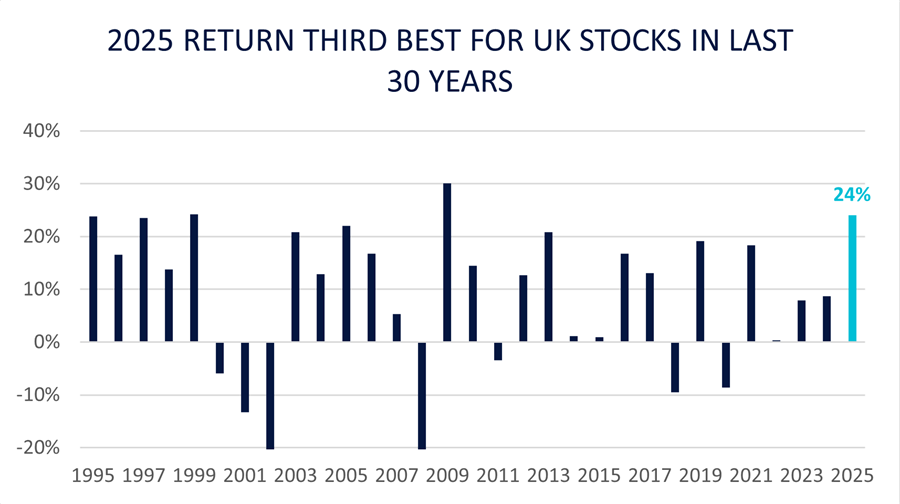

After years in the shadows, the UK stock market was the firecracker of 2025. Global equities enjoyed a strong run last year thanks to steady economic growth and falling interest rates, with the global buzz around AI adding extra fuel. Yet UK equities greatly outpaced global markets, to the surprise of many.

Growing appetite to diversify away from the Magnificent Seven stocks that dominate American and global indices, combined with concerns over unpredictable US government policy, more than offset underwhelming UK economic data that has been the norm for many years now. Attractive valuations across the FTSE All Share created favourable conditions, while tariff disputes and concentration risk served as catalysts for renewed interest.

For some time, commentators have highlighted the risks facing UK investors who adhere to a 4% global benchmark allocation in domestic equities, potentially missing opportunities in a market offering compelling valuations with scope for attractive returns. Those predictions materialised over the past year.

Source: FactSet, Rathbones; FTSE All Share index total returns by calendar year

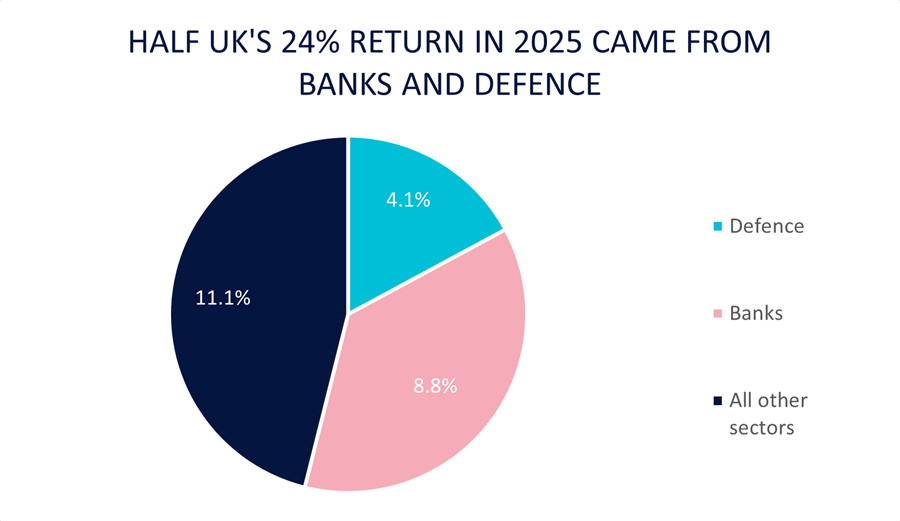

Investment flow data reveals that overseas investors have primarily driven the return to UK equities thus far. Domestic investors have yet to capitalise on these opportunities to the same extent. Passive flows from the United States gained momentum, with their impact most visible at the upper end of the index. Large-cap banks and defence stocks contributed over half of the FTSE All Share's impressive 24% annual return. In contrast, the FTSE World index of global developed companies delivered 15% by contrast.

Source: FactSet; data contribution to total return of FTSE All Share index for 2025

‘Quality’-oriented stocks, typically flourish during periods of economic stagnation, a descriptor that aptly characterises the current UK environment. Emphasising the quality factor provides a hedge against domestic economic challenges. However, the extent of outperformance from ‘cyclical’ sectors exceeded expectations.

Across Europe more broadly, 2025 marked the quality factor's worst relative performance in two decades, leaving this investment style de-rated and out of favour. This dynamic creates opportunities for when these high-quality British businesses receive appropriate recognition from the market.

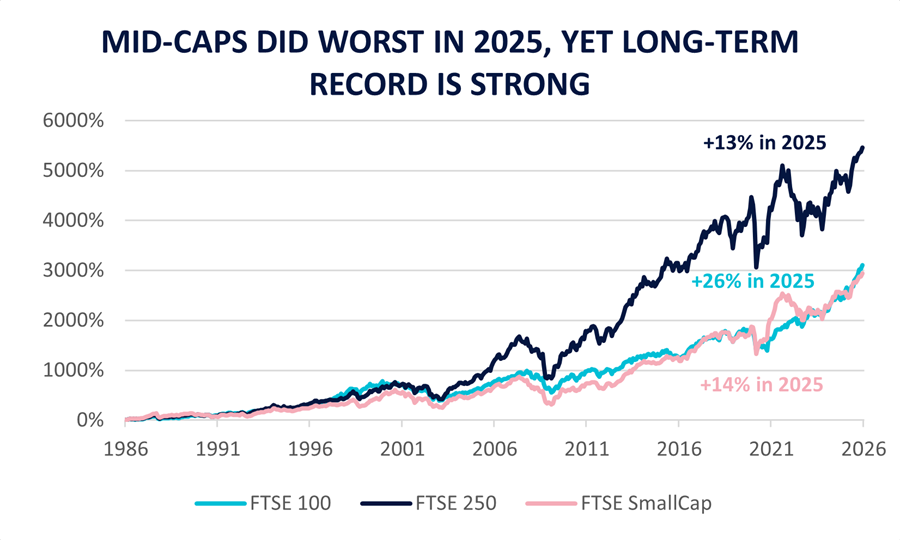

Mid-caps have endured a historically unusual period of underperformance relative to large-caps. The FTSE 250 has outpaced the FTSE 100 only once this decade, discounting a virtual dead heat in 2023. While long-term evidence demonstrates that mid-caps offer higher returns to compensate for elevated volatility compared with large-caps, passive flows have altered market dynamics. The anticipated trickle-down effect has failed to materialise and market leadership remains narrow, which pose challenges for active managers with defined investment processes.

Academic research indicates that return on invested capital serves as the strongest predictor of through-cycle returns in the UK market. This metric, measuring the profit a company generates from capital raised through equity and debt, remains fundamental to disciplined investment processes. Mid-caps have historically generated above-benchmark returns over extended periods in the UK market, supporting their continued centrality in quality-focused portfolios.

Source: FactSet; data total return 31 Dec 1985 to 31 Dec 2025

The disconnect between short-term market dynamics and long-term fundamentals presents both challenge and opportunity. While recent performance has tested conviction in quality mid-cap strategies, the underlying investment case remains compelling. Attractive valuations, strong business fundamentals and historical evidence of mid-cap outperformance suggest patient investors may be well rewarded.

The UK equity market's renaissance has begun, in our view, driven initially by international investors seeking diversification and value. As domestic investors recognise these opportunities and market leadership broadens beyond a handful of sectors, quality mid-cap businesses with strong returns on invested capital appear well positioned to deliver sustained outperformance. For long-term investors willing to look beyond recent style and size headwinds, the current environment may represent an attractive entry point into overlooked segments of a revitalised UK market.

Alexandra Jackson is manager of the Rathbone UK Opportunities fund. The views expressed above should not be taken as investment advice.