Investors shouldn’t pin their hopes on the €1trn European Green Deal, according to Devon Equity Management’s Alexander Darwall (pictured), who warns the continent has a lengthy track record of failing to deliver on ambitious strategies.

Under the European Green Deal, €1trn will be invested in transforming the continent into a low-carbon economy, with more than half of this to come from the EU budget. Another €279bn will come from the private sector, with companies encouraged to make risky green investments by loan guarantees from the European Investment Bank.

This programme is one reason why many fund managers are referring to the green energy revolution as the next investment “mega trend”, with Europe at the epicentre of this transformation.

However, Darwall, who manages the European Opportunities Trust, warned the reality is likely to be far more underwhelming if history is anything to go by.

“If we go back to 2000, the European Commission had the Lisbon Strategy for 2010, which said that in that 10-year period Europe would, and I quote, ‘become the most competitive and dynamic knowledge-based economy in the world, capable of sustainable economic growth, with more and better jobs and greater social cohesion’. Well, that failed,” he said.

“As an expression of good intent and virtue, you couldn't fault it, but it failed completely.

“In 2010, the European Commission came up with the Europe 2020 strategy. This had much less hubris, but didn't work out much better.”

“I think it is perfectly reasonable to be sceptical about whether this latest iteration of the Commission's good intent will be successful. It hasn't before, but maybe it will be third time lucky.”

Despite his pessimism about the post-Covid rescue plan for Europe, Darwall said the continent is still an attractive destination for investors due to the large number of global businesses listed there. For example, at 37 per cent, North America makes up a larger proportion of revenues for his portfolio companies than Europe.

This should dampen the impact if, as Darwall expects, the European Commission's inability to deliver on its promises is not the only negative outcome of the Green Deal. Darwall pointed out that a pledge to spend €1trn over the next decade – and there are estimates this could rise to €10trn by 2050 – is “not just good news” and that one of the side effects is likely to be a leap in inflation. Yet the manager said he appears to be in the minority in worrying about this risk.

“This is a particularly important point at the moment because it seems to me that many valuations in the market are based on zero interest rates forever,” he continued.

“That is not what we think is likely: we are not setting up a portfolio for the free-money world.

“As an addition to that, we've been very keen to avoid binary risk, which comes from taking a view on things like Brexit or the US presidential elections. We don't alter the portfolio for black or white outcomes.

“We're building for various economic scenarios because we don't know exactly what's going to happen. It is an attempt at a fund for all seasons. I think that is vital because in due course, interest rates will have to rise.”

To build this “fund for all seasons”, Darwall looks for companies with low levels of debt, strong pricing power, “lots of intellectual property” and multiple barriers to entry, so their business models are not vulnerable to a single change.

In addition, he said corporate governance “has always been at the heart of what we do”, adding: “We have to believe that the companies in which we invest are doing the right thing and doing the right thing for our investors and for the owners of their capital by trying to build sustainable, successful businesses for the long term. We don't actually need the regulator to tell us to do that.”

Yet it was a failure of corporate governance that led to Darwall’s biggest flop as a fund manager. Last year Wirecard – which made up 17 per cent of his portfolio at one point – announced €1.9bn was missing from its accounts and was declared insolvent.

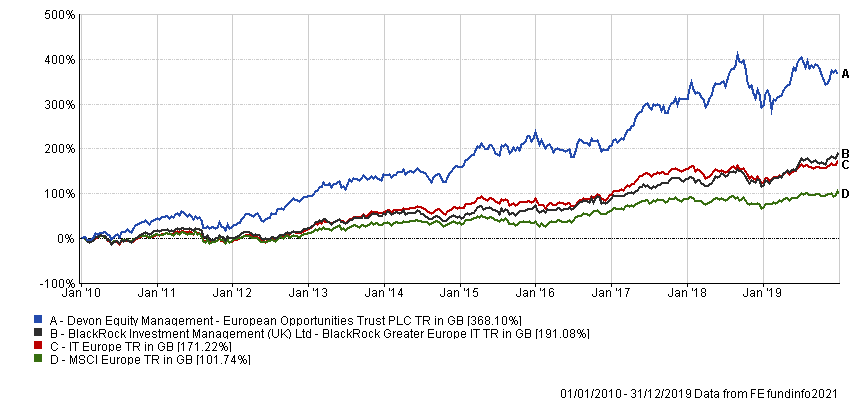

Performance of trusts vs sector and index Jan 2010 - Dec 2019

Source: FE Analytics

This has had a major impact on the manager’s long-term figures: his trust had made 368.1 per cent in the 10 years prior to the start of 2020, almost twice as much as his closest sector peer.

Wirecard’s plummeting share price has pushed him into the fourth quartile over five years.

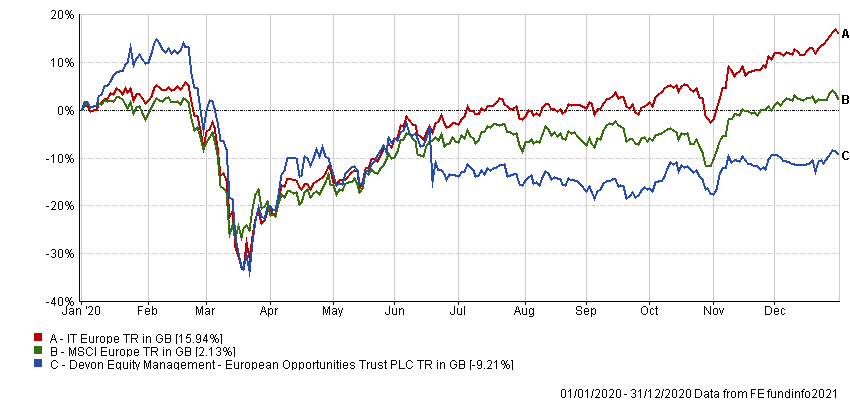

Performance of trust vs sector and index in 2020

Source: FE Analytics

However, when asked what this incident has taught him, his reply was inconclusive.

“Clearly it's a huge mistake on my part,” he admitted. “Of course, I recognise there are lots of lessons to be learned, but it's hard to be sure on all aspects of that because we don't know exactly what happened.

“I'll give a couple of general thoughts: one is the sizing of the position was an issue and I was probably wrong on that.

“Certainly, the regulators in Germany and the accountants proved to be inadequate safeguards, which I think is a form of lesson: you can't rely on these people.

“And I think another one might be that of the four operating directors of Wirecard, two are either in custody or being sought by the police and two are not. And one of the lessons might be that you can have a very significant fraud without all the senior people involved. It can be a very small number of people.

He added: “There are lessons and certainly we have given it plenty of thought, but we don't actually know precisely what's happened at this stage.”

Data from FE Analytics shows the European Opportunities Trust has made 192.04 per cent over the past decade, compared with 187.62 per cent from its IT Europe sector and 88.55 per cent from its MSCI Europe index benchmark.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

The trust is trading at a discount to net asset value (NAV) of 11.17 per cent, compared with 8.81 and 4.32 per cent from its one- and three-year averages. It has ongoing charges of 0.99 per cent and is 1 per cent geared.