Just over 95% of funds in the Investment Association funds have made a loss in recent days, with those focused on the US and tech bearing the worst of the pain as markets rout on bubble fears.

Stock markets have been falling since Wednesday last week, driven by investor concerns over the valuations of artificial intelligence (AI) companies, interest rate expectations and global economic uncertainty.

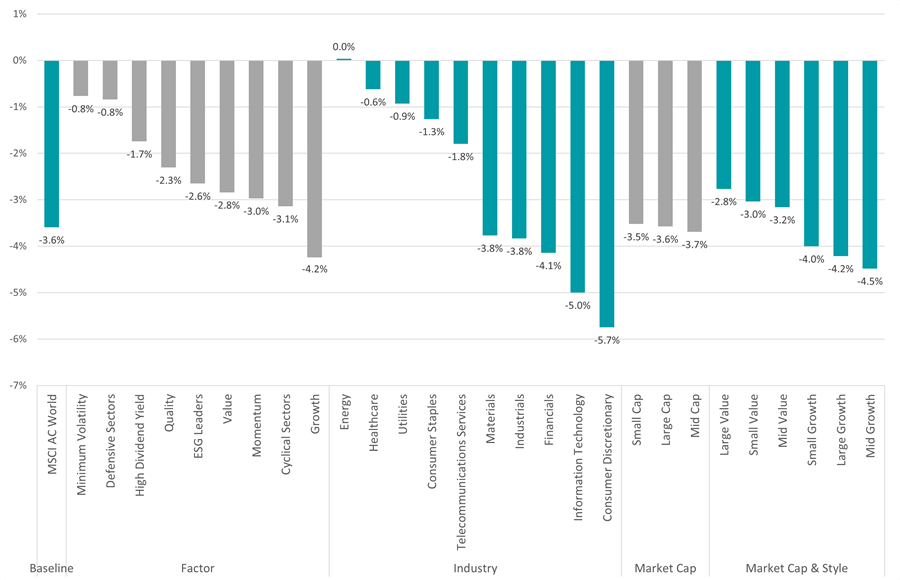

Over the past week, the MSCI AC World index has shed 3.6% (in sterling terms), with all sectors of the global market posting losses. As the chart below shows, growth stocks have been hit harder than value stocks, reflecting investors’ worries about valuations in the tech space.

Performance of MSCI AC World and sub-indices since Wed 12 Nov

Source: FinXL. Total return in sterling between 12 and 19 Nov 2025

Fear over an AI bubble and doubts about tech companies’ abilities to deliver on high expectations triggered heavy selling in major AI-linked stocks such as Nvidia, Microsoft, Amazon, Palantir and others.

This week’s Bank of America Global Fund Manager Survey found 45% of asset allocators think an AI bubble is the biggest tail risk in the market at the moment. This is up from 33% last month.

“AI stocks are already in a bubble according to 53% of Fund Manager Survey investors (down from a record 54% in October),” Bank of America strategists added. “A record 63% of [survey] participants believe global equity markets are currently overvalued (up from 60% last month).”

Investors will be closely watching the results of Nvidia, the chip maker at the core of the AI revolution, later today to see if high valuations are justified.

Russ Mould, investment director at AJ Bell said: “As fears over an AI bubble build, there has rarely been more riding on an individual set of results than Nvidia’s on Wednesday. Even a mild disappointment could reinforce the market’s worries and spark a wider sell-off.”

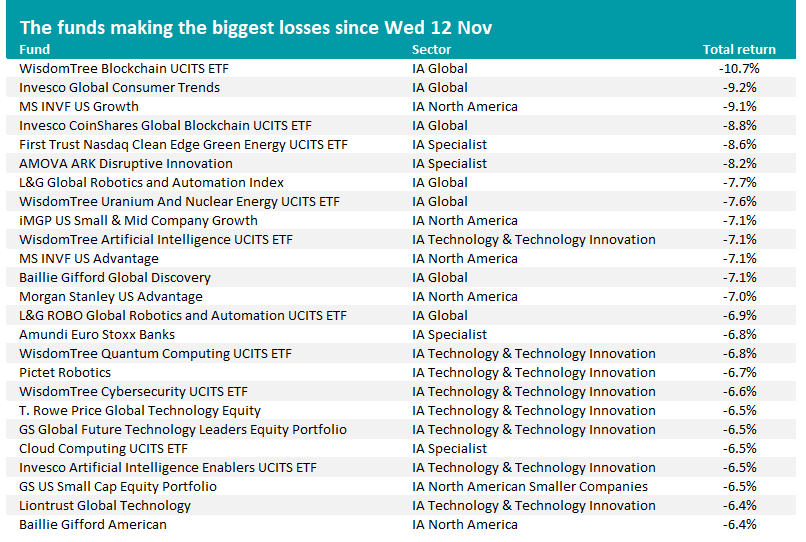

Performance of fund sectors since Wed 12 Nov

Source: FE Analytics. Total return in sterling between 12 and 19 Nov 2025

FE Analytics shows that the average fund in every sector in the Investment Association universe has made a loss since Wednesday 12 November, with the biggest drops being seen in the IA North American Smaller Companies, IA Financials and Financial Innovation, IA Technology & Technology Innovation and IA North America peer groups.

The IA Standard Money Market and IA Short Term Money Market sectors – where funds invest in cash or cash-like assets – are the only peer groups where the average fund has remained in positive territory over the past week.

In all, 5,038 funds – or 95.6% of the Investment Association universe – have made a loss since last Wednesday. In 28 sectors, including IA Technology & Technology Innovation, IA Europe Excluding UK, IA Global Equity Income, IA UK Equity Income and IA Volatility Managed, every fund is down.

Source: FE Analytics. Total return in sterling between 12 and 19 Nov 2025

Those with the largest losses can be seen in the table above, which has WisdomTree Blockchain UCITS ETF at the top with its 10.7% loss. Invesco CoinShares Global Blockchain UCITS ETF is in fourth place with an 8.8% fall.

This is down to a plunge in Bitcoin and other cryptocurrencies. Bitcoin is currently trading around $90,000 mark, having dropped from its all-time high of $126,300 little over a month ago.

Simon Peters, crypto analyst at eToro, said: “One of the main factors that has been attributed to this correction is traders and investors becoming less confident about a cut to interest rates by the Federal Reserve at their upcoming December meeting, due to recent comments from Fed members as well as a lack of economic data due to the recent US government shutdown.

“Crypto is arguably the most sensitive asset class to (or to the perception of) loosening or tightening financial conditions, and traders and investors have been recalibrating.”

The bulk of the list of funds with the biggest losses is linked to the US mega-cap/AI trade, with eight of the 25 residing in the IA Technology & Technology Innovation sector and those in other sectors – such as L&G Global Robotics and Automation Index and Cloud Computing UCITS ETF – have a remit focused on tech.

Funds such as MS INVF US Growth, AMOVA ARK Disruptive Innovation and Baillie Gifford American also have portfolios tilted towards the US growth stocks that are falling the hardest in the sell-off, while WisdomTree Uranium And Nuclear Energy UCITS ETF is tied to electricity demand caused by the AI revolution.