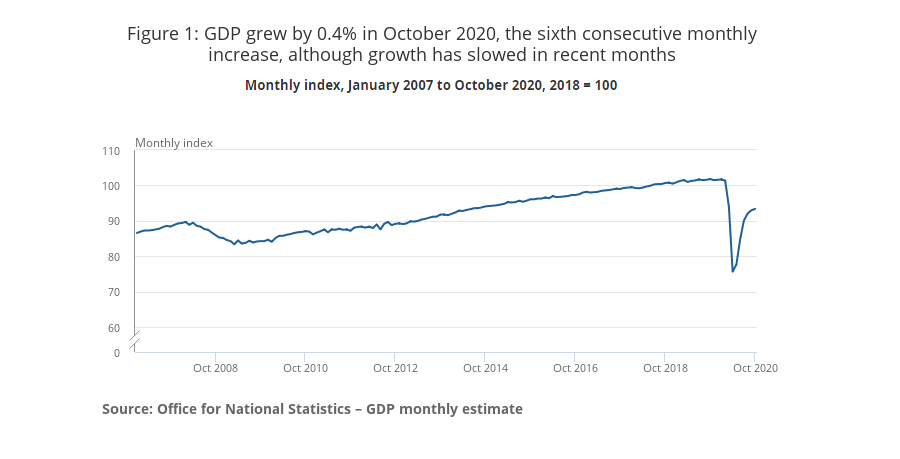

The UK economy saw its sixth consecutive month of growth in October, according to the Office for National Statistics (ONS), but the recovery has slowed down in recent months.

The UK economy grew by just 0.4 per cent in October down from 1.1 per cent growth seen in September and is still 7.9 per cent smaller than its pre-pandemic peak in February, the ONS noted.

The muted recovery in October was largely caused by a reintroduction of lockdown restrictions, with the biggest impact seen in the consumer-facing services such as pubs and restaurants.

The impact is clear when comparing the services sector September and October output, which fell from 1.1 per cent to 0.2 per cent.

It’s expected that November’s stats will be even weaker due to the full lockdown restrictions, according to Close Brothers Asset Management’s Robert Alster.

The chief investment officer said: “It’s hard to keep pace with the rollercoaster of restrictions in the UK and consequently, the economic impact. With October seeing a host of tiered restrictions, the slowdown in GDP growth is to be expected.

“Fast forward to now, England has headed back into localised rules following the second national lockdown, which is inevitably likely to cause a contraction in November’s data print as shops and restaurants once more closed their doors.”

He added that some sectors, such as manufacturing and construction, are recovering better than others and December’s GDP could see a boost in retail and hospitality in the run up to Christmas with increased consumer spending.

But the UK recovery still has ongoing Brexit problems to contend with.

These Brexit issues could damage any potential economic recovery, according to Derrick Dunne, Beaufort Investment chief executive.

He said: “With the fears of a second wave clearly starting to feed through, there is a real danger that Brexit could derail any economic progress if it causes significant disruption to key GDP components like trade and consumer spending.”

Dunne continued: “While there has been some good news around the vaccine and restrictions easing, we simply haven't seen the true scale of the economic damage being wrought by coronavirus, lockdowns, and now sweeping job cuts.

“We also cannot ignore the fact that the impact on sectors such as travel and real estate will be much longer lasting than other sectors as many peoples’ fundamental way of life looks set to change.”

Dunne added that earlier this month the Organisation for Economic Co-operation and Development (OECD) warned that the UK faced a “double threat from both Covid-19 and then Brexit,” and advised investors that “more than ever, it is vital to stay calm, while taking steps to ensure your investment strategy is still fit for purpose in meeting your long-term goals”.

But if the UK can achieve some resolution on Brexit this, combined with the current Covid-19 vaccine rollout, UK GDP could have a more positive 2021 outlook, according to Jon Hudson, manager of the £154m Premier Miton UK Growth fund.

He said: “With the vaccine programme now being rolled out, and provided a trade deal with the EU can be agreed, we can start to look forward to GDP recovery in 2021 with greater confidence.”