Where does it make the most sense to hire an active manager? The answer is Japan: Over the last 10 years, over 70% of Japanese active funds have outperformed their benchmarks compared to 29% in the US and 44% in Europe.[1]

For investors seeking exposure to Japanese equities, selecting active managers with a proven ability to deliver stable outperformance is particularly important.

Compared with the US and European equity markets, Japan has remained relatively inefficient, giving a higher probability of active managers outperforming their benchmarks, even when measured against major large-cap indices.

The superior performance potential of active strategies in Japan is underpinned by three structural and cyclical factors unique to the market, discussed below.

Lots of stocks and few analysts

Japan has just under 4,000 listed equities, comparable in scale to the listings of Nasdaq and the NYSE. In contrast, the UK has fewer than 1,000 listed companies, while Switzerland has slightly more than 200. This reflects the fact that many small and mid-sized companies that remain private in other markets are publicly listed in Japan.

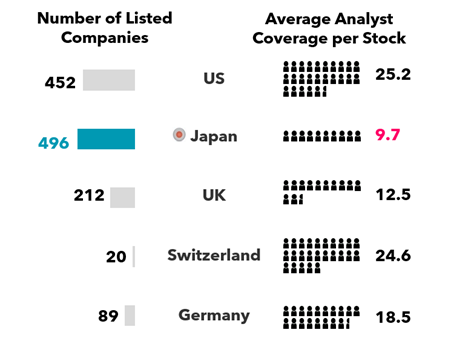

However, despite the large opportunity set, analyst coverage per stock in Japan remains remarkably low. While the average analyst coverage is approximately 8.3 analysts per stock in the US, 4.1 in the UK, and 6.6 in Switzerland, Japan averages only around 1.7 analysts per company. Even when focusing solely on the stocks with the top market cap that institutional investors target for their portfolios, this gap remains unbridged as shown in the chart below.

Number of listed stocks and average analyst coverage per stock

Source: US: S&P500, JP: TOPIX500, UK: FTSE350 Index, Swiss: Swiss Market Index, Germany: HDAX Index; Source: Bloomberg, SuMi TRUST AM (as at the end of September 2025)

Japan is at a historic economic turning point

Japan is undergoing a profound macroeconomic transition after nearly three decades of deflation. The economy is shifting toward a more stable inflationary environment, accompanied by rising interest rates.

The country moved away from its long-standing negative interest rate policy in 2024 and has entered a rate-hiking cycle. Unlike many developed economies that have struggled with sharp inflation spikes in recent years, Japan’s inflation has emerged gradually and remains relatively moderate, while wage growth has also continued.

As a result, individual stock selection will carry even greater weight when investing in Japanese equities. Specifically, companies will be divided into those capable of growing sales and profits by adapting to the structural changes in the Japanese economy and those lagging behind due to outdated corporate structures.

In an inflationary economy, companies must pass on rising costs through prices. Customers may accept price increases for superior products or services but this proves difficult for mass-produced, run-of-the-mill goods. Whereas previously everyone maintained prices at the same level, differences in the ability to pass on costs will create disparities from here on and, influenced by economic shifts, will manifest as disparities in future share price performance.

Amidst anticipated corporate polarisation, investing in the companies with the greatest pricing power becomes crucial. Considering the recent changes in the Japanese economy, the ability of active management to selectively invest in the companies best placed to weather the return of inflation has made it more important.

Accelerating divergence from corporate governance reform

Corporate governance reform, led by the Japan Exchange Group (JPX), is another powerful driver of dispersion in Japanese equities. The gap between companies that proactively address governance requirements and those that do not has widened materially.

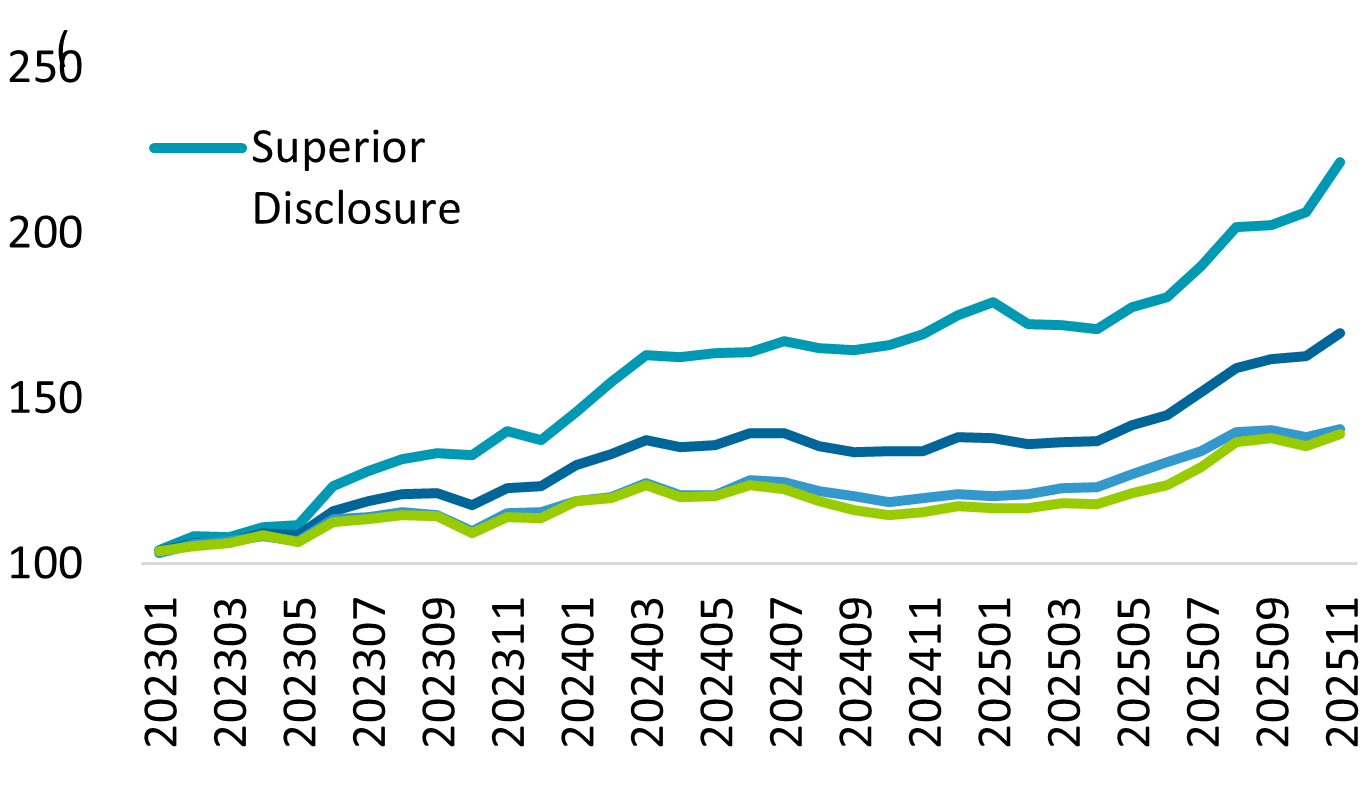

Based on JPX disclosure data, the chart below compares share price performance by governance disclosure status, rebased to 100 at the end of December 2022 and measured through the end of November 2025. Companies that actively disclose concrete initiatives to improve governance have significantly outperformed those that do not.

Share price performance by governance disclosure status

Source: Japan Exchange Group, SuMi TRUST AM (as at the end of November 2025). These figures represent the weighted average of the constituent stocks at each disclosure level as of November 2025. Calculated with a base of 100 at the end of December 2022. ‘Superior Disclosure’ refers to companies featured in the case studies published by the Tokyo Stock Exchange on 21 November 2024 as companies promoting initiatives that incorporate investor perspectives.

This evidence reinforces the importance of selective evaluation and active engagement. It also illustrates how the effective use of non-financial information such as governance practices can translate directly into superior investment outcomes in the Japanese equity market.

The advantage of local asset management firms with analyst teams who are native Japanese speakers is considerable especially when it comes to the effective use of non-financial information. Among TOPIX constituent companies, 1,503 firms (70% of the total) disclose initiatives about management practices designed to impact capital costs and share prices. However, only 806 companies (37% of the total) disclose these initiatives in English.