As UK businesses continue to struggle through the impact of coronavirus, dividend pay-outs have fallen to the lowest third quarter total since the aftermath of the global financial crisis in 2010, according to the latest Link UK Dividend Monitor.

Headline UK dividends – which include special dividends – fell 49.1 per cent, year-on-year,to £18bn, however the decline was less severe than second quarter when dividends fell 57.2 per cent to £16.1bn.

On an underlying basis, excluding special dividends, payouts fell by 45.1 per cent year-on-year to £17.7bn. This was slightly less than the 50.2 per cent decline seen during the second quarter.

“UK plc is not out of the woods, but the trees are perhaps thinning a bit,” said Susan Ring, chief executive for corporate markets at Link Group. “Our worst-case scenario has steadily improved all year and though UK investors face a historic decline in their income this year, the worst is now behind us.”

Source: Link UK Dividend Monitor Q3 2020

Just under half of UK companies cancelled dividends outright in the third quarter and a further 20 per cent cut them. This was in line with Link Group’s expectations that almost two-thirds of companies would cut or cancel their payouts.

However, this is a slight improvement from the second quarter when a ‘staggering’ three-quarters of companies cut or cancel dividend pay-outs.

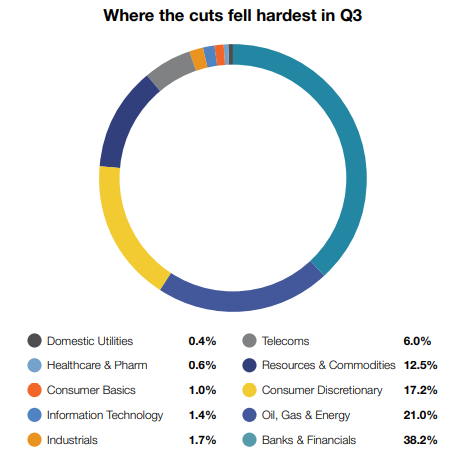

As such, dividend cuts totalled £14.5bn in the third quarter, with banks accounting for almost two-fifths, as they continued to be barred from paying any dividends by the Bank of England.

The oil sector accounted for over one-fifth of dividend cuts, which Link Group attributed as part of a permanent shift for UK investors. However, the group said the cuts leave oil giants such as Shell and BP better able to sustain their dividends in a future with changing energy priorities.

Mining contributed for a further one-eighth of cuts, except for gold miners who instead saw sharp increases in payouts thanks to the rising price of gold this year.

Sectors that bore the brunt of the coronavirus lockdown measures, namely airlines, travel & leisure, as well as housebuilding and consumer goods and services, saw large dividend cuts.

Travel and retail payouts fell 96 per cent year-on-year, while media, housebuilding and consumer goods sectors were down by two-thirds.

Dividend cuts by sector in Q3 2020

Source: Link UK Dividend Monitor Q3 2020

Only two of the classically defensive sectors – food retailers and basic consumer goods –delivered year-on-year dividend increases.

Defence contractor BAE Systems and engineering firm IMI were the first companies to catch up on all dividends missed year-to-date, while property developer Berkeley Group, paid an interim dividend five times bigger than last year’s having rescinded a big special payout earlier in the year.

Nevertheless, one-off special dividends were sharply lower in the third quarter of the year, falling 90 per cent year-on-year to £299m. Despite experiencing a £2.8bn fall in special dividends, levels were a little better than Link Group expected.

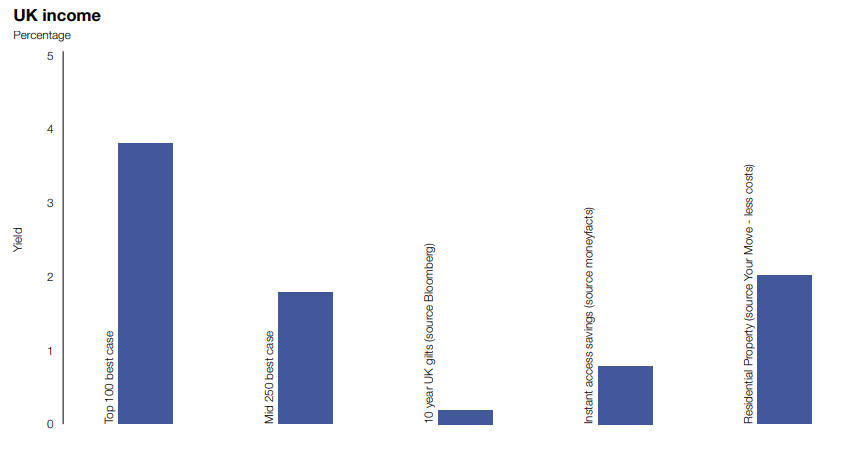

Much like in the second quarter, the third quarter saw the payouts of the top-100 UK companies fall by less than their small- and mid-cap counterparts. Link Group said this reflected the positive counterbalancing effect of big defensive companies in the healthcare and consumer basics sector, as well as the greater financial vulnerability of the more domestically focused small- and mid-cap companies.

On an underlying basis, payouts from the top-100 stocks fell by 42.9 per cent, from mid-caps by 60.4 per cent and from smaller companies by 69.5 per cent.

In terms of dividend yields, Link Group estimates UK shares will yield 3.6 per cent in their best-case scenario and 3.3 per cent in their worst-case scenario over the next 12 months.

Source: Link UK Dividend Monitor Q3 2020

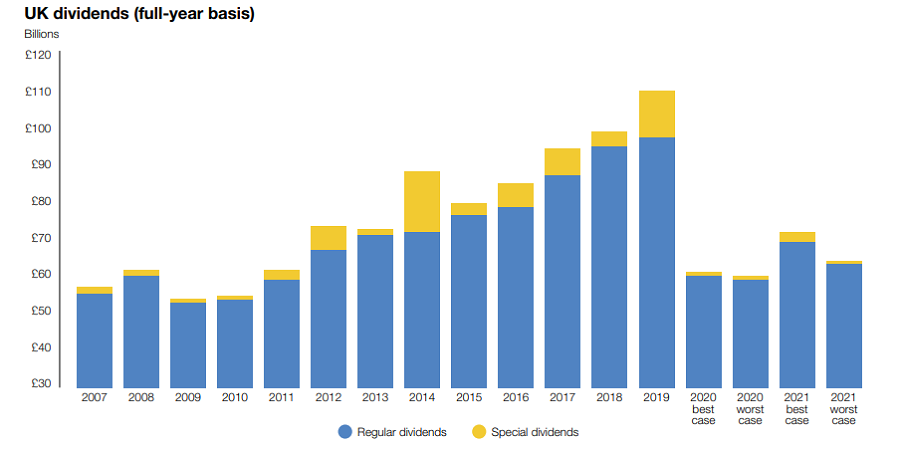

Due to ‘excellent’ visibility on the prospects for the rest of 2020, the group said it has therefore been able to almost eliminate the gap between its best- and worst-case dividend scenarios.

They expect underlying UK dividends for the year to fall to £60.4bn on a best-case basis and £59.9bn on a worst-case basis, a decline of 38.7 and 39.2 per cent respectively.

On a headline basis, the 2020 decline is estimated to be between 44.6 per cent and 45.2 per cent, yielding £61.2bn or £60.6bn respectively.

For 2021, the group estimates a preliminary best-case increase of 15 per cent and a worst case of 6 per cent in dividend payouts, taking them to levels last seen in 2012 and 2013.

“Looking ahead there is still huge uncertainty,” Ring admitted. “With the pandemic showing no sign of abating and no hoped-for vaccines likely to be distributed for at least several months yet, governments are trying to walk the tightrope of using prolonged restrictions to limit healthcare caseloads without destroying even more of the economy and creating even more unintended consequences for health in other ways.”

She said while Q4 2020 and Q1 2021 are set for further declines, from April onwards – a year on from the lockdown of 2020 – the comparisons will start to ‘look more favourable’ and a bounce-back could begin.

Ring added: “Oil dividends will not increase significantly (if at all), however, so the big question will be whether the Bank of England permits the banks to begin distributing again.”

“Beyond the obvious economic impacts on their trading, the extent to which companies in other sectors have taken government support will influence their freedom to pay shareholders too.”

She concluded: “There’s no doubt we have a long road ahead before dividends return to pre-pandemic levels, but there is now at least a signpost to the route that will take us there.”