Picking a multi-asset fund can be viewed as a one-stop shop solution. But while these portfolios can invest in a range of different assets, it does not mean that they are immune to everything the market might throw at them.

Despite their wide remits, many multi-asset funds can still function similarly, moving up and down broadly in tandem. As such, investors with a top-rated multi-asset fund may wish to pair it with others doing something different to provide additional diversification.

Trustnet therefore looked at correlations between IA Mixed Investment 40-85% Shares funds with a top FE fundinfo Crown Rating of five to see which funds operate differently to others. A score of 0.7 or below means they are sufficiently lowly correlated to one another.

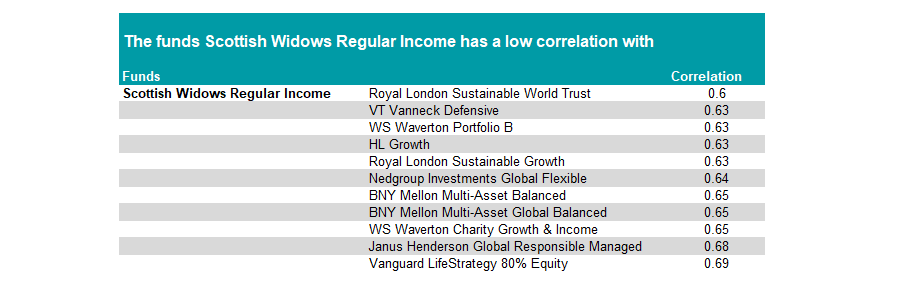

With 29 portfolios to choose from, here we have ranked the funds by the number of portfolios they have a low correlation with. In first place was Scottish Widows Regular Income. Managed by Philip Chandler, this £193m fund had a score below 0.7 against 11 other five-crown rated portfolios.

It aims to provide a quarterly income with some capital growth, through primarily investing in UK stocks (73.4% of the portfolio), UK bonds (13.1%) and global bonds (9.4%).

Most multi-asset portfolios tend to invest in global equities, however this fund only has a 0.4% position in overseas shares, giving it a different risk profile to its peers.

Source: FE Analytics

It is the only top-rated fund to post a low correlation with the behemoth £16.1bn Vanguard LifeStrategy 80% Equity fund (0.69). It is also the sole fund to score below 0.7 with Royal London Sustainable Growth and Janus Henderson Global Responsible Managed.

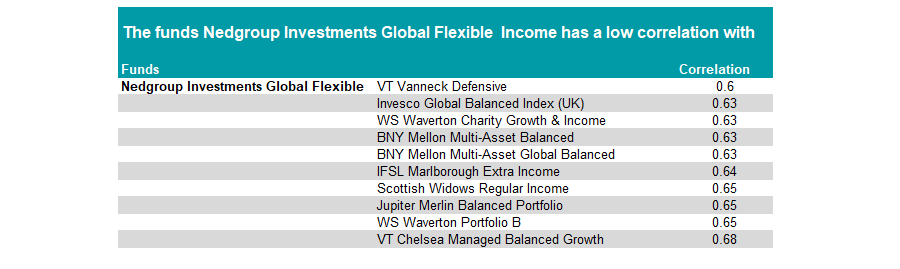

In second place is Nedgroup Investments Global Flexible, with low correlation scores to 10 other five-crown rated funds. It has historically used cash and equities as its main assets, although it can invest in traditional bonds, convertible bonds and asset-backed securities, as well as real estate.

At present, it has 55.6% weighted to equities, predominantly in the US (35.4%) and Europe (20.2%). It barbells this with a 40.5% weighting to cash, 2.9% in fixed income and 1% in listed property.

Its top holding by some distance is Alphabet. The parent company of search engine Google is a 5.4% position, almost double that of Facebook owner Meta (2.9%) and circuit maker Analog Devices (2.8%), which round out its top three holdings.

Nedgroup Investments Global Flexible is the only fund with a score below 0.7 to the £2bn Jupiter Merlin Balanced Portfolio, run by FE fundinfo Alpha Manager John Chatfeild-Roberts, Amanda Sillars, David Lewis and George Fox.

Source: FE Analytics

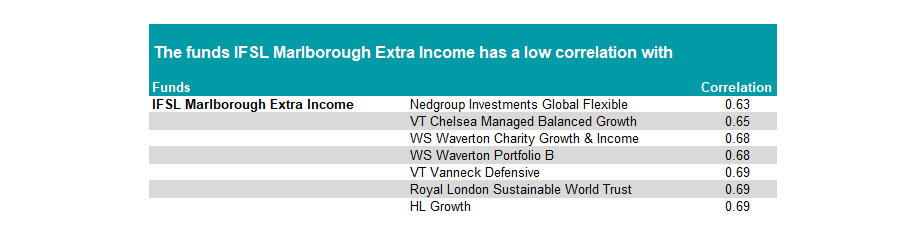

In joint third place is IFSL Marlborough Extra Income, which has a low correlation score to seven other top-ranked funds. Although it does not have any unique pairings, it is one of only two funds to score lowly against HL Growth, the £2.3bn fund managed by Ziad Gergi.

With £38m in assets under management, IFSL Marlborough Extra Income is one of the smaller names on the list. Run by Matthew Rainbird since 2009, it aims to yield more than the FTSE All Share index over three years while taking on less risk and adding some capital growth.

It invests predominantly in UK shares (58.4%) and domestic bonds (19.9%), with international equities (14.3%) the only other major weighting. It also holds smaller positions in investment trusts, international bonds and cash.

Source: FE Analytics

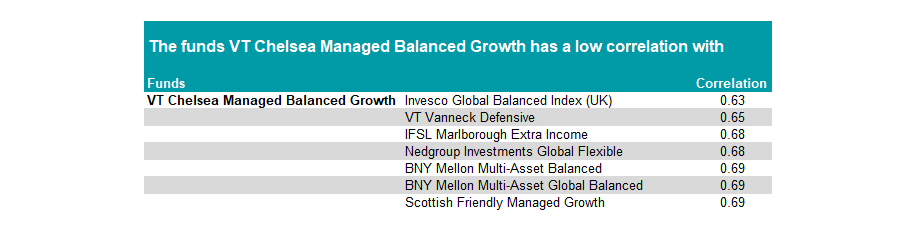

In contrast, the £61m VT Chelsea Managed Balanced Growth portfolio is a fund-of-funds portfolio headed by Darius McDermott.

It is split between equities (51.5%), bonds (11.3%) and alternatives (13.5%), with smaller positions in cash, absolute return, property, gold and silver.

The fund invests in a range of open and closed-ended vehicles, with its top including investment trusts, market trackers and active funds. The team noted recently it was adding to its trust positions, however, as discounts on many have “started to widen again” giving them “a good opportunity to put our cash to work”.

VT Chelsea Managed Balanced Growth is the only fund with a correlation of below 0.7 to Scottish Friendly Managed Growth and one of just two names to score lowly against Invesco Global Balanced Index (UK).

Source: FE Analytics

This is the final article in our series looking at lowly correlated top-rated funds. Previously, we have looked at the low-risk multi-asset funds, US equity portfolios, the major UK sectors and the IA Global peer group.