Man GLG Income, M&G Global Dividend and Montanaro UK Income are among the funds that have been recommended by fund pickers for income investors in 2021.

Continued uncertainty over dividends and ultra-low interest rates for the foreseeable future mean investors are having to look for elsewhere for income.

“2020 has been a tough environment for income seekers in equities with the pandemic creating a perfect storm,” said Rob Morgan, pensions and investment analyst at Charles Stanley Direct.

“Companies cut or postponed dividends in expectation of a tougher trading environment or increased regulatory pressure, but with vaccines being rolled out and a return to normal life on the horizon there is greater visibility on earnings and companies are seeking to build back up or reinstate dividends.”

With that in mind, Trustnet asked five fund pickers which strategies they would recommend to income investors in 2021.

M&G Global Dividend

Charles Stanley Direct’s Morgan chose the £2bn M&G Global Dividend fund, overseen by Stuart Rhodes and deputy managers John Weavers and Alex Araujo.

“Shares and sectors that have been badly damaged by the absence of customers during lockdowns and the shortage of turnover can be expected to bounce if as they return to better earnings, cashflow and profitability,” said Morgan.

He said a selective approach could favour active managers who are focused on the ability of companies to grow earnings, and one fund that stands out in this regard is M&G Global Dividend.

“Since the launch of the fund in 2008, manager Stuart Rhodes’ philosophy of backing companies that grow their dividends while avoiding high yielders whose dividends don’t grow has been largely successful,” he added.

“The fund has been able to healthily increase its pay outs to investors and it looks on course to do so this year, albeit modestly, despite the adverse conditions posed by the pandemic.

“I believe it is an attractive proposition for those seeking a rising income from global companies in a challenging environment.”

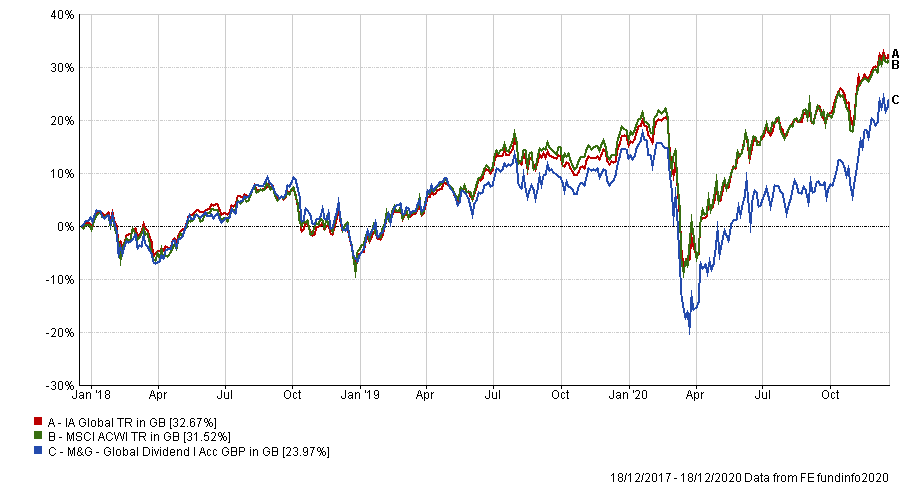

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, M&G Global Dividend has made a total return of 23.97 per cent, against a return of 32.67 per cent for the average fund in the IA Global sector and 31.52 per cent for the MSCI ACWI Index.

It has an ongoing charges figure (OCF) of 1.36 per cent and a yield of 2.24 per cent

Man GLG Income

The second pick is the £1.7bn Man GLG Income fund – run by FE fundinfo Alpha Manager, Henry Dixon and co-manager Jack Barrat – chosen by Adrian Lowcock, head of personal investing at Willis Owen.

The managers aim to add value by analysing company balance sheets to better understand a company’s true real-world assets and liabilities.

“They seek to identify two types of stock,” said Lowcock. “Those trading below their view of the company’s value and those where the company’s profit stream is being undervalued relative to the cost of capital.

“The portfolio has a clear bias to the value style, but it does include elements of quality and positive earnings momentum. Dixon has demonstrated his ability to consistently execute his investment process with discipline and care.”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, Man GLG Income has made a loss of 1.42 per cent, against a loss of 2.79 per cent for the average IA UK Equity Income fund and a loss of 0.21 per cent for the FTSE All Share benchmark. It has an OCF of 0.90 per cent and a yield of 5.77 per cent.

Montanaro UK Income

The third pick comes from Fairview Investing co-founder Ben Yearsley who has opted for the €710.4m Montanaro UK Income fund and run by Charles Montanaro and Guido Dacie-Lombardo.

“I think the UK is well-set for a period of outperformance as markets are cheap and most the barriers preventing a positive outlook have receded,” said Yearsley.

“I am a believer in small- and mid-cap companies so a trust such as Montanaro UK Income is an ideal pick combining the long-term growth potential with decent income prospects from an excellent team.”

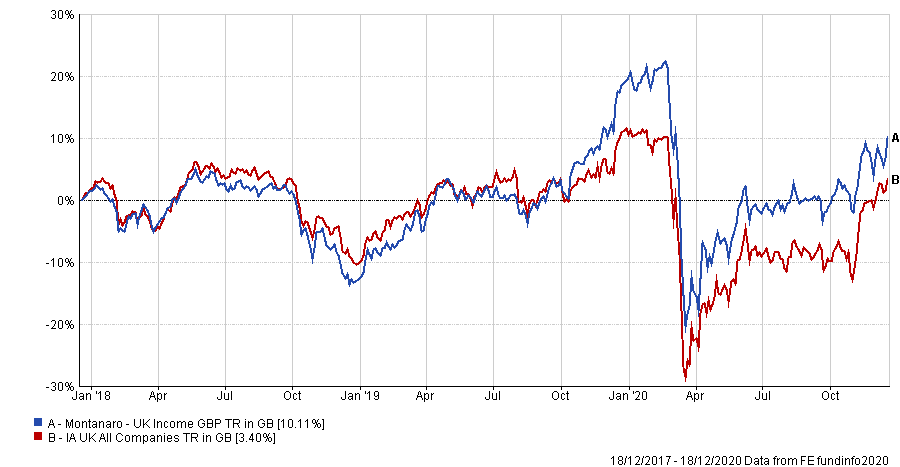

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over three years, the fund has made a total return of 10.11 per cent compared with a 3.40 per cent gain for the average IA UK All Companies peer. It has an OCF of 0.86 per cent and a yield of 3.40 per cent.

Aegon Diversified Monthly Income

Alex Farlow, head of risk-based solutions research at Square Mile Investment Consulting & Research, picked the Aegon Diversified Monthly Income fund run by FE fundinfo Alpha Manager Vincent McEntegart and Jacob Vijverberg.

“The managers aim to provide an income of 5 per cent per annum payable monthly along with some capital growth over the long term,” said Farlow.

They seek to achieve this while limiting volatility to around half to two-thirds of equity market volatility.

“Investment is made across a broad range of income paying assets in order to meet its income and capital growth objectives, with the managers utilising the specialist equity, fixed income and alternative asset class teams within Aegon,” he added.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over the same period, the £817m Aegon Diversified Monthly Income fund has made a total return of 10.36 per cent compared with a 9.91 per cent gain for the average IA Mixed Investment 20-60% Shares sector peer. It has an OCF of 0.59 per cent and a yield of 4.47 per cent.

Nothing

“I can’t really find anything to recommend for income,” said Andy Merricks, manager of the EF 8am Focused fund. “People’s interpretation of income has changed – or rather it has failed to change with the era in which we find ourselves.

“Most people would expect income to mean anything north of 5 per cent, yet to achieve this in an era of sub-1 per cent interest rates means that you will need to take on a high risk in the investments that you make.

“This may be especially unpalatable for the very bracket of investors to whom ‘income’ is important.”

To those seeking income, he recommended being as widely diversified as possible across their portfolios and to take profits as they arose.

He finished: “It’s probably best to keep at least one year’s income requirement in the bank as cash initially to allow for fluctuations as we’ve seen this year.”