As money has flowed into strategies with a responsible investment approach, funds such as Royal London Sustainable Leaders Trust, Baillie Gifford Positive Change and Pictet Global Environmental Opportunities are among those to win the most in investors’ cash, analysis by Trustnet suggests.

While momentum has been gaining for some time behind environmental, social and governance (ESG) investing, 2020 has seen the trend accelerate further as the coronavirus pandemic pushed these issues to the foreground.

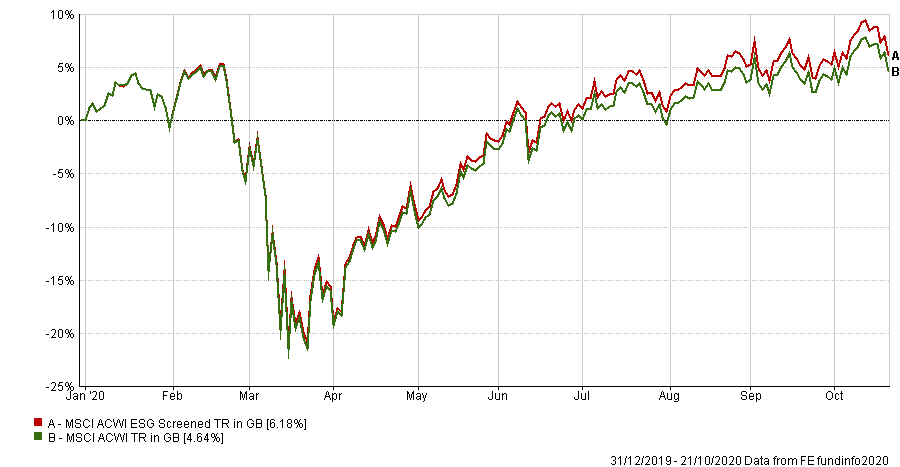

The ESG approach has outperformed over the year so far. FE Analytics shows the MSCI ACWI ESG Screened index has made a 6.18 per cent total return over the year-to-date; this compares with 4.64 per cent from the MSCI AC World.

Performance of indices over 2020

Source: FE Analytics, as at 21 Oct 2020

This outperformance has been witnessed among funds as well, with ESG strategies moving towards the top of the Investment Association sectors this year.

Meanwhile, investors have started to allocate more to funds such as these. The Investment Association says that a total of £36bn is now held in responsible investment funds, accounting for 2.7 per cent of the industry’s assets.

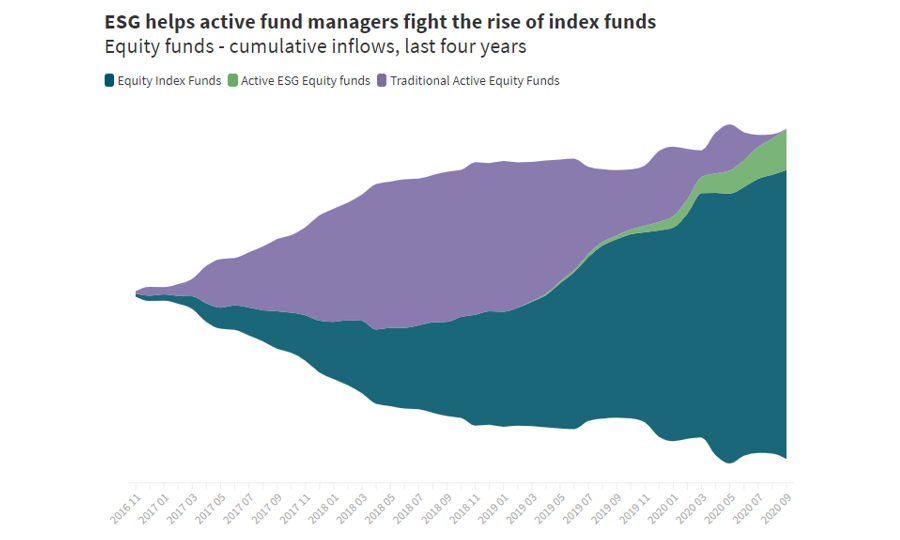

Data from global funds network Calastone suggested that ESG equity funds are one of the few areas where investors are continuing to pay up for active management. The trend of recent years has been for investors to shun active funds in favour of index trackers.

However, Calastone said ESG funds are “a safe haven for active fund managers in the face of the ever-rising popularity of passively managed funds”. Indeed, there were record inflows into active ESG equity funds in September while flows dried up for their conventional active peers.

Source: Calastone

Edward Glyn, head of global markets at Calastone, said: “The huge quantity of ‘legacy’ capital in traditional active equity funds means that fund managers are still thriving, despite the challenge posed by ever greater pressure on fees.

“By pivoting to ESG funds, they are not only capturing the Zeitgeist, but also bolstering their margins. There is enormous public interest as ESG goes mainstream, and active managers are able to differentiate these products much more effectively from passive funds, and they can charge premium fees as a result.

“It’s astonishing that a fund category as small and unloved as ESG as recently as 2016 has been responsible for all the net new money flowing into active funds since then.”

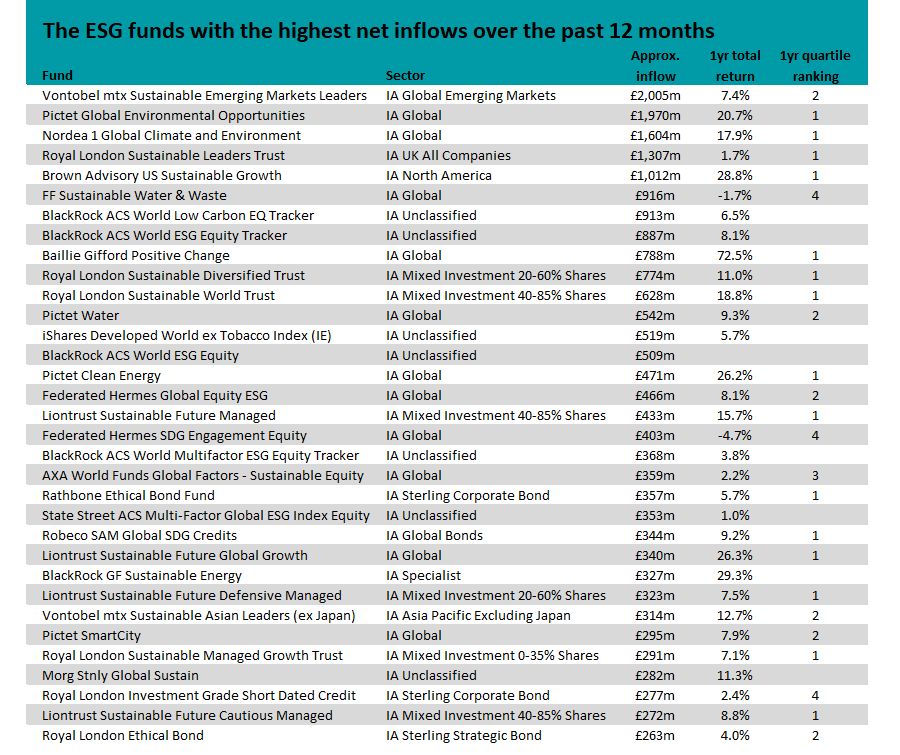

But which funds have been investors been putting the most money into over the past year?

In this research, Trustnet filtered the Investment Association universe to find 248 funds that class themselves as having an ethical/sustainable approach then calculated their approximate inflows over the past year.

Of the 248 funds, 170 have benefitted from positive net inflows in the 12 months to the end of September 2020. The 33 that appear to have taken in more than £250m can be seen in the table below, along with their total returns and, where appropriate, quartile ranking.

Source: FE fundinfo, all data to 30 Sep 2020

Some of the funds on this list as Luxembourg-domiciled Sicavs, which means that their net inflows will include money from European investors as well as from those in the UK.

That’s the case with Vontobel mtx Sustainable Emerging Markets Leaders, Pictet Global Environmental Opportunities and Nordea 1 Global Climate and Environment, which occupy the top three spots on the list.

Royal London Sustainable Leaders Trust, in fourth place, is a UK-domiciled unit trust and has taken around £1.3bn in inflows over the past year. The fund was around £816m in size one year ago but has grown to £2.2bn thanks to net inflows and a positive total return.

Headed up by FE fundinfo Alpha Manager Mike Fox, the fund invests in UK stocks that are making a positive contribution to society while offering potential for growth and appearing relatively undervalued by the market.

To 30 September 2020, the five FE fundinfo Crown-rated fund was first decile in the IA UK All Companies sector over one, three, five, 10 and 15 years. Since Fox took over in November 2003, it has made 429.09 per cent – compared with 178.46 per cent from its average peer.

Performance of fund vs sector under Fox

Source: FE Analytics

The FE Investments team, which has Royal London Sustainable Leaders Trust on its Approved List, said: “The fund is distinguishable from its ethical peers, who focus predominantly on negative screening whilst Fox and his team go a step further and screen all ‘ethical’ companies to isolate those that are actively engaging in sustainable areas as well as those which operate in socially neutral areas, such as alcohol production, but which utilise responsible methods of production.

“As such it is a very good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner.”

Fox’s Royal London Sustainable Diversified Trust, Royal London Sustainable World Trust and Royal London Sustainable Managed Growth Trust funds can also be found on the list of ESG funds that have captured plenty of inflows over the past year.

Baillie Gifford Positive Change is another fund that has caught plenty of investors’ eyes this year. Over the 12 months to the end of September, the fund made a 72.53 per cent total return – one of the highest in the entire Investment Association universe.

This strong performance, combined with net inflows of around £788m, caused its assets under management swell from around £160m to £1.2bn over the past year.

The team-managed fund will only invest in companies that fit into at one of four impact themes: social inclusion & education, environment & resource needs, healthcare & quality of life and base of the pyramid.

Square Mile Investment Consulting & Research, which gives the fund an ‘A’ rating, said: “We believe this fund is currently one of the most attractive responsible fund offerings in the market. Baillie Gifford has clearly put a lot of thought, effort and resources into this product. It has a well-defined and distinctive investment process for companies it seeks to invest in and places a strong emphasis on both returns and providing a positive impact over the long run.”

Other fund groups well-represented on the list include Liontrust, with its Liontrust Sustainable Future Cautious Managed, Liontrust Sustainable Future Defensive Managed, Liontrust Sustainable Future Global Growth and Liontrust Sustainable Future Managed funds.

All four, which are managed by Peter Michaelis and Simon Clements, are in the top quartile of their respective fund sectors over one, three, five and, where there’s a long enough track record, 10 years.

BlackRock has four of its index trackers on the list: BlackRock ACS World ESG Equity Tracker, BlackRock ACS World Low Carbon EQ Tracker, BlackRock ACS World Multifactor ESG Equity Tracker and BlackRock ACS World ESG Equity.