Investors do not agree on the value of Tesla, which has become one of the most polarising stocks of the last few years thanks to being headed by equally polarising chief executive officer Elon Musk and an exponential rally.

The electric car maker’s shares surged roughly 700 per cent over the last year to $880, valuing the company at over $880bn and making it worth more than all other car manufacturers combined. It also contributed to Musk becoming the richest person on the planet.

Tesla’s surge has benefited individual investors and investment funds alike – most notably Baillie Gifford, which has backed Tesla since 2013 through popular vehicles such as the £18bn Scottish Mortgage Investment Trust and £7.2bn Baillie Gifford American fund. These were some of the best-performing funds of 2020.

Three reasons to be bullish

Another of Tesla’s biggest advocates is US-based ARK Investment Management, run by Cathie Wood. It owns a large stake via its actively managed ARK Innovation ETF, among many others.

Wood has been a long-time Tesla bull and originally predicted in 2018 the stock would be worth $4,000 (or $800 when adjusted for the five-to-one share split that took place on 31 August 2020).

According to the firm’s latest investment case for the stock, its expected value for Tesla by 2024 is $1400 (after being adjusted for the stock split).

ARK’s investment thesis effectively revolves around three major variables: Tesla’s gross margins, its capital efficiency, and its autonomous capability.

“We believe that gross margins are key to Tesla’s viability and value,” explained Sam Korus, an analyst at ARK Investment Management.

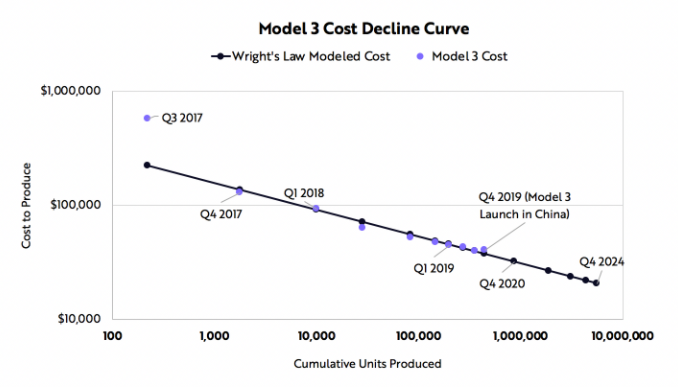

“Based on Wright’s Law and expressed in ARK’s model, Tesla’s auto gross margins could approach 40 per cent in 2024, though they are unlikely to increase in a straight line as new models launch and production scales.

“Wright’s Law has forecast cost declines successfully in more than 60 technologies ranging from solar power to televisions, and from semiconductors to ovens.”

Korus pointed out how Tesla’s Model 3 already has demonstrated cost declines in line with Wright’s Law.

Source: ark-invest.com

The next major variable is Tesla’s future capital efficiency.

“ARK assumes that Tesla will be more capital efficient than traditional automakers,” Korus wrote. “The amount of capital required to produce a car powered by an internal combustion engine in the US has been rising steadily.

“With a fraction of the moving parts, electric vehicles should be manufactured much more efficiently than gas powered cars. In our capital efficient case, we assume Tesla will be able to build factories for $11,000 per unit volume of capacity.”

The final variable in Ark’s thesis is Tesla’s future autonomous capability: “A fully autonomous taxi network could break the mould of a traditional automotive manufacturer’s business model completely.

“Tesla could shift from a model of one-time transactions at hardware-like margins to a model of recurring transactions at software-like margins, charging passengers per mile and taking a platform fee.

“We model that Tesla will take a 50 per cent cut of gross revenues from autonomous taxi networks, much higher than the 20-30 per cent cut that Uber and Lyft enjoy today, based on the additional convenience, improved safety, and cost savings, as well as ARK’s analysis of platform fees in other markets.

“We also assume that its autonomous taxi service will begin in 2021, one year after Elon Musk has predicted the service will be available, regulatory approval permitting, with just 2 per cent of eligible Tesla vehicles on the network in its first year.”

“Tesla really is the definition of what a bubble is”

However not all investors are quite as optimistic on Tesla. Christopher Rossbach, manager of the $142m J. Stern & Co. World Stars Global Equity fund, is concerned about the stocks’s current valuation.

He started off by acknowledging that Tesla is “clearly an incredible company”.

“It has an extremely charismatic CEO, who has had a vision about the auto industry and electric cars that he has pursued with tremendous energy and conviction,” he said.

“But as investors, we have to separate our interests and our enthusiasm for a company, or for a charismatic CEO like Elon Musk, from the investment case.”

The first concern Rossbach has is around the automotive industry. “I don't think it's in a good and growing industry,” he argued. “I think that the car industry is going through tremendous change and disruption and the eventual shape of that industry is completely unclear.”

He believes urbanisation and growing environmental pressures will result in an automotive industry where electric vehicles, car sharing and autonomous driving will be the norm, but that the winner of this outcome remains unclear.

Rossbach said: “If we look at a longer time period whether the winner is going to be Volkswagen, Daimler, Chrysler, General Motors, Toyota, Alphabet’s Waymo or Tesla - it’s a question that is very difficult to answer.”

This leads to his next concern, which is around Tesla’s competitive position. “It may be that the traditional car companies have preserved combustion engines for too long, to preserve that market and their earnings from that business at the expense of electric vehicles, so they're lagging behind,” Rossbach explained.

“But I think they're catching up dramatically I think there are many car companies and many large and well capitalised ones with resources that are working on it.

“The idea that Tesla will go from the production levels that they have now and the market share to the market share that I think is necessary to justify the valuation, both in unit and in margin terms, is very unlikely.”

He added: “The unit terms are going to be very challenging and I think the margin terms are going to be practically impossible.

“I think that the global car industry will continue to respond, and it will become as it has already, a fiercely competitive industry that is going to be shrinking in terms of the relative demand.”

Rossbach also questioned whether lithium ion technology will be the future of battery technology, as they are polluting in terms of the raw materials, the supply chain and eventual disposal.

But one of his biggest concerns is that Tesla can issue equity seemingly without punishment. Indeed, the company issued $5bn in equity twice last year alone on the back of its surging stock price, without much pushback from shareholders.

“At $800m, if they did a 5 per cent equity issue, it would be $40bn,” Rossbach explained. “You could buy and build a lot of capacity for that amount. You can also, by the way, offset a lot of losses for $40bn. But that's why I think that Tesla really is the definition of what a bubble is.”

He believes Tesla is the opposite of Amazon, which grew from an online book retailer over two decades ago to an e-commerce giant. Its share price has grown by 190,000 per cent since its IPO in 1997.

“Amazon only ever went public once and then everything it's done since has been paid for by the cash flow that the company has generated itself,” Rossbach explained. “Even though it's been earnings negative, it's always been cash flow breakeven.

“You can't get distracted, if you will, by the amazing product and by what could happen. You always have to ask: what about the cash flow? What about the value?”

DISCLAIMER: The author of this article Abraham Darwyne owns Tesla shares in his personal portfolio.