With 2021 almost upon us, the Trustnet editorial team has picked out thematic and structural trends among their fund picks for next year as the Covid pandemic continues.

Below editor Gary Jackson, Trustnet Magazine editor Anthony Luzio, news editor Rob Langston, senior reporter Abraham Darwyne and reporters Eve Maddock-Jones and Rory Palmer have highlighted the funds they believe could prosper in 2021.

It should be noted, however, that these are personal views and should not be taken as investment advice.

Abraham Darwyne – Scottish Mortgage Investment Trust

First up is Trustnet senior reporter Abraham Darwyne, who has backed one of the best-known investment trusts in the industry: Scottish Mortgage Investment Trust.

“The top-10 listed companies aren’t what draws me to Scottish Mortgage,” said Darwyne. “It’s the several dozen unlisted holdings which might be private today but could go public and become some of the biggest companies in the world.”

He explained: “Businesses are staying private much longer than before, but managers James Anderson and Tom Slater have recognised and embraced this.

“They ride the gains that occur after businesses list, rather than just selling out at IPO like most listed private equity or venture capital firms, who also often take riskier stakes earlier in financing rounds.

“Scottish Mortgage has been an early – but not too early – investor in many of the most exciting companies in the world, where incredible progress – and valuation gains – occur before they go public. Also, I am a fan of SpaceX and Tesla.”

Performance of trust vs sector & benchmark over 3yrs

Source: FE Analytics

The £17.6bn, five FE fundinfo Crown-rated Scottish Mortgage trust has returned 168.05 per cent over three years, compared with 30.22 per cent for the IT Global sector average and 31.15 per cent for the FTSE World benchmark. It had ongoing charges of 0.36 per cent, is 4 per cent geared, and is trading at a 1.2 per cent premium to net asset value (NAV), as at 22 December.

Gary Jackson – VT Teviot UK Smaller Companies

Trustnet editor Gary Jackson has gone for the £70m VT Teviot UK Smaller Companies fund, which has been managed by Andrew Bamford and Barney Randle since its launch in August 2017.

“In going for a fund that invests in the UK with a focus on smaller companies and value stocks, I’m backing three firmly unloved areas of the market. But as this is going into portfolios of my two very small kids, it’s very much a long-term play,” he said.

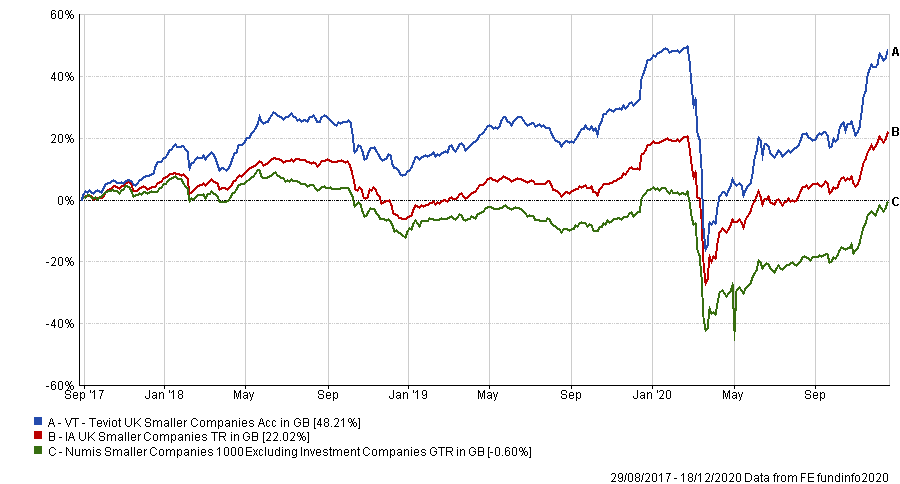

Performance of fund vs sector and index since launch

Source: FE Analytics

“Things might seem bleak with regards to these three areas because of the Brexit muddle and the new, more infectious coronavirus variant, but if there’s the slightest improvement in any of them, the market could turn around quickly with UK value small-cap being among the beneficiaries.

“But I don’t think everything has to be perfectly aligned for VT Teviot UK Smaller Companies to do well. Just look at its track record since launch: these have been terrible years for value but the fund made 48.21 per cent – the fourth highest return of its peer group.”

VT Teviot Smaller Companies has an ongoing charges figure (OCF) of 0.88 per cent.

Rob Langston – Pictet Security

After choosing a Chinese consumer strategy last year, news editor Rob Langston has gone for something slightly different for 2021 with a more thematic strategy.

“For my fifth fund pick while at Trustnet I’ve decided to go for Pictet Security,” said Langston. “It’s a thematic fund – with a particular focus on physical security, security services and IT security – that I’ve added as a satellite fund in my own modest portfolio this year.”

Langston continued: “Almost every day I have several e-mails or texts claiming to be from reputable companies, and even the UK government, claiming to need me to log-in with my details in various phishing attempts.

“I fear this will become a greater problem as more people have moved their lives online during the pandemic.

“In addition, Pictet Security also invests in areas such as health & safety, covering everything from food production to infrastructure, helping to make our lives safer. And it’s socially responsible too, not investing in companies involved with weapons, military contracting or nuclear power.”

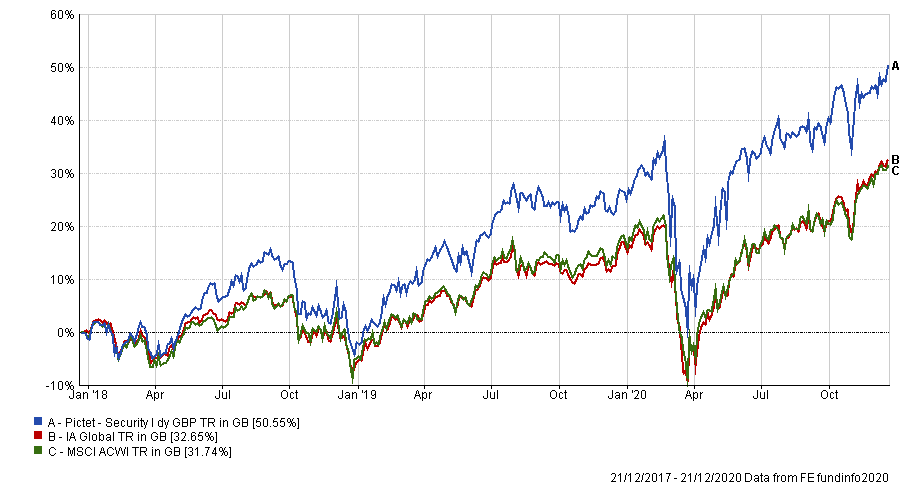

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the $7.2bn, four FE fundinfo Crown-rated Pictet Security fund – managed by Yves Kramer, Alexandre Mouthon and Rachele Beata – has made a total return of 50.55 per cent compared with a 32.65 per cent return for the average IA Global peer and a 31.74 per cent return for the MSCI ACWI. It has an ongoing charges figure (OCF) of 1.1 per cent.

Anthony Luzio – Henderson Smaller Companies Investment Trust

Like Trustnet editor Gary Jackson, Trustnet Magazine editor Anthony Luzio has opted for a UK smaller companies strategy, albeit a closed-ended fund, in Henderson Smaller Companies Investment Trust.

“The UK, and small-caps, in particular, have underperformed the rest of the market for the past five years,” said Luzio. “With the end of the Brexit transition period in sight, we should finally get some clarity on the future direction of the country, which should hopefully see an influx of foreign investors.

“As a result, I have selected the Henderson Smaller Companies Investment Trust. Manager Neil Hermon takes a growth-at-a-reasonable-price approach, focusing on what he calls the ‘four M’s’ when analysing a company: business model, management team, momentum and money (fundamentals).

“He is not afraid to run his winners, only selling out when they reach the FTSE 100. This strategy has served him well over the long term and the trust is a top-quartile performer over the past decade.”

He added: “There are other trusts in its IT UK Smaller Companies sector on a wider discount than its 5.57 per cent, but Hermon excels when the market is in recovery mode, making 64.71 per cent in 2009 and 56.84 per cent in 2010. The trust is 9 per cent geared and I am confident that Hermon can put this money to good use.”

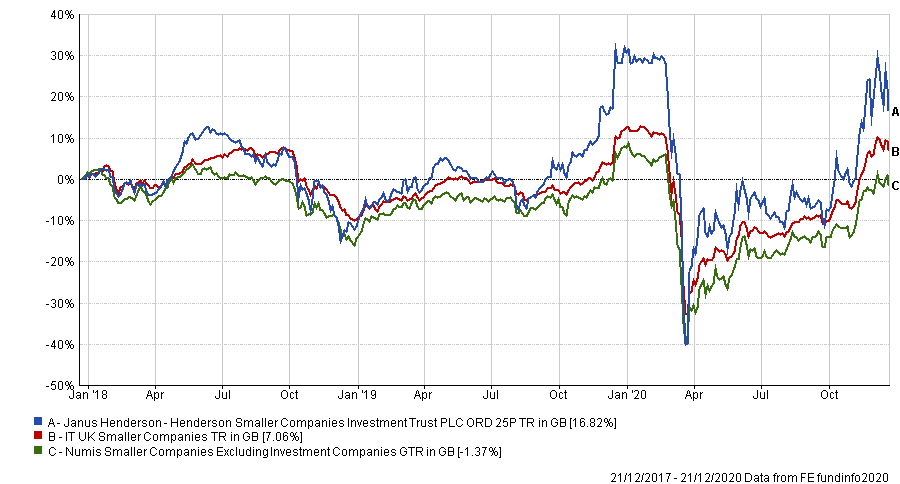

Performance of trust vs sector & benchmark over 3yrs

Source: FE Analytics

Source: FE Analytics

The £886.5m Henderson Smaller Companies Investment Trust has returned 16.82 per cent over three years, compared with 7.06 per cent for the IT UK Smaller Companies sector average and a loss of 1.37 per cent for the Numis Smaller Companies Index ex Investment Companies benchmark.

It had ongoing charges of 0.42 per cent, is 9 per cent geared, and is trading at a 10.1 per cent discount to net asset value (NAV), as at 22 December.

Eve Maddock- Jones – Pictet Global Environmental Opportunities

Leveraging her interest in sustainable investing, Trustnet reporter Eve Maddock-Jones has picked another environmental, social & governance (ESG) strategy for 2021.

“Following a watershed year for sustainable investment options in terms of interest, returns and inflows my fund pick is the €5.8bn Pictet Global Environmental Opportunities fund,” she said.

“Run by Gabriel Micheli, Luciano Diana and Yi Du, the fund goes beyond just tackling climate change, investing in companies looking to solve environmental issues in areas such as resource efficiency, agriculture or forestry for more than a decade.

“During that time the fund has made a top-quartile return, with a gain of 233.14 per cent since launch in 2010.”

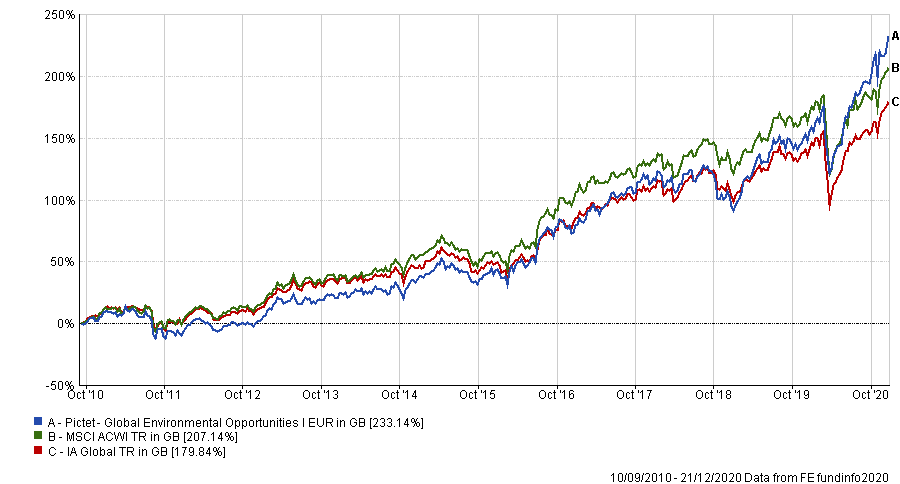

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

She continued: “There has been an increase in regulatory and government policy focused on tackling climate change this year with new climate-risk regulation to follow in 2021.

“The fund looks well-placed and supported by the wider Pictet Asset Management’s sustainable commitments to take advantage of this growing trend and is already ahead of new regulation which may catch-out some funds in the new year.”

Pictet Global Environmental Opportunities has an OCF of 1.11 per cent.

Rory Palmer – Premier Miton US Smaller Companies

Reporter Rory Palmer has opted for the Premier Miton US Smaller Companies fund as his pick for 2021.

He said: “Like many, I’m bullish on the small-cap outlook for 2021. That being said, if you would have asked me in November, I would have chosen a UK smaller companies’ strategy.

“However, further uncertainty posed by increased restrictions and a Brexit resolution still unfinalised – the investment case for US smaller companies looks far stronger.”

Palmer continued: “US small-caps should see a lift from the economy’s early-cycle dynamics, increased merger and acquisition activity from cash-hoarding companies and the shift from lagging large-caps to playing catch-up.

“This was evident in November when the Russell 2000 index rose 17 per cent compared with an 11 per cent gain for the S&P 500.

“Therefore the £308.5m Premier Miton US Smaller Companies fund is my selection for 2021. Managed by Hugh Grieves and FE fundinfo Alpha Manager Nick Ford, which is up by 71.16 per cent year-to-date.”

Performance of fund vs sector since launch

Source: FE Analytics

Since launch in 2018, the fund is up by 117.46 per cent compared to a gain of 48.95 for the average peer in the IA North American Smaller Companies sector. Premier Miton US Smaller Companies has an ongoing charges figure (OCF) of 0.86 per cent.