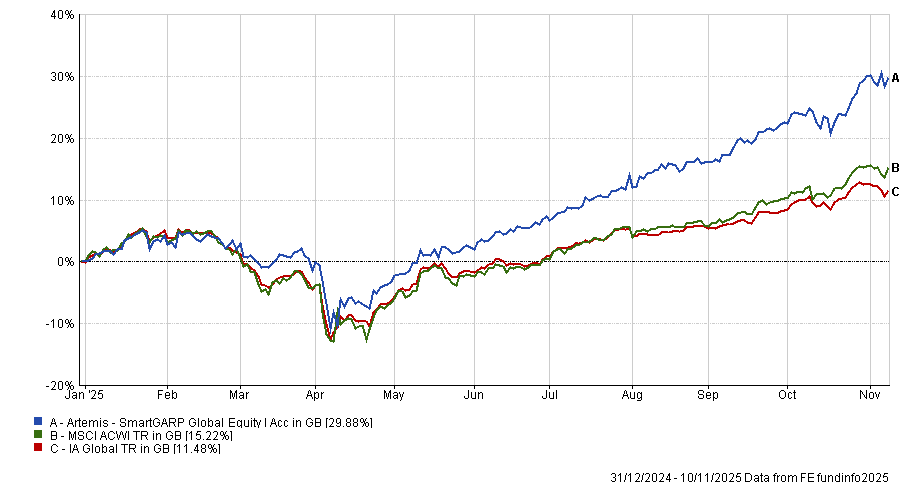

The focus on emerging markets has contributed to the Artemis SmartGARP Global Equity fund’s strong performance this year. Since the start of 2025, the strategy has surged 29.9%, outpacing the MSCI ACWI as well as its peers in the IA Global sector.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics