Chancellor Rachel Reeves’ Budget announcement to impose a £2,000 cap on salary sacrifice for auto-enrolment pensions has triggered alarm across the pensions industry.

Salary sacrifice enables employees to exchange part of their salary for employer pension contributions in a bid to reduce their income tax and National Insurance (NI) liabilities. This ensures more money in employees’ pockets and is also beneficial for the employer, as it reduces their NI contributions for employees.

Research earlier this year suggested that 48% of all UK private sector companies offer salary sacrifice pension contribution benefits. At larger firms, this rises to 67% and 85% for the biggest employers.

In the Budget this afternoon, Reeves confirmed a £2,000 annual cap which will come into effect from April 2029 and is estimated to raise £4.7bn for the Treasury.

This projected tax take is greater than previous estimates – which sat at around £2bn.

Gary Smith, retirement specialist at Evelyn Partners, said: “[This higher projection] means the impact of this policy on pensions, pay or businesses – or all three – could be severe.

“It is a tax penalty on people trying to do the right thing by saving efficiently for their own retirement and it’s yet another NI cost increase imposed on firms, which may result in reduced pay and pension benefits for private sector employees.”

In its own response to the Budget, on salary sacrifice the OBR said employers will seek to pass on the cost of these limits to employees, which will result in reduced contributions as well as reduced pay rises and bonuses. Employees can also expect to see an impact on their take-home pay.

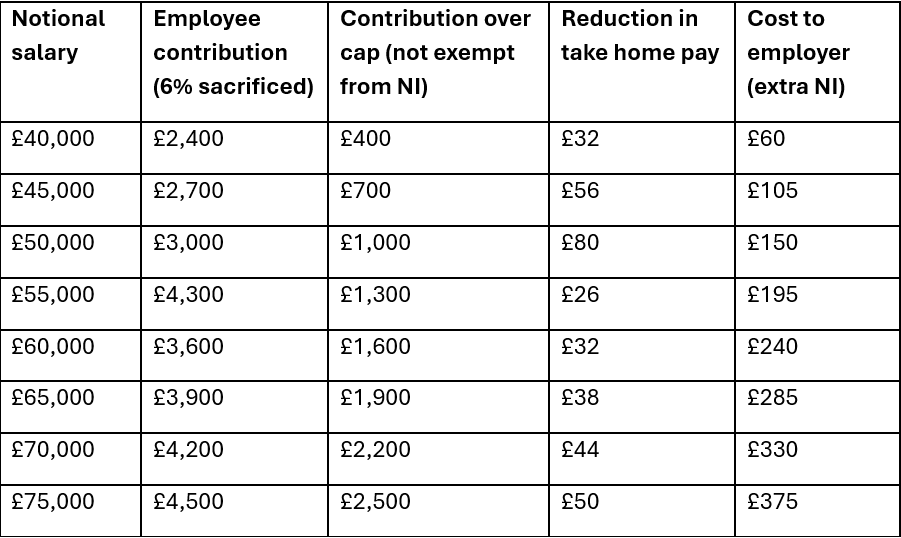

The below research by AJ Bell shows the impact on employee pay packets and the extra NI bill to employers per year of the £2,000 a year cap – assuming the employee has agreed to exchange 6% of their notional salary for a pension contribution, with a 6% employer match.

The cost of the salary sacrifice cap

Source: AJ Bell. Figures based on when the changes come into effect in 2029.

Charlene Young, senior pensions and savings expert at AJ Bell, said: “Despite the NI savings being capped, pension contributions will still be exempt from income tax and workers can still enjoy pension tax relief up to their marginal rate of income tax.”

In addition, making pension contributions to schemes like SIPPs will still reduce a taxpayer’s ‘adjusted net income’, she noted.

“Rather than making a formal arrangement to keep their salary below a certain level, workers will need to work out what extra contributions they need to make to reduce their adjusted net income,” Young said.

“This will involve a little bit of extra admin but will still be well worth it when you consider the potential tax savings on offer.”

However, if the chancellor is looking for a more positive reaction, she may find it from the public sector, Smith noted.

“It is politically convenient that public sector schemes do not generally operate on a salary sacrifice basis but rather operate as ‘net pay arrangements’,” he said.

It will, however, “put a further wedge” in the growing divide between private and public pensions, he added.

“Restricting this sensible tax benefit that makes private sector saving more attractive adds insult to injury in a two-tier pension system where public sector pensions, underwritten by taxpayers, are hugely more generous and reliable than those available in the private sector,” Smith said.

The decision also undermines the government’s recently reestablished Pensions Commission, which is charged with trying to encourage greater pension saving, following mounting concern that people are more likely to retire into poverty.

Zoe Alexander, executive director of policy and advocacy at Pensions UK, said: “Over half of savers are on course to fall short of the retirement income targets set by the 2005 Pensions Commission. Applying NI to salary-sacrificed pension arrangements above £2,000 will harm the economy, businesses and pension saving.”

A recent survey of Pensions UK members found that 75% of respondents said they believe savers are likely or very likely to alter retirement contributions or decisions because of the cap.

Employers and individuals will have time to prepare, with implementation of the cap not expected until April 2029.

“Applying the changes from 2029 should at least give businesses time to prepare and we urge them to consider how they can maintain the generosity of their workplace pension arrangements to lessen the harm to savers’ retirement prospects,” said Alexander.

For a full breakdown on everything else you need to know about the Budget, click here.