European equities enjoyed a standout year in 2025 as investors broadened their horizons beyond the US and poured back into the region’s markets.

Against this supportive backdrop, JPM Europe Dynamic ex-UK was a notable beneficiary, posting a 33.3% return and beating the FTSE All-World Europe ex-UK index by 6.4 percentage points.

Going into 2026, the fund – which is managed by Jon Ingram, Blake Crawford and Alex Whyte – has since secured a place on interactive investor’s Super 60 list.

Tom Bigley, fund analyst at interactive investor, said: “The portfolio is thoughtfully constructed and provides investors with a core exposure to European equities, with the flexibility to tilt between different styles as market conditions change.”

With a portfolio primarily tilted towards large-cap names, Trustnet asked fund pickers which strategies could best complement the JPM fund across different styles, market capitalisation segments and risk profiles.

Bigley suggested the £785m European Smaller Companies Trust, which focuses on smaller businesses the management team believe have the potential to outperform larger peers.

The trust has been managed by Ollie Beckett since 2011, supported by Rory Stokes and Julia Scheuffler, and its shares are on a 9% discount to net asset value (NAV).

“It places particular emphasis on identifying companies that are mispriced relative to their ability to generate cash,” said Bigley.

“While investing in smaller companies can lead to greater volatility, the team has consistently delivered returns ahead of both the benchmark and peers over short- and long-term periods.”

Performance of the trust vs sector over 5yrs

Source: FE Analytics

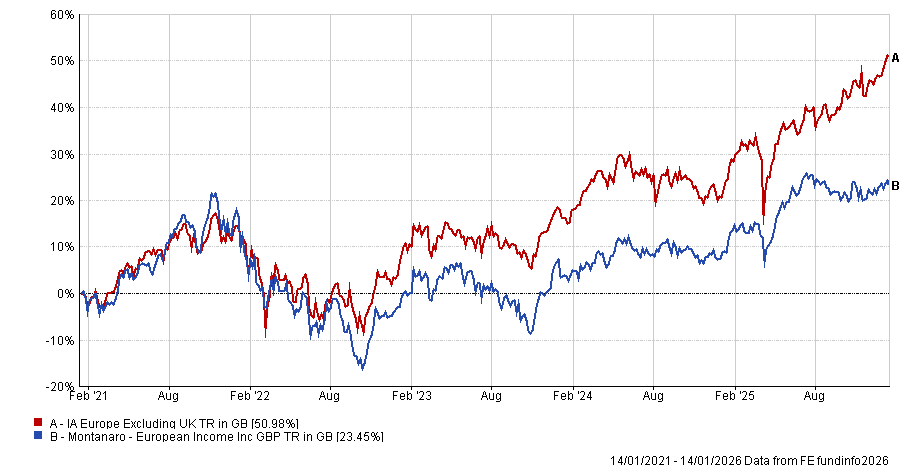

Meanwhile, Darius McDermott, managing director at FundCalibre and Chelsea Financial Services, said a natural complement to JPM Europe Dynamic ex-UK would be Montanaro European Income.

“This fund invests exclusively in European small- and mid-cap companies, an area of the market that remains structurally out of favour,” he said. “It also has a bias towards quality-growth businesses, another style that has lagged in recent years.”

As a result, the fund offers diversification both by market capitalisation and investment style, while also offering exposure to parts of the European market that could benefit meaningfully from recovery.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

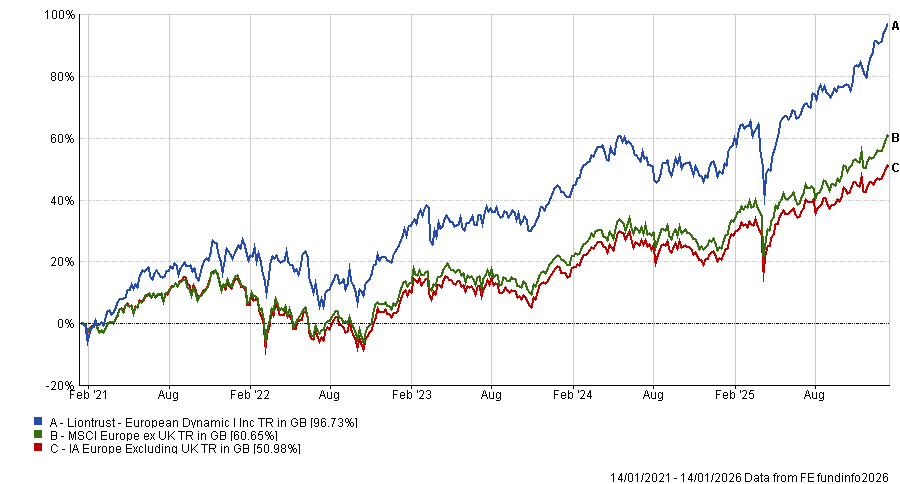

For investors looking for a higher-octane approach to European equities, Jason Hollands, managing director at Bestinvest, suggested the Liontrust European Dynamic fund.

“Ultimately, [managed Jamies Inglis-Jones and Samantha Gleave] are looking for companies able to generate significantly more cash than is required to support their growth plans,” said Hollands.

“The approach has been highly successful over many years, with the fund returning 94% over the past five years, significantly ahead of the MSCI Europe ex UK index return of 66%.”

The fund has also delivered a high level of consistency from year to year, seemingly able to cope well with changing market conditions, he added.

“Overlap between the two funds is relatively low, adding to the case for them as complementary holdings,” he said.

Among the top 10 holdings in both funds, there are three common positions – ASML, Banco Santander and UniCredit. In each case, the Liontrust fund’s position is bigger.

“The punchier positioning of the Liontrust fund is evident in the fact that the top 10 holdings represent 43% of the portfolio, whereas the more diversified JPM fund’s top 10 represent 29.5% of its portfolio,” Hollands said.

There is, however, a big difference in country and sector exposure. JPM Europe Dynamic ex-UK has just shy of 21% in German companies, which is double Liontrust, while Liontrust European Dynamic has more exposure to Nordic stocks.

In addition, the Liontrust fund has greater exposure to industrials while the JPMorgan fund has more in healthcare.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

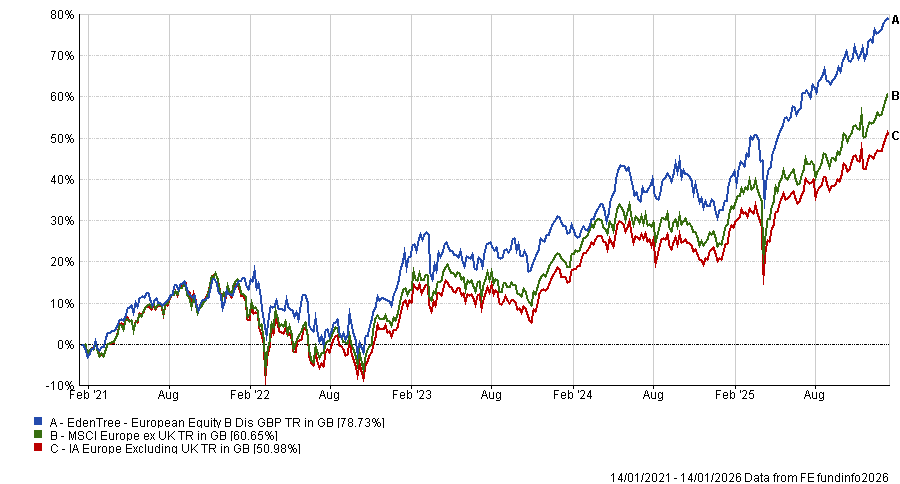

Meanwhile, Amaya Assan, head of fund origination at Titan Square Mile, suggested EdenTree European Equity.

“There’s a limited selection of European ex UK funds with a value bias (and even more so when combined with a responsible approach),” she said. The fund sits in Titan Square Mile’s Academy of Funds and a Responsible ‘A’ rating.

“Typically, its European equity peer group tends to have more of a growth tilt, whereas we believe this fund offers a differentiated exposure with its value bias and responsible characteristics and, as such, the strategy is likely to appeal to investors that are looking to broaden their exposure in the region,” Assan said.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

In addition, from a style perspective, growth has had a tough time in recent years – including in 2025 where growth has underperformed value and the broader index materially, Assan added.

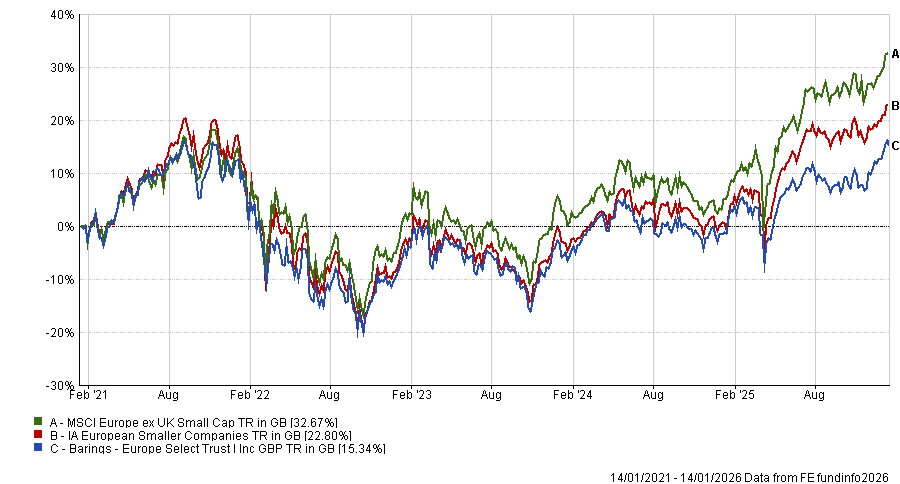

“Managers with a quality-growth focus have tended to lag their value peers in a year where we have had tariff scares, geopolitical tensions and simmering growth worries,” she said. “So, we now have a number of managers with a quality-growth/growth strategy at a reasonable price, such as the ‘AA’-rated Barings Europe Select Trust.”

The fund invests in European medium- and smaller-sized companies and is managed by Nick Williams, along with two co-managers. It follows a quality-growth at a reasonable price investment approach, targeting attractively valued investment opportunities with strategic positioning and competitive strengths which the management team believes can drive sustained improvements in their profitability and returns.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, also suggested Barings Europe Select Trust.

“Nick Williams has managed this fund for over 20 years, which makes him one of the most experienced investors in the European smaller companies sector,” she said.

“Overall, we believe the fund could be used to diversify the European part of an investment portfolio, or a broader global portfolio focused on growth.”

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

Rob Morgan, chief analyst at Charles Stanley Direct, added that the dynamic nature of JPM Europea Dynamic ex-UK means it cannot be “pigeonholed as either growth or value”. As such, it is quite versatile in terms of pairing.

As another example, he said it would sit well alongside an active fund with a more defined strategy like out-and-out value, such as WS Lightman European.

“This fund that’s a more contrarian value approach, with manager Rob Burnett sticking to long-held principles and a well homed process,” he said. “The stock overlap between the strategies is small despite them sharing a large cap focus.”

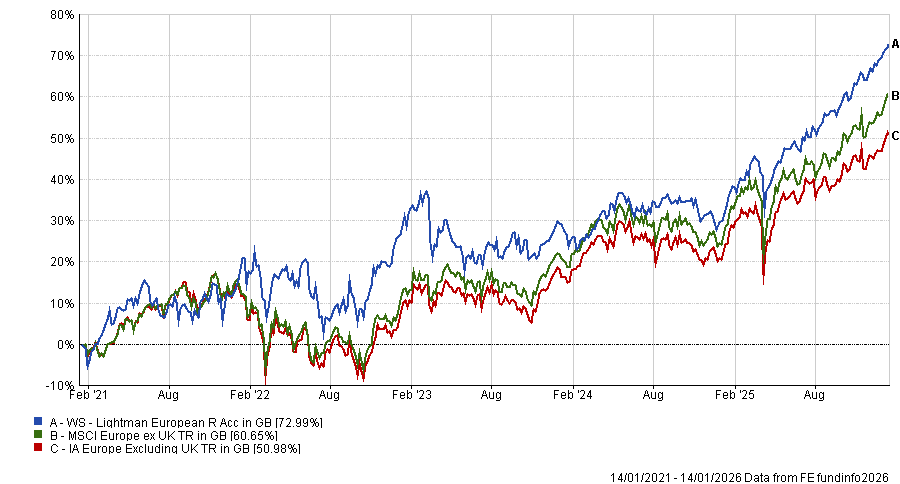

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics