UK businesses undertook the biggest collective dividend cut on record during the second quarter of 2020 as the country reeled from the impact of the coronavirus crisis, the latest Link UK Dividend Monitor shows.

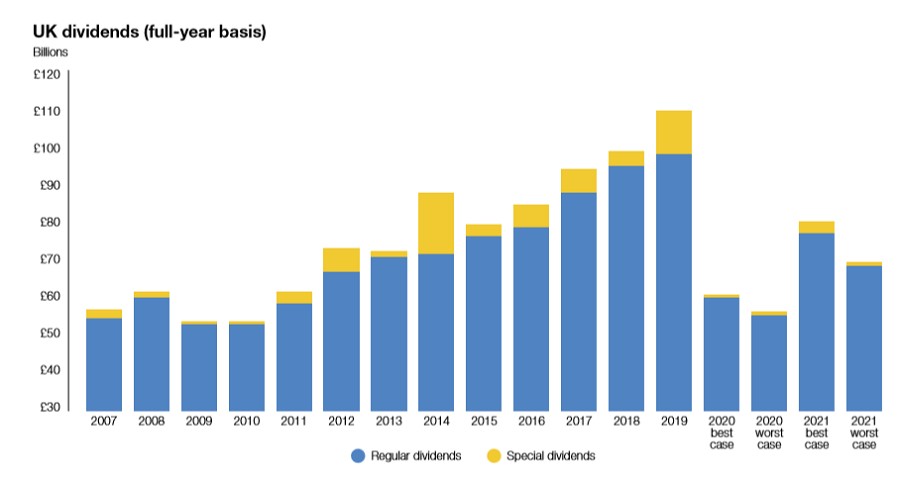

Headline dividends, which include special dividends, fell by 57.2 per cent over the three-month period to £16.1bn. This was down almost £22bn from the total payout made in 2019’s second quarter.

On an underlying basis, UK dividends dropped 50.2 per cent to £16bn. This strips out special dividends, which Link Group said were “exceptionally high this time last year”.

“The second quarter was truly a record breaker. Not by a whisker, nor by a nose, but by a mile,” the group added. “As the Covid-19 pandemic sent the world into lockdown, UK companies slashed payouts with unprecedented speed and ferocity.”

Source: Link UK Dividend Monitor Q2 2020

To date, 176 UK companies have cancelled their dividends and 30 more announced a cut, accounting for three-quarters of all UK companies that usually pay dividends in Q2. Only 61 companies increased their payouts.

This surpasses the levels of dividends cut and cancelled in the aftermath of the global financial crisis, when two-fifths of UK companies cut their dividends in the worst quarter and one-fifth cancelled them in 2009’s first quarter.

“The global financial crisis […] used to be the undisputed benchmark for ‘how bad things can get’,” Link added.

Some 124 companies also rescinded a dividend they had already declared - something which is highly unusual according to Link - totalling £12bn of previously announced dividends now not being paid.

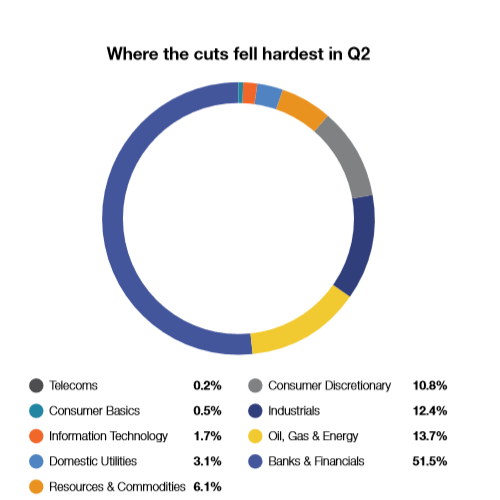

Dividend cuts by sector Q2 2020

Source: Link UK Dividend Monitor Q2 2020

Of the £16.1bn dividends cuts made in the quarter, half came from the financial sector with UK banks contributing the most after coming under pressure from the Bank of England, which ordered them to cancel all shareholder payouts for 2020 and encouraged insurance companies to do the same.

HSBC and Lloyds bank were just two of the major banks to backtrack on their previously announced dividend payouts after pressure from the Bank of England.

Oil, gas and energy was the second hardest hit sector, accounting for 13.7 per cent of overall UK dividend cuts.

The biggest shock there was when Royal Dutch Shell “took a knife to its world-beating payout”, cutting its dividend by two-thirds. This was the first time the oil & gas giant has made a cut since the second world war.

Shell’s cut was a major signal that Link’s ‘best case scenario’ outlook from the first quarter was now diminishing.

“As the largest dividend payer in the world, this move symbolised the enormous impact the global health crisis was having on the world economy and was tough medicine for income investors,” the group said.

Looking at the remaining sectors and £1.7bn of cuts came from the consumer discretionary sector with the lockdown hitting media, housebuilding, travel, leisure and retail the hardest.

The more defensive sectors were less savagely hit, as areas like consumer basics and utilities combined accounted for less than 4 per cent of cuts.

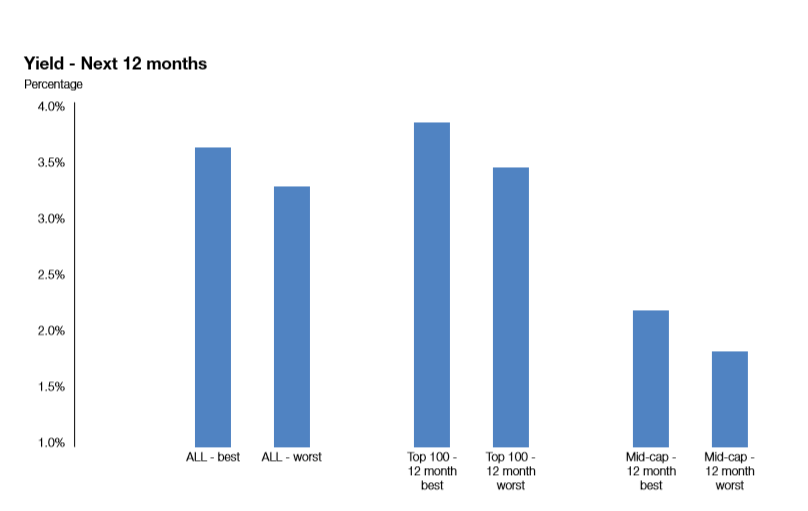

Examining the impact, the second quarter’s cuts had on yields – arguably the most used metric to assess the relative value of a market – Link said: “The yield indicated that share prices were at worst fairly valued and at best significantly undervalued.”

Source: Link UK Dividend Monitor Q2 2020

Under Link’s ‘best case scenario’, UK company shares will yield 3.6 per cent in the next 12 months and 4.1 per cent in 2020.

But in the ‘worst case scenario’, the same shares will yield 3.3 per cent over the next year and 3.6 per cent in 2020.

“The UK stock market has duly rebounded from its mid-March lows, but is still well below its peak – the recovery has lagged behind international peers,” Link said

Factors behind this underperformance include the severity of the dividend cuts prompting a revaluation of UK equities, the UK’s slower and poorer response to the pandemic and the ever looming threat of a ‘no deal’ Brexit.

On the overall outlook, Link said: “It is hard not to overburden this report with superlatives, but 2020 will without doubt see the biggest hit to dividends in generations.”

And although the Q2 picture was the bleakest ever, Link said it has provided “enormous clarity to the UK dividends picture”, enabling it to majorly narrow the gap the best and worst case scenarios.

The ‘best case scenario’ for 2020 sees UK payouts fall by 45 per cent on a headline basis, decreasing from £110.5bn to £61.6bn. On an underlying basis the ‘best case scenario’ is a fall of 39 per cent, down to £60.5bn, Link said.

On the flip side, if things go the worst they possibly can then the UK will see a fall of 49 per cent down to £56.7bn on a headline basis, or 43 per cent down to £56.3bn on an underlying basis.

Susan Ring, chief executive of corporate markets at Link Group said: “As the lockdown wore on and restrictions became ever tighter, the economic damage spread to more and more companies. At the same time, it became clearer which companies were more resilient, and we were able to assess more accurately how deep cuts would go for those companies not simply cancelling pay-outs altogether. The gap between our best- and worst-case scenario is now just 4 percentage points, far narrower than our first estimate made in early April in the midst of the turmoil.

“The cuts have been made to protect balance sheets in the face of horrendous disruption to trading and to the economy. But to some extent, companies in 2020 are also ensuring they don’t waste a good crisis. Dividend cover, a measure of affordability that relates payouts to profits, has been far lower in the UK than the global average. 2020 has provided an opportunity for many companies to reset their dividends at a lower, more sustainable level from which they can again start to rebuild. In the short term this is painful for investors, but in the long run it helps create healthier companies.

“This resetting, together with the economic legacy of the pandemic, means it could take until 2026 for dividends to return to their 2019 level.”