Henderson Euro Trust has scrapped its dividend target to allow manager Jamie Ross to focus on “the industries of the future” rather than "the worst companies” in the market.

Henderson Euro Trust was named by the AIC as one of its Next Generation Dividend Heroes in March, having raised its payout for 16 years in a row. Only 22 trusts in the AIC universe have a longer record of dividend increases.

Yet while the trust had dividend cover of 1.3x going into the coronavirus crisis, it decided that maintaining its policy of consistent dividend growth was not in the long-term interests of shareholders.

“What the board has said to our shareholders is we think you will be better off if we allow the fund manager to focus on investing in growing companies and not feel constrained by having to invest in high-yielding ones,” said Ross (pictured).

“I want to own [growth companies], I don’t want to own some of the banks and I don’t want to own the telcos.

“But have a guess which are paying the mid to high single-digit dividend yields and which are paying no yields? I think the ones that are paying no yields are the businesses that will make the most money and the ones that are paying high dividend yields – because they are mature, low-growth businesses – will be the worst companies to own for our clients. And the board backs me on this.”

Ross is so pessimistic about the prospects for the major dividend-paying sectors in Europe, he is looking at ways to profit from their decline. For example, he is negative on the banks, pointing out their returns have long been squeezed by low interest rates, while the coronavirus crisis has meant they have had to build capital reserves and cut dividends.

The manager said that as a result of their commitments to the regulator and shareholders, they have started selling off their payments infrastructure so they can maximise short-term profits and focus on other areas of their business.

“The banks need to sell their crown jewels; they need to sell their best assets,” he continued. “When you use your card, transact online or use your phone or Apple Watch, every bit of the infrastructure is classified as the payments business, and the banks are selling that.

“Nexi and Worldline, both of which we own, are exposed to the very powerful theme of the growth of the cashless economy. This is a fast consolidating industry that is a beneficiary of the struggle of the banks.”

Ross said there is a close parallel between the banks and telecoms. He pointed out the latter is an industry with zero pricing power – when people reach the end of a mobile phone contract, they will simply switch to the cheapest provider available, as there is little difference in the service. And, just as banks are selling off their payments infrastructure, the telecoms companies are selling off their towers.

“The towers are the jewel in the crown: they are great infrastructure assets with very solid, predictable revenues and long-term contracts,” he explained. “Cellnex is buying them. The general theme is one of category champions buying from distressed sellers.”

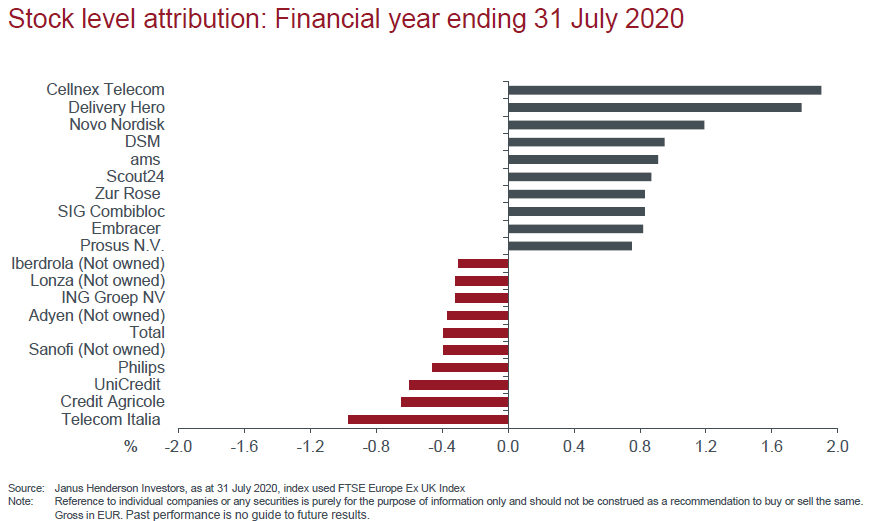

Cellnex was the biggest contributor to the trust’s performance over the past financial year.

While greater freedom to focus on growth industries is the main reason behind the removal of the trust’s dividend policy, Ross said the coronavirus crisis also affected the decision.

In light of widespread dividend cuts, many trusts have dipped into their reserves to ensure they can maintain or increase payouts to investors this year. Yet Ross said it is unlikely that the underlying holdings will be able to fully reinstate dividends by 2021, meaning many of the Dividend Hero trusts are just delaying the inevitable.

“Oil has cut, travel and leisure have cut, the banks have been forced to cut and the wider industry has cut even when it’s not necessary,” the manager added.

“Income expectations should have already moderated for this year and I don’t think we should expect a very big recovery next year apart from the banks. I think it is entirely sensible to not get too carried away and think, ‘OK, we’ve lost some dividend income this year, but it’s all going to bounce back next year’.

“I’m not convinced that will be the case, especially given as of the last two to three weeks, there has been no headline that’s not about a second wave. There’s a real chance that we enter into another tough economic environment that would further delay income recovery.”

And Ross said removing the dividend target also reflects a more honest and transparent approach from the board. For example, he said that while the dividend-growth target was supposed to offer more clarity to shareholders in that it gives them an idea of how much income they will have in the coming years, “actually all it does is provide clarity until the dividend is cut”.

“The progressive dividend is not guaranteed, it is an intention,” he explained. “So we’re moving away from that to what we think is a much clearer policy. And the board decided the clearest policy is just to say, whatever income we generate from the companies that we own, almost all of it will just go to shareholders in any one given year.

“And the final thing to mention is that, under the new policy, having a substantial revenue reserve is no longer necessary. What we’re going to do is pay out that revenue reserve to shareholders over the next three to four years, or the substantial majority of it. And that will smooth the transition between last year’s dividend of 31p, and the eventual dividend we end on.”

Data from FE Analytics shows Henderson Euro Trust has made 15.42 per cent since Ross became joint manager at the end of August 2018, compared with gains of 3.62 per cent from the IT Europe sector and a loss of 0.36 per cent from the FTSE World Europe ex UK index.

Performance of trust vs sector and index under manager

Source: FE Analytics

The trust is trading at a discount of 10.09 per cent to net asset value (NAV) compared with 10.95 and 8.66 per cent from its one- and three-year averages. It has ongoing charges of 0.81 per cent and is 4 per cent geared.