As geopolitical tensions sharpen and technological gaps widen, Europe must rapidly rebuild the pillars of its sovereignty – from defence to energy and advanced artificial intelligence (AI) infrastructure – according to Mirova.

Hervé Guez, global head of listed assets at Mirova, and Karen Kharmandarian, head of thematic equities at the firm, were speaking during a roundtable briefing on core investment themes for 2026.

“Europe is at a turning point,” said Guez. “There are dependencies on China and other emerging market countries, in terms of industrial production, but there are also dependencies on things like technology from the US – and Europeans need to react to change that.”

The geopolitical landscape is also rapidly shifting, he acknowledged, citing the ongoing aggression from Russia and conflicts in the Middle East.

“Then there is [the evolving situation with president Donald Trump in] the US,” Guez said.

Tensions have mounted between European governments and Trump in recent weeks following the latter’s escalated push to wrest Greenland from Denmark on national security grounds.

At Davos this week, European figureheads stressed Europe’s sovereignty anxieties; Trump, for his part, called for “immediate negotiations” but said he would “not use force”.

“This is all changing the way European companies are looking at the European market because they will need to face the growing demand [for domestic production and services],” Guez said.

With Europe estimated to require as much as €3trn in investment over the next five years to build out digital and energy infrastructure (this figure does not include defence spending), there are also opportunities for investors, according to Guez.

As such, three of the core themes for Mirova in 2026 are AI and technology independence, defence and security capacity, and the energy transition and resource autonomy.

European AI

2025 was a blockbuster year for tech, and the AI surge shows no sign of slowing in 2026, making Europe’s technology catch‑up an immediate priority.

Kharmandarian said: “We don’t expect the Magnificent Seven to be so much driving the equity market in 2026, as there are other opportunities emerging within the tech cluster thanks to new world disorder, paired with all the implications that come with reshoring, onshoring and establishing autonomy. This is what we want to capture.”

In particular, he noted that stock pickers may be able to identify opportunities in less well-loved areas of the tech sector such as software – home to companies like ServiceNow, Salesforce, Adobe and Intuit.

“What is quite striking to us in the tech space today is the divergence in performance between infrastructure plays like semiconductors and the software space, as there is currently a 19-percentage point difference,” Kharmandarian said.

“The market seems to be frightened about what AI means for existing software companies, and investors want to see some evidence that they are capable of adopting and embedding AI-driven technologies into their own products and services to remain valid in terms of bringing some value proposition.”

Although Europe is home to some critical subscale technology companies – like Mistral in France and Aleph Alpha in Germany – there are “obvious gaps” in the value chain, he added.

“The main issue for Europe is ultimately where the data sits – mostly in the US. It will take time to address this, with a data centre costing billions and typically taking at least four years to build.”

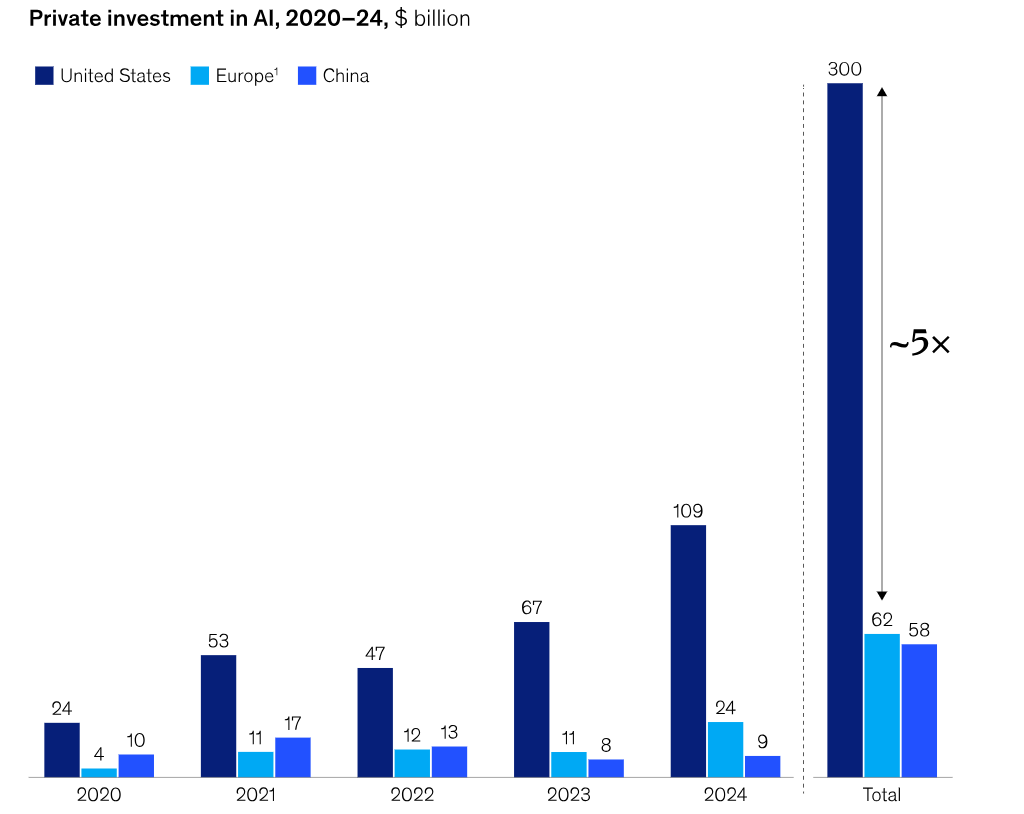

This will require European companies to massively ramp up investment in AI – which have long been overshadowed by the US.

US corporate investment in AI versus European counterparts

Source: McKinsey and Co, Stanford HAI. European Union plus Norway, Switzerland and the UK.

McKinsey and Co estimated that Europe’s sovereign AI opportunity could unlock up to €480bn in value annually by 2030.

Shoring up defence

Alongside the tech challenge, Europe is under intensifying pressure to scale its defence spending.

However, investment in the sector has been up for debate among sustainable investors, with many choosing to limit their exposure or avoid it altogether.

According to Guez, the political landscape has shifted so sharply that defence can no longer be treated as a peripheral issue for Europe or for sustainable investors.

Last year, the EU published its position on the importance of defence investment, sovereignty and immediate and future challenges, launching a plan to raise over €800bn in defence spending, including through mobilising private capital.

The bloc also issued guidance and a legislative proposal to align the EU’s position on defence with its sustainable finance framework, which includes the environmental taxonomy, the Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Reporting Directive (CSRD).

“The main issue from a sustainability point of view has been [visibility] of exports to non-democratic countries,” Guez said. “We are considering the landscape.”

There are ways for sustainable investors to invest in Europe’s defence without directly investing in the combat component, such as critical cybersecurity and safety or dual-use technologies that are key for European sovereignty.

“From laptops to data centres to the cloud to edge computing, the surface of attack is now so big that AI will also be needed to automate the detection of threats and responses to them,” said Kharmandarian.

“We play this through investment in AI robotics and it is an area where we see quite an interesting leg of growth, [capturing] flows into themes like border control and protection from cyber threats and AI-generated attacks.”

Rooting sustainable energy in megatrends

An underlying focus for Mirova in 2026 will continue to be the energy transition, according to Guez.

“This has not been a very popular theme in the market over the past couple of years because of geopolitical instability but, beyond the debate and the noise, it is important to remember that the energy transition is already happening, and it will continue.”

More recently, energy demands have heightened as the AI build-out has accelerated, meaning Guez sees opportunities in energy efficiency, water scarcity and renewables tied to AI-focused infrastructure.

Kharmandarian added: “The consumption of energy in AI could be a limiting factor in terms of growth. Data centres are so energy hungry they are now built next to nuclear plants, or they go off grid with a direct energy provision. To what extent this can be sustained going forward without exploring all sources of energy remains to be seen.”

Natixis affiliates Mirova and Thematics Asset Management recently merged. The former manages €32bn in assets, while Thematics reports €3.1bn in assets concentrated across five themes: AI and robotics, water, safety, health and the subscription economy.