Investors who have been swept up by recent momentum in European stock markets need to be more cautious moving forward, as the fundamentals of companies no longer seem as supportive, warns James Cook, manager of the JPM Global Focus fund.

“People are getting very excited about Europe. I want to calm that down,” the FE fundinfo Alpha Manager said.

So far this year, interest in Europe has been bolstered by an aggressive infrastructure stimulus package in Germany (€500bn), improved earnings prospects for European companies and investors pivoting out of the US as they became concerned about president Donald Trump’s aggressive fiscal policy.

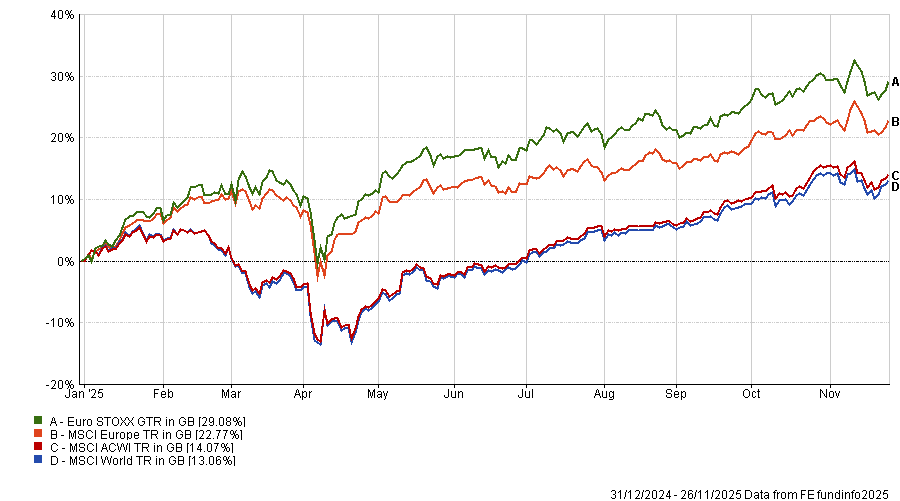

As a result, European stock markets have thrived with the Euro Stoxx up 29.1% year-to-date and the MSCI Europe up 22.8%, outperforming the MSCI World as seen in the chart below.

Performance of indices YTD

Source: FE Analytics.

However, investors chasing this momentum trade may find themselves disappointed, Cook said, as they might be overestimating the extent of fiscal stimulus.

So far, Germany is the only country engaging in a programme of fiscal stimulus, but this would “need to broaden out” to justify further investment in Europe.

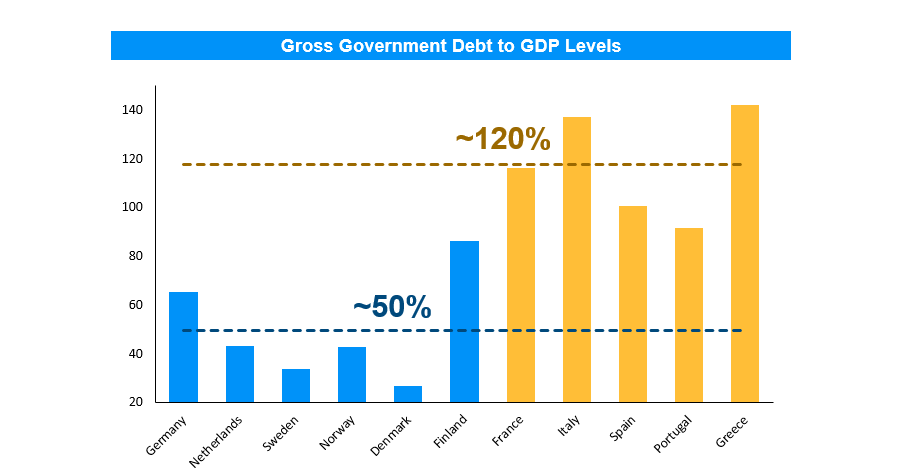

However, very few Eurozone countries have the means to stimulate because they have far higher levels of debt-to-GDP than Germany. The only countries with the fiscal leeway for a similar package of investment are in Northern Europe, represented in blue on the chart below.

Source: J.P. Morgan Asset Management, International Monetary Fund. Data is as of October 2025

The issue with this is that they “simply do not move the needle of the market”. These countries represent less than 15% of Europe’s total GDP, meaning that even if they were to invest, it would not make as much of a difference as people believe, Cook said.

By contrast, the countries most constrained by their levels of debt make up much greater percentages of European GDP. For example, France represents almost 15% of European GDP but has a debt-to-GDP ratio of 120%. At the same time, other large economies, such as Italy, are even more fiscally constrained, preventing a broad rally in Europe, Cook said.

Additionally, the “clear and obvious beneficiaries of the current rally have largely already played out” to the extent that popular European stocks now seem overvalued.

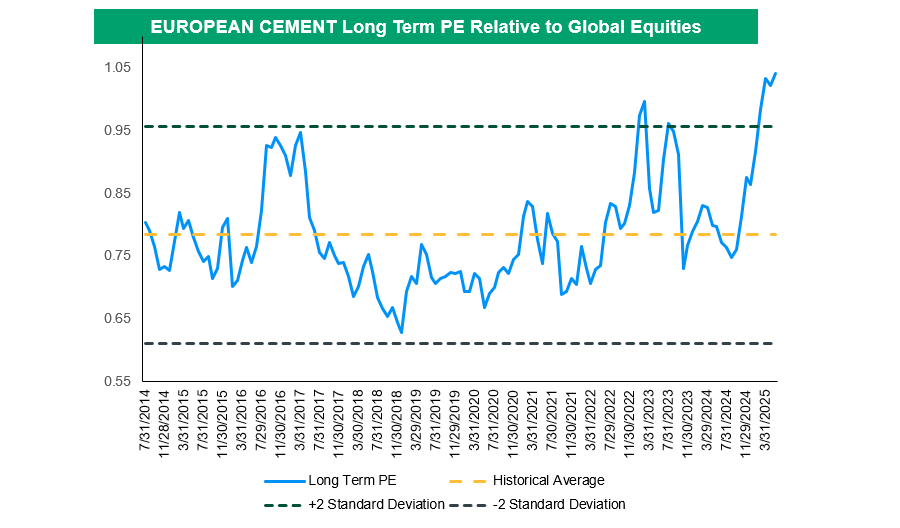

For example, he pointed to Heidelberg Materials, the German building materials company, which was expected to be a beneficiary of the infrastructure stimulus.

Despite having just 10% of its revenue in Germany, its share price has surged by more than 80% so far this year, which does not seem to match the fundamentals, according to the JPM manager.

“If you put European fiscal stimulus into the numbers and it doesn’t actually move the needle, then Heidelberg Materials’s valuations look expensive,” Cook said.

Source: JP Morgan Asset Management. Bloomberg. Estimates as of April 2025

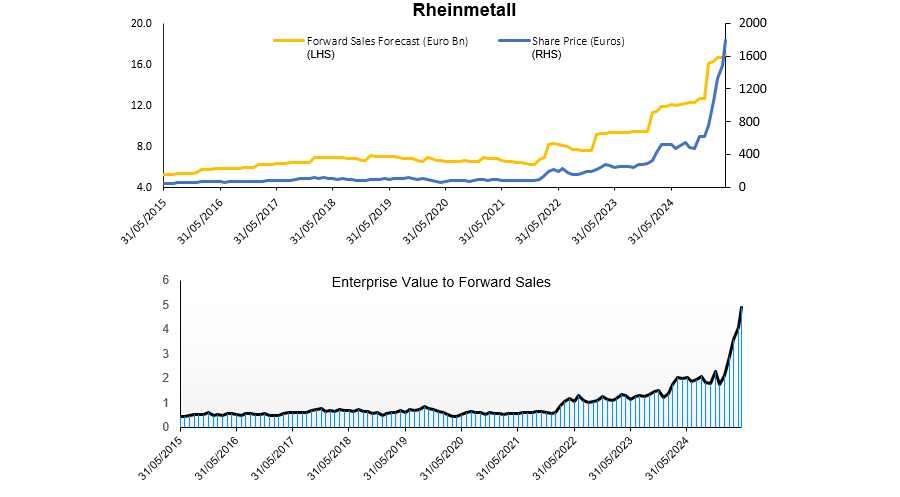

Defence and automotive company Rheinmetall is another example, with military stocks surging due to geopolitical tensions and commitments to spending 2% to 3.5% of GDP on defence.

But even if defence companies raised their budget by 70% overnight, they “cannot simply double the production of warships or fighter jets instantly”; it will take time to expand supply chains. As a result, Rheinmetall’s share price, which has surged ninefold over the past two years, seemed excessive, the manager said.

Source: JP Morgan Asset Management. Bloomberg. Estimates as of April 2025

Cook runs the JPM Global Focus fund, which has reduced its allocation to EMEA stocks this year, bringing its weighting within the portfolio down to 11.5%, a slight underweight compared to the MSCI World benchmark.

However, Cook said there are still good opportunities in Europe for bottom-up investors, as long as they remain discerning and avoid chasing a momentum trade.

In Europe, the team favoured German automotive and industrial company Siemens. As one of the largest engineering companies in Europe, responsible for rail transport and infrastructure, it is “well-positioned" in a period where Germany needs to expand and rebuild its supply network.

“We think it’s heading for a cyclical recovery, which could be bolstered even further by a structural growth opportunity in rebuilding those networks,” Cook said.

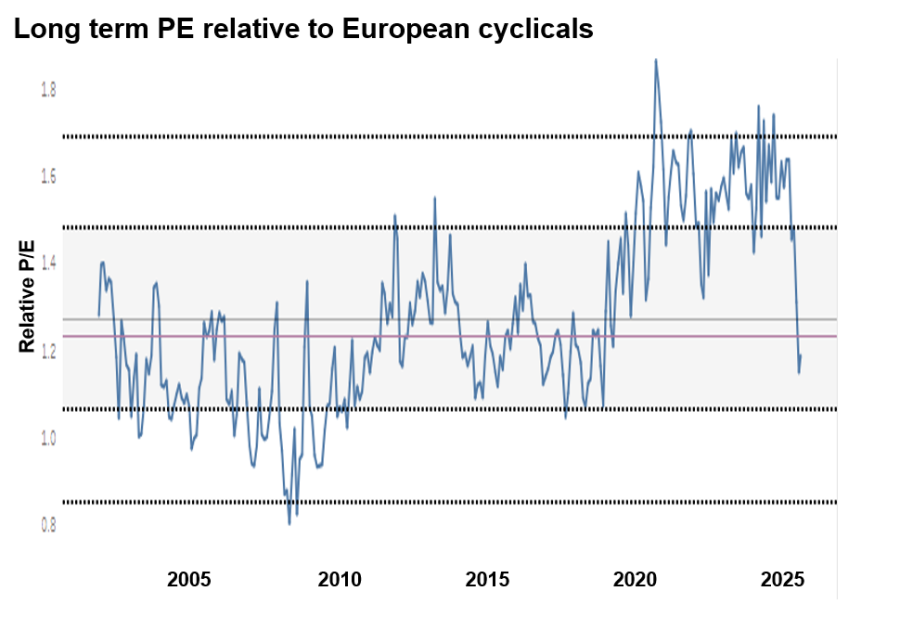

However, it has been “mostly forgotten” in the recent rally, with its long-term price-to-earnings ratio compared to other cyclicals falling in recent years, despite the share price climbing 20% year to date.

As a result, it looks “attractively priced, unlike some of those other names I’ve discussed”.

Source: JP Morgan Asset Management. Bloomberg. Estimates as of April 2025