Savers have been hit by a “shocking” tax on their cash, experts have said, after chancellor Rachel Reeves upped the amount payable on interest earned.

From April 2027, savers in the basic rate tax band will pay 22% in savings income tax, up from the current 20%. Higher and additional rate taxpayers will pay 42% and 47% respectively.

Sarah Coles, head of personal finance, Hargreaves Lansdown, said it was a “shocking tax rise for savers”, while AJ Bell director of personal finance Laura Suter said the “whopping” increase adds to the “tax tsunami” that has befallen people over the past few years.

It is a double whammy for savers, with the cash ISA allowance falling from £20,000 to £12,000 in the Budget for anyone under the age of 65. People can still put the full £20,000 into an ISA, but £8,000 of this must be placed in a stocks and shares option.

Coles said: “The personal savings allowance will still protect the first £1,000 of savings interest for basic rate taxpayers and £500 of interest for higher rate taxpayer, but after that people will face a hike in their tax bill.”

Part of the rationale behind the move is to encourage more people to invest, but Richard Hansell, head of wealth management at Chetwood Wealth Management, said this could have little impact.

“The chancellor’s hope is that investors turn to equity investment and boost UK markets with fresh inflows,” he said.

“Trimming the cash cap is unlikely to materially boost equity participation or direct more money into UK shares, meaning the policy may miss its growth objective while adding household risk.”

How much will it hit savers?

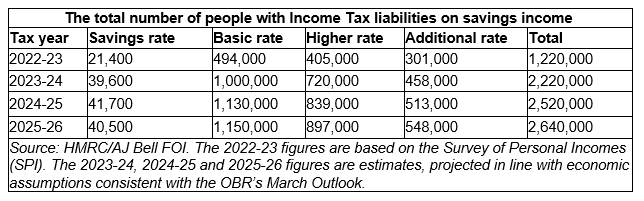

AJ Bell analysis shows that 2.64 million people already are expected to be hit with tax on their savings this year. The new tax rates are expected to cost an additional £100 for someone with £5,000 of savings interest above their personal savings allowance.

“But the cumulative effect of it is seen over a number of years,” Suter said. A higher-rate taxpayer with a £50,000 savings pot earning 4% interest will face £380 more tax over 10 years thanks to the tax increase. For a basic-rate taxpayer, this will be £135 in extra tax across that period.

Pensioners account for 44% of people paying tax on interest earned on their cash savings, with 1.16 million Britons over the age of 65 expected to incur the charge this year. In total, around 2.6 million people are due to pay income tax on cash savings interest earned in the current financial year.

For a full breakdown on everything else you need to know about the Budget, click here.