The coronavirus pandemic hit some emerging market economies harder than others and, depending on how the crisis was dealt with, fund managers are tipping some to perform better than the rest next year.

Over the last decade, emerging market equities have underperformed developed market, and especially US equities, by a wide margin.

However, since the announcement of the coronavirus vaccines in November, emerging markets have begun to outperform in anticipation of a worldwide rollout and a return to normal economic activity.

Performance of emerging markets versus developed markets over 10yrs

Source: FE Analytics

Christopher White, co-manager of the MI Somerset Emerging Markets Discovery fund, believes that 2021 could be “a breakout year” for the asset class.

He said: “First, valuations across EMs are supportive both relative to developed markets and to their own histories, particularly in less loved parts of the emerging market universe in Latin America and EMEA.

“Second, the change to macroeconomic conditions brought about by the government response to Covid and now the arrival of effective vaccines should be particularly good for emerging market assets.

“The unprecedented US peacetime fiscal deficit combined with aggressive monetary stimulus is putting pressure on the dollar, which is helpful for many emerging economies that need to source capital from abroad.”

White also highlighted how emerging markets typically have higher exposure to consumer discretionary and financial sectors than developed markets.

He said: “As economic recovery takes hold, we expect the most beaten up areas of EMs, namely smaller companies, Latin America and EMEA, and the more cyclical and discretionary sectors, to perform particularly strongly.”

Indeed, though developed markets will be receiving coronavirus vaccines first, emerging markets will still experience a strong rebound, according to RBC Wealth Management head of investment strategy Frédérique Carrier.

“One can be forgiven for thinking that as the vaccines are initially rolled out in advanced economies, EMs stand to lose out,” he said. “But that is not necessarily the case.”

Carrier pointed out that many emerging markets rely heavily on exports, so as global economic activity picks up, their economies should benefit.

“Countries like Thailand, Mexico, and Turkey, which generate 23 per cent, 16 per cent, and 12 per cent of GDP respectively from tourism, could enjoy an incremental recovery on the return of freshly vaccinated tourists,” he explained.

He also added that emerging markets equities also tend to outperform when the global purchasing managers’ indices increase.

This is due to “companies’ high operating leverage”, and “pronounced exposure to cyclical sectors”, which account for roughly 50 per cent of the MSCI Emerging Markets index.

William Davies, chief investment officer for EMEA at Columbia Threadneedle Investments, singled out China as the strongest economy going into 2021.

He said: “As ever with emerging markets, there are those countries where we see growth ahead, and others where we see challenges, such as with Brazil or India (although they a smaller part of the emerging market investment landscape).

“The largest emerging market is of course China, which is growing this year and was the first to emerge economically from Covid-19.

“Other countries are at different stages of their recovery, and this will be linked to how quickly mass vaccinations are rolled-out. But we see China at the forefront and the likes of India and Latin America further behind.”

Andrew Dalrymple, Rob Brewis and John Ewart, managers of the $194m Aubrey Global Emerging Markets Opportunities fund, are also overweight China compared to the rest of emerging markets going into 2021.

“The fiscal and monetary response from Asian governments has not been nearly as expansive as in America and Europe, where government backed lending support schemes have massively inflated the money supply,” they said.

“The economic background therefore looks to comprise an appealing cocktail of low inflation, a sharp recovery in economic growth, improving liquidity and governments which remain solvent and fiscally prudent.

“It is worth recalling that Asia now accounts for over 50 per cent of world GDP, and some 60 per cent of world economic growth, a position that looks likely to improve even further over the next few years, aided by a very pronounced demographic advantage.”

As a result, heading into 2021, China and India make up around 90 per cent of their portfolio, with around 55 per cent in China and 35 per cent in India.

The BlackRock Investment Institute also highlighted China, describing it as “a distinct pole of global growth – and as an investment destination separate from emerging markets”.

“Strategic US-China rivalry looks here to stay, with competition and bifurcation in the tech sector at its core,” the think tank said in its 2021 outlook.”

The institute’s strategists anticipate an increased emphasis in both countries on seeking self-sufficiency in critical industries of the future, where China is looking to master foundational technologies such as semiconductors, an area it has traditionally lagged compared to the US.

This is why the investment think tank believes investors need exposure to both the US and China as poles of global growth.

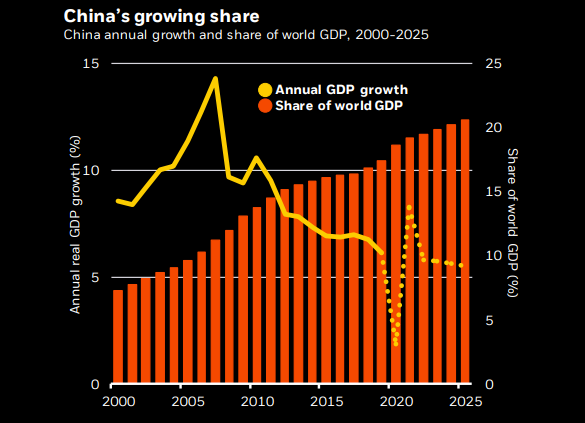

“This is not a simple story of deglobalization as China is opening up its capital markets to global investors,” it explained. “China’s share of global GDP has been steadily growing even as its growth has slowly trended down as the economy matures.

“Growth now is on track to return to its pre-virus trend, just as it bounced back quickly in the post-global financial crisis period.”

Source: BlackRock Investment Institute

BlackRock Investment Institute also expects “persistent inflows to Asian assets as many global investors remain underinvested and China’s weight in global indexes grows”.

Dale Nicholls, portfolio manager of the £1.2bn Fidelity China Special Situations trust, believes the 2021 economic backdrop for China “remains supportive”.

“Strong control of the Covid-19 virus has clearly been a factor supporting the recovery,” he said. “Regarding markets, while valuations are clearly not as attractive as they were earlier in the year, they continue to trade at a significant discount to the US markets despite arguably better growth prospects.

“The return to “normality” in China should mean lower risks relative to many other countries with higher uncertainty as they still struggle to get the virus under control.”

While some individual stocks have done quite well, particularly the Covid-19 beneficiaries, Nicholls said there are many laggards and still “significant value” in many parts of the market.

“We remain positive and overweight sectors that will grow in share in the economy over time, particularly consumer-related, technology and healthcare,” he said. “In many of these areas, Covid-19 has accelerated structural trends already underway in China.”