With the UK’s departure from the EU now complete, it is now able to manage more of its affairs without the collective approach of the bloc and the UK economy is likely to become even more decoupled from the EU.

As such, investors may need to start treating UK equities as a standalone asset class, according to Lazard Asset Management’s Alan Custis.

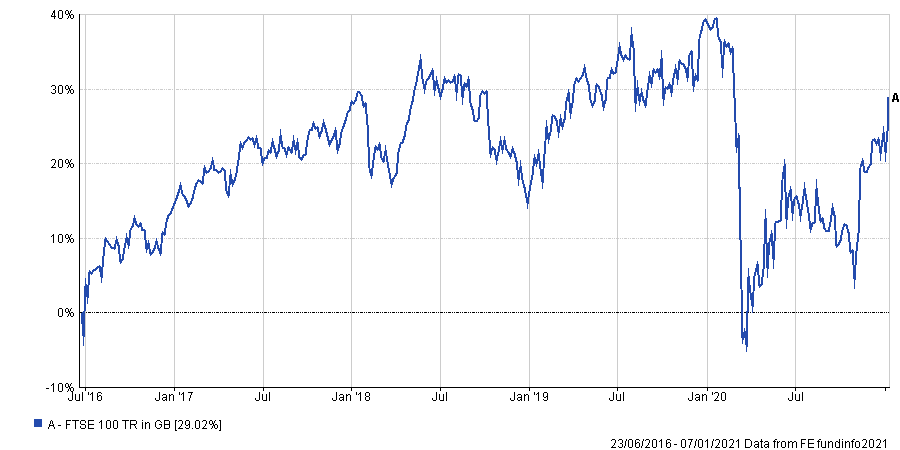

Since the 2016 EU referendum, the UK market has been dogged by uncertainty of what Brexit would entail. This saw UK equities become out of favour with overseas investors and lag their international peers.

Performance of FTSE 100 since EU referendum

Source: FE Analytics

With a deal now in place, Custis – Lazard’s head of UK equities and manager of Lazard Multicap UK Income – said investors might start to view the UK as an asset class separate from other European markets.

He said: “I remember – going back in the eons of time when I used to travel to Europe quite a lot – investors would own both UK and continental European portfolios, [and] over the years, that morphed into being a pan European portfolio.

“But, can people start to view the UK as a sort of separate asset class in a way now a bit like they may have used Switzerland?”

If this were to happen Custis that that it could be “positive for UK equities”.

He said it could become a diversifying asset class in portfolios, an idea he said one of his long-term clients has been considering in their own pension portfolio construction, for example.

Looking at the outlook for post-Brexit UK equities, Custis said that there must be reasons to be positive about the UK because he doesn’t believe “we could be any more negative”.

One of the immediate post-Brexit factors Custis highlighted was the impact on sterling.

He said: “I’m not one of these advocates that says that sterling is going to be super-strong as a result of this Brexit because the more we read into the nitty-gritty of it the more you kind of become a bit underwhelmed.

“And the fact that, to my read of it, Europe’s kind of got what they want out of it, probably more than we’d necessarily got out of it.”

According to Custis, it’s unlikely that sterling would suddenly experience a massive rally versus the dollar once a trade deal was agreed. But he doesn’t believe that’s a bad thing.

“I don’t think that stops the UK performing well,” Custis said. “As we know, the vast majority of earnings in the UK actually come from overseas anyway. So, the strength of sterling might have helped some of the domestic names, but it would have been at the expense of some of the international earners.”

He said that if sterling remained cheap compared to the US dollar, for example, then it could make UK equities more attractive to overseas investors as they see domestic names strengthen.

“What it needs is international investors to come back to the UK, [and] probably buy the FTSE 100,” he added.

Although the Brexit deal brings some positives to the UK, it doesn’t alleviate all risks and uncertainties.

Custis said: “I think, shorter term, clearly the sort of the tail risk event has disappeared, and where we are now is better than trading on WTO [World Trade Organization] terms clearly.

“Now, I’m not one of these people that is trumpeting the UK as catching up 10 years of relative underperformance. When I look at my colleagues, I can’t see them chomping for UK equities at the minute.”

One of the reasons for this is that the deal didn’t fully answer all the questions on what the UK’s future will look like post Brexit.

Custis said: “My initial reaction to the Brexit news was [that I felt] a bit underwhelmed. I think if we were reviewing this deal after the 2016 referendum vote we would view this as a pretty hard Brexit.

“Obviously there are elements of the deal which very much leave an open question like financial services. Where we end up in the short, medium and longer term there, I think is open to debate at the moment. [And] I think that’s one of the things that the market is clearly going to have to wrestle with for the next the next year or two.”

Custis added: “And I think over the next six months the market will very much and focus on the narrative from companies. I’m sure there’ll be some companies that will find exporting and importing goods more and more challenging.”

This ‘wait and see’ period is how international investors are likely to approach the UK immediately following the deal, Custis added.

He said overseas investors have been “studiously avoiding the UK, and I think overseas investors always want to see the facts before they consider their next move”.

The Lazard Multicap UK Income fund manager added: “I think that over the next, two or three, four weeks, we will start to see a more considered approach the UK market, at which point, we might see some of the relative undervaluation start to close.”

The backdrop to all of this – and a major reason why there’s still caution on UK equities, according to Custis – is the ongoing Covid-19 pandemic and how the UK deals with it.

Days into the New Year, the UK entered its third national lockdown as an aggressive vaccine programme is rolled out, with plans to deliver almost 14 million doses by mid-February.

However, the situation is different to last March year, Custis said, because then “we really were potentially looking over the edge of the cliff without overseas being the horizon”.

He concluded: “I think we are seeing a horizon now.”

Custis runs the £62.4m Lazard Multicap UK Income fund with Alan Clifford, investing in high-yielding companies with strong, or improving financial productivity and attractive valuations.

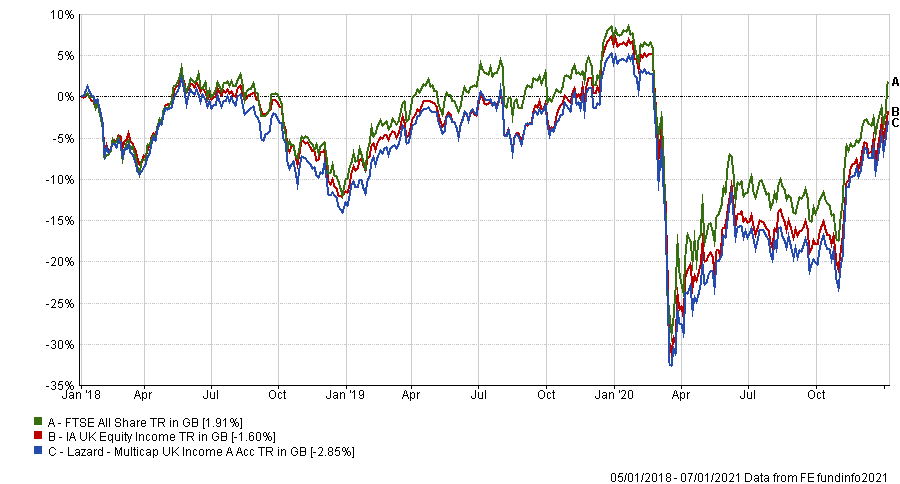

Over the past three years, the fund has made a loss of 2.85 per cent, underperforming the 1.91 per cent return made by FTSE All Share benchmark and a loss of 1.6 per cent for the IA UK Equity Income peer group.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

It has a yield of 3.26 per cent and an ongoing charges figure (OCF) of 0.82 per cent.