Investors have almost certainly underestimated the potential for a 2026 rally in UK small-cap equities due to recent underperformance in the asset class.

This is the view of Ken Wotton, manager of the Gresham House UK Smaller Companies fund, who predicted smaller companies could return more than 30% next year.

While UK equities have surged this year, the rally has not been even, with the FTSE 100 climbing the most, up 22.2%. By contrast, the Deutsche Numis Smaller Companies excluding Investment Companies index is up 10.9% and the FTSE 250 has risen just 9.9% year to date, based on FE Analytics data.

Many investors have allowed the recent underperformance of smaller companies to distract them from the potential turnaround, Wotton said. “Market participants have short memories, but history tells us that the recovery in UK small caps can be sharp and rapid when it comes.”

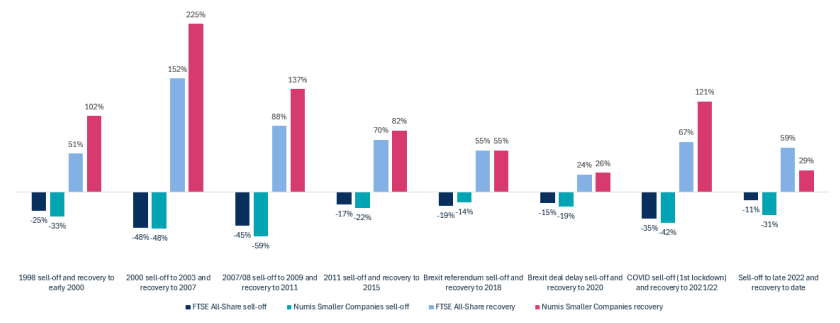

This is demonstrated by an analysis of how different parts of the UK market have performed after major sell-offs, the manager said.

Small- and large-caps’ sell-offs and recoveries

Source: Gresham House. Bloomberg. Data as of 10 November. Data in sterling.

Despite investors' tendency to favour more liquid large-caps during downturns, small-caps have traded in line with their bigger counterparts in most drawdowns since 2000, Wotton said. By contrast, they tend to recover much more sharply and materially than their larger-cap counterparts when things picked up.

For example, after the initial UK lockdown, the Deutsche Numis almost doubled the recovery of the wider FTSE All Share, despite only losing six percentage points more in the initial sell-off, as demonstrated in the chart above.

“This trend is what’s driven small-cap outperformance against large-caps over the very long term: They draw down slightly more on a sell-off, but they’ll more than make that up when they recover.”

Small-caps have historically rallied so much quicker than their larger cap counterparts due to liquidity differences, Wotton said.

Smaller, less liquid companies end up trading at material valuation discounts after periods of underperformance. As a result, very little capital is needed to cause prices to “squeeze up materially”, meaning the rally happens much faster than investors often anticipate, Wotton said.

“It’s not unusual in these sorts of periods to make 30% or even 50% from UK small caps in sterling terms.”

Looking ahead to 2026, Wotton said that the conditions in the UK equity market are supportive of another rally like this in small-caps, which investors risk missing out on.

Because the market has been “out of favour and overlooked for years now” and sentiment is pessimistic, many small caps are now trading at compelling valuations. He said this could appeal to overseas investors, particularly as the wider UK market itself is also undervalued with a price-to-earnings (P/E) of just 18x, compared to 39.8x in the US, according to data from Barclays.

“There’s a value play on the UK for investors, and within that there’s a value play at the small and mid-cap end of the market.”

Wotton pointed to the rise of mergers and acquisitions (M&A) and takeovers as evidence of this valuation gap.

Indeed, there were nearly 50 takeover attempts against UK-listed companies in the first half of the year, according to research from AJ Bell. High-profile takeover attempts such as Greencore's purchase of food producer Bakkavor or H&T pawnbrokers' acquisition by FirstCash are some examples.

The Gresham House manager said: “These sophisticated buyers move before the market and are a leading indicator rather than an impediment to the recovery coming through.”

On top of this, while the recent UK Budget was something of a “wasted opportunity” to change the small-cap narrative, many overseas investors had likely hesitated to add to the UK in the lead-up to the budget, Wotton said.

However, now that the Budget has been dealt with, the UK now seems comparatively fiscally stable compared to regions such as France, Germany and Italy, “although it may not feel like it.” For investors who started pulling money out of the US this year due to concerns over valuations and fiscal policy, this looks very supportive, Wotton said.

“With those risk points out of the way, there is nothing to prevent more of that US money that’s flowed in this year to restart or even go positive next year.”

Given the scale of the US market, it would take a relatively low rotation of capital for a sudden resurgence in the asset class, he said.

“If large caps can do 18% this year, I don’t think it's beyond the realm of possibility that undervalued small caps can do 30% or more next year,” Wotton concluded.