Scottish Mortgage, Fundsmith Equity and Rathbone Global Opportunities are some of the global funds that advisers on FE fundinfo's AFI panel believe could be appropriate for investors of all risk profiles.

After looking at the UK funds that an investor of any age could hold, Trustnet turns its attention to the global funds that appear in all three FE Adviser Fund Index (AFI) portfolios.

With the continued success of the vaccine rollout, the global recovery has begun in anticipation of the wide-scale re-opening of the economy in the summer months.

The latest rebalance of the AFI portfolios, which is based on the recommendations of some of the UK’s leading financial advisers, has seen some additions and removals to mark the changing economic landscape.

Constructed for different risk appetites, the AFI Cautious is designed for someone around retirement age, whereas the AFI Aggressive is for someone in their late-20s. AFI Balanced is for those in between.

Performance of AFI indices over 5yrs

Source: FE Analytics

Over five years, the AFI Aggressive index has returned 63.84 per cent, comparred to 43.36 per cent for the AFI Balanced and 29.52 per cent for the AFI Cautious indices.

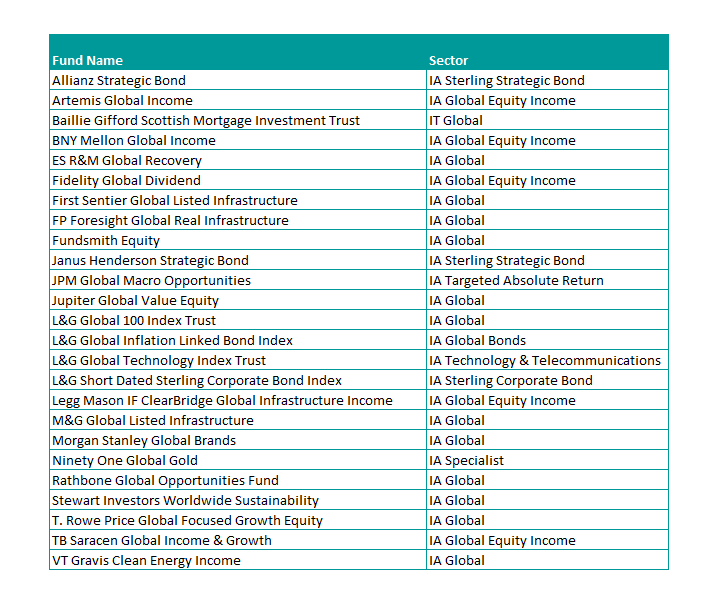

Across all three portfolios, there are 26 global funds that are appropriate for an investor irrespective of the risk tolerance.

Within that 26, most sit in the IA Global sector, but there are a few which come from the IA Sterling Strategic Bond and IA Global Equity Income sectors.

The only global investment trust to feature in all three portfolios is the £16.2bn Scottish Mortgage Investment Trust, managed by James Anderson and Tom Slater.

One of the most famous funds on the list, the portfolio features names such as Tencent, Amazon and Tesla.

In 2020 alone, the trust returned 110.49 per cent, but its exposure to the big global names has hit performance in 2021 and is in the lower quartile of its sector, posting a loss of 6.67 per cent so far this year.

Staying with megafunds, Terry Smith’s £22.6bn Fundsmith Equity strategy has also suffered in terms of near-term performance, with the fund sitting in the fourth quartile of its sector over three and six months.

But Smith, an FE fundinfo Alpha Manager, has a strong track record and an initial investment five years ago would be up 124.9 per cent as of 11 March.

Global funds in all three AFI portfolios

Source: FE Analytics

Another FE fundinfo Alpha Manager, James Thomson, runs the £3.2bn Rathbone Global Opportunities fund, which the AFI panel recommends to an investor of any risk appetite.

The manager has run the fund since inception and presides over a bottom-up, high conviction portfolio of around 40-60 holdings.

Thomson looks for businesses that are easy to understand, demonstrate scalable and sustainable growth, have barriers to entry and are able to control their own destiny.

One of the younger funds to make all three portfolios is the £210.7m Jupiter Global Value Equity fund.

Launched in March 2018 and run by Ben Whitmore and Dermot Murphy, 70 per cent of the fund is invested in global companies which are deemed to be undervalued.

The value-style of investing is expected to rebound after a decade of underperformance, which includes the recovery many of the businesses hit hard by Covid-19.

Included in the portfolio are BP, Airbus and Standard Chartered.

Two global sustainable funds are also included across all three portfolios: the £253m VT Gravis Clean Energy Income and £693.5m Stewart Investors Worldwide Sustainability funds.

The latter has an FE fundinfo Crown Rating of five and invests in shares of high quality companies which are positioned to benefit from, and contribute to, the sustainable development of the countries in which they operate.

The £3.5bn BNY Mellon Global Income, £2bn Fidelity Global Dividend, £750.6m Legg Mason IF Clear Bridge Global Infrastructure Income and £90m TB Saracen Global Income & Growth funds all make up the IA Global Equity Income strategies across all three AFI portfolios.

Managed by Daniel Roberts, the Fidelity fund has succeeded in growing dividends by at least 4 per cent every year through until 2019 and would be an obvious choice for cautious investors searching for a global source of dividends, according to the team at FE Investments.

Two funds are from the IA Sterling Strategic Bond sector: Allianz Strategic Bond and Janus Henderson Strategic Bond.

Charlie Parker, managing director of Albemarle Street Partners, commented on the flexibility of both these strategies.

“Allianz Strategic Bond is able to take advantage of changes in volatility to extract alpha and is differentiated from its peer group and more traditional corporate credit exposure,” he said.

The £3.1bn Janus Henderson Strategic Bond fund can invest in multiple bonds, including high-yield, investment grade and government bonds as well as derivatives.

“The unique derivatives overlay has been instrumental in creating the manger’s long-term track record,” added Parker.