Artificial intelligence (AI) is reshaping industries and portfolios alike, but its meteoric rise has sparked concerns of a bubble.

Rather than going all-in on the tech giants, we asked fund selectors to match an AI-focused fund with a strategy rooted in sectors less vulnerable to a potential AI rerating.

With plenty of short-term AI risk factors in play, these pairings should allow investors to stay aligned with long-term AI beneficiaries while keeping a firm grip on downside risk.

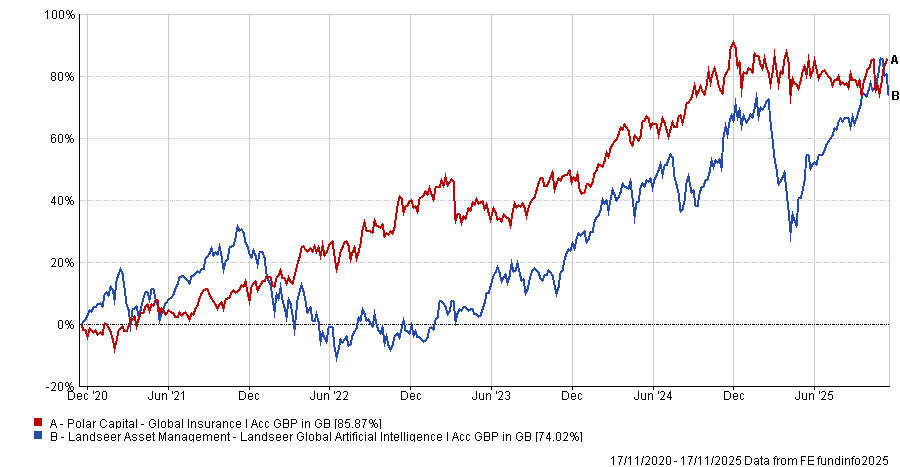

Landseer Global Artificial Intelligence and Polar Capital Global Insurance

For a fund to capitalise on the AI surge, Dzmitry Lipski, head of funds research at interactive investor, suggested Landseer Global Artificial Intelligence.

The global equity growth portfolio, which is managed by Chris Ford and Tim Day, focuses on businesses that have meaningfully adopted AI to ensure a competitive advantage.

“The strategy is supported by a proprietary AI-driven investment platform and follows a high-conviction, bottom-up approach,” said Lipski.

“The management team believes we are still in the early stages of a multi-year transformation driven by AI automation and digital infrastructure.”

Top holdings include well known global tech leaders such as Nvidia, Alphabet and Tesla.

Lipski noted that the fund is also “competitively priced for an active fund”, with an ongoing change of 0.45%.

He said he would pair the AI-driven fund with Polar Capital Global Insurance, which offers exposure to a high-conviction portfolio of 30 to 35 non-life insurance companies.

“It is the only European fund focused exclusively on the global insurance sector,” said Lipski.

The management team, led by Nick Martin, believes the insurance sector offers attractive long-term opportunities which are supported by structural growth, broad geographical diversification and relative stability during periods of volatility.

“Given that demand for insurance is generally less sensitive to macroeconomic conditions and the industry faces limited disruption risk from big tech disruptors, the sector has historically displayed counter-cyclical characteristics,” Lipski noted.

“As a result, the fund may offer valuable diversification benefits within a broader investment portfolio.”

Performance of the funds over 5yrs

Source: FE Analytics

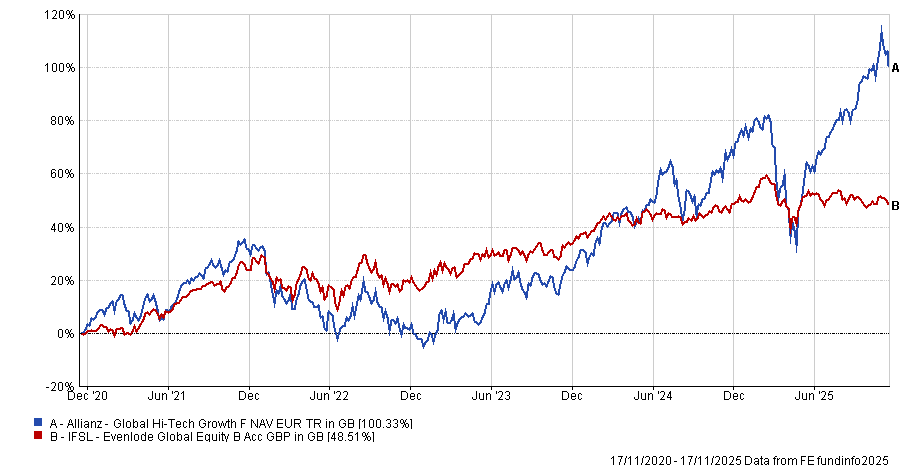

Allianz Global Hi-Tech Growth and IFSL Evenlode Global Equity

Darius McDermott, managing director at FundCalibre, suggested Allianz Global Hi-Tech Growth – a multi-cap global technology strategy that deliberately looks beyond the Magnificent Seven (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla), focusing on high-growth companies with strong business models “rather than blue-sky concepts”.

The fund has found opportunities across core AI themes, including cloud computing, cybersecurity, industrial automation, future mobility and AI enablement.

“They aim for the ‘sweet spot’ of the tech lifecycle, where the technology works, the economics stack up and the growth runway is still long,” said McDermott.

Alongside it, McDermott turned to quality growth, which he noted “looks attractively valued relative to both tech and the wider market”.

“We like IFSL Evenlode Global Equity, which prioritises companies with dependable cashflows, strong competitive moats and high returns on capital – the kind of all-weather business models that can remain resilient even if an AI-driven shock drags down the wider market,” he said.

Fund manager James Knoedler highlighted the unsustainable economics emerging at the sharp end of the AI race, where capital intensity is enormous and spending is flowing into areas with uncertain returns.

McDermott said: “Many of these companies are beneficiaries of AI at the operational level – through efficiency, pricing power or margin improvement – but their success doesn’t depend on the technology, or on market hype being sustained.

“They run durable, cash-generative franchises with long records of compounding. In a risk-off shock, these kinds of businesses tend to hold up better, providing ballast while more speculative parts of the market reprice.”

Performance of the funds over 5yrs

Source: FE Analytics

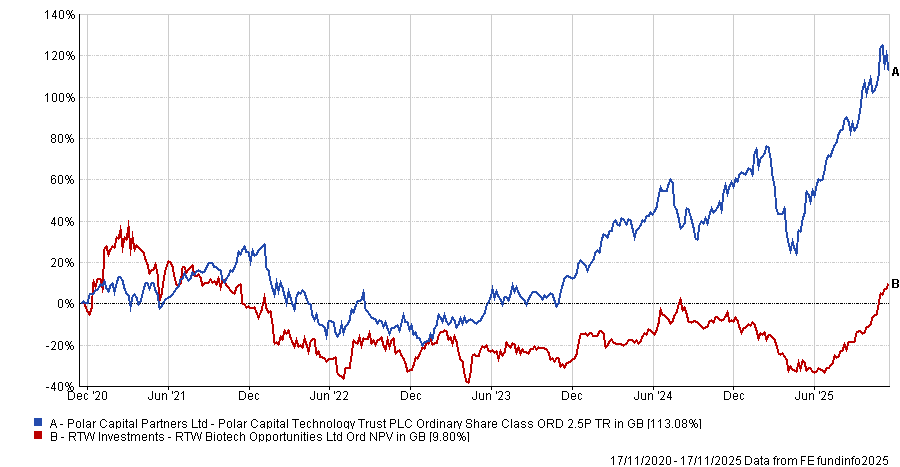

RTW Biotech Opportunities and Polar Capital Technology Trust

Riccardo Persona, investment manager at Whitman, looked to pair two investment trusts with contrasting exposures to the adoption of AI.

He first suggested RTW Biotech Opportunities, which has minimal direct exposure to AI and is based upon “the pressing requirement to treat chronic conditions such as obesity and cancer”.

Although the trust does not invest directly in AI companies, many of its portfolio holdings do harness AI for operational efficiency, such as for data sequencing to assess the prevalence of different diseases.

In contrast, Persona’s other pick – Polar Capital Technology Trust – has tilted its portfolio intentionally towards AI by selecting investments associated with the vast physical infrastructure required to build out capabilities.

“The trust is less focused on companies that will be effective at harnessing AI for productivity gains – it is more about ‘getting AI built’, a so-called ‘picks and shovels’ play.”

Performance of the trusts over 5yrs

Source: FE Analytics

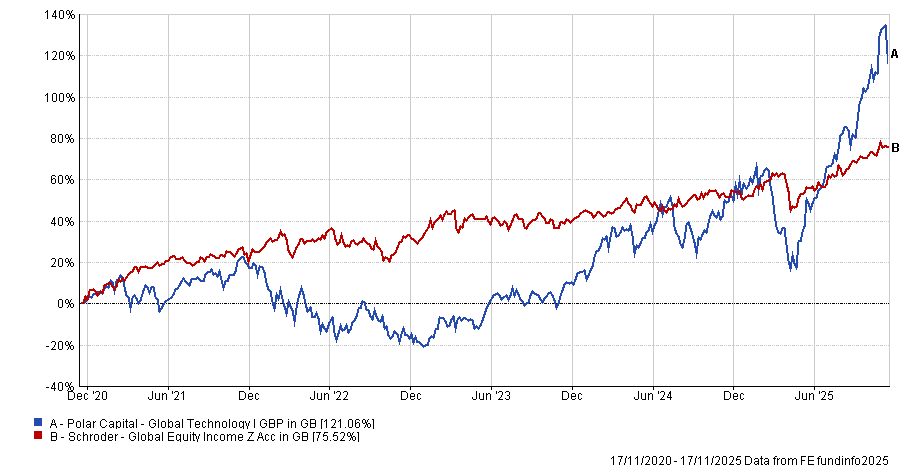

Polar Capital Global Technology and Schroder Global Equity Income

To capitalise on AI, Paul Angell, head of investment research at AJ Bell, picked Polar Capital Global Technology, noting it is “a great fund for AI bulls”.

“The managers are positive on the outlook from here, believing a vast amount of the economy is still to be disrupted by AI, particularly software businesses and service level jobs more generally,” said Angell.

A circa 10% weighting to semiconductor chip designer Nvidia is the largest holding in the fund, with Meta, Broadcom and TSMC also featuring in its largest holdings.

“From a valuation perspective the fund’s price-to-earnings ratio stood at 28.8x and 5.7x price/sales as of 30 September 2025,” Angell added.

Meanwhile, Schroder Global Equity Income would be a “great counterbalance should the AI theme fail to deliver from here”.

The management team deploys a disciplined accounting-based process where they scour the cheapest 20% of global stocks – while looking to avoid value traps – with every prospective investment undergoing independent modelling before being allocated to.

The fund has a lower weighting (around 35%) in the US, with a large regional overweight to the UK, Japan and Europe.

Typically more defensive companies also feature in its top holdings, including healthcare majors GSK and Pfizer, alongside UK bank Standard Charters, Spanish energy business Repsol and German tyre manufacturer Continental AG.

The fund is also cheaper of the pair, with a price-to-earnings multiple of 10.2x and 0.5x prices/sales as of 31 October 2025, Angell said.

Performance of the funds over 5yrs

Source: FE Analytics