Investment trusts such as International Public Partnerships, TwentyFour Income and HICL Infrastructure could be attractive options for income investors worried by widespread dividends cuts in the UK market.

A swathe of UK businesses have cut or postponed their dividends since the coronavirus crisis took hold, with the most high-profile names including the banks, Royal Dutch Shell and BT.

This has raised challenges for traditional UK equity income strategies but investment trust analysts have pointed out that there are a number of portfolios that invest in alternative assets and look set to continue paying out an income.

Monica Tepes, head of investment companies research at finnCap, said: “The scarcity of income is nothing new and the economic backdrop of ultra-loose monetary policy is going to make income-producing alternative assets even more attractive.

“The investment company alternative income sector has grown tremendously over the last 15 years precisely because it can fill this gap, which open-ended funds, equities and bonds can’t. I think there will be more income solutions to come from this space.”

She said investors looking for as much insulation as possible from further dividend cuts essentially have two types of investment to consider: sectors where either the local or state government is their counterparty or those were come from businesses which are unaffected or even benefit from the current environment.

“In the first category I can only put infrastructure equity (BBGI, International Public Partnerships, HICL Infrastructure), infrastructure debt (GCP Infrastructure Investments, Sequoia Economic Infrastructure Income) and supported living (Civitas Social Housing, Triple Point Social Housing REIT),” Tepes said.

“In the second category I think there are no clear winning sectors – certain players in the logistics sectors seem to be in the right assets, but others aren’t. If the products transiting through your logistics centres are not selling, you will have trouble collecting rents.”

Ewan Lovett-Turner, director of investment companies research at Numis Securities, agreed that trusts which invest across a range of alternative asset classes remain an attractive option for income investors.

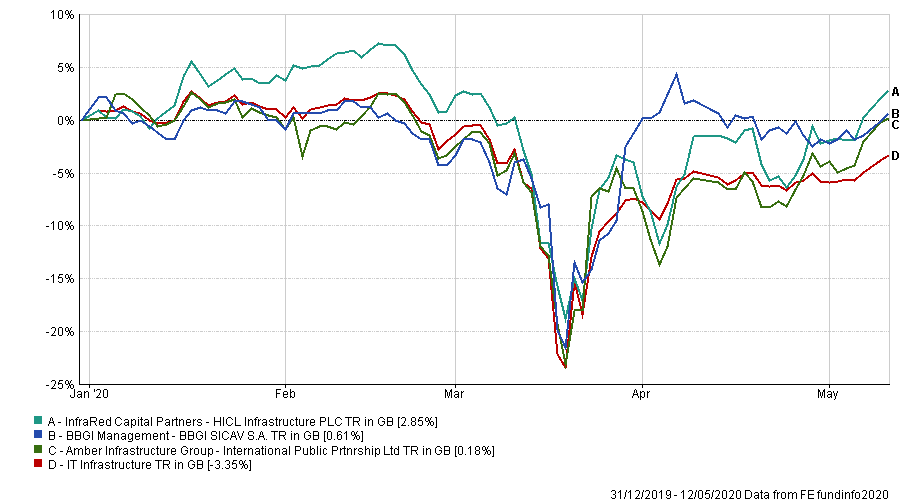

Performance of infrastructure trusts vs sector over 2020

Source: FE Analytics

“In particular, core infrastructure funds look to be trading on attractive yields given their long-term, government-backed income streams and with a high degree of inflation linkage,” he added.

“I believe an attractive option is International Public Partnerships. It invests in a diversified portfolio of assets providing essential services and recently reiterated its 2020 dividend target, putting it on a 4.8 per cent yield. HICL Infrastructure offers a 5 per cent yield and, whilst it has more exposure to demand-based assets, we understand these are robustly structured to withstand near-term reductions in revenues.”

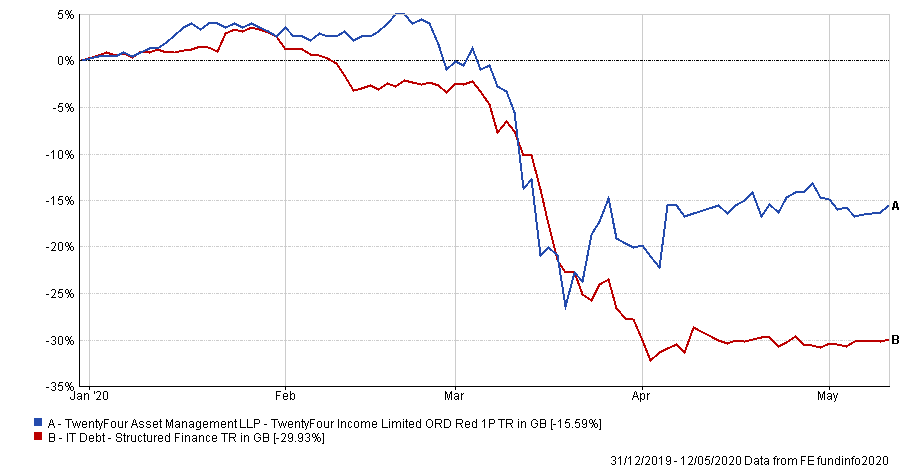

In addition, Lovett-Turner said certain specialist debt investment companies offer an attractive yield, even though defaults are expected to increase in the challenging economic conditions ahead.

He singled out TwentyFour Income because of its management team and attractive yield of 7.1 per cent. The trust invests in European asset-backed securities, which offer structural protection against first losses and have historically shown very low levels of defaults. The analyst added that there is the there is the potential for capital growth “given the portfolio has yet to participate in the recovery seen in wider credit markets”.

Performance of TwentyFour Income vs sector over 2020

Source: FE Analytics

Lovett-Turner pointed out that all of the trusts he has highlighted offer added security from the fact they run diversified portfolios with a large number of underlying investments.

International Public Partnerships, for example, has over 100 projects in the UK, Europe, North America and Australia in areas such as education, justice, transport and energy while TwentyFour Income’s assets are backed by thousands of underlying loans.

Alan Brierley, director of investment companies research at Investec, said the current climate has made sustainability of income more important than ever and his preferred sector is infrastructure.

Investec’s recommendations in this space include HICL Infrastructure, The Renewables Infrastructure Group, Greencoat UK Wind and Sequoia Economic Infrastructure Income.

“These companies give a diversified exposure to social, economic and renewable infrastructure along with infrastructure debt,” Brierley said. “Within the debt sub-sector, many constituents had over-promised and under-delivered even in a benign credit environment before the onset of the pandemic.”

When it comes to the debt sub-sector, he added that stock selection is “even more critical” and said the firm’s preferred investments are GCP Asset Backed Income, which invests in asset-backed loans, and BioPharma Credit, which provides debt capital to the life science industry.

However, infrastructure investing is not without its risks. Tepes said the biggest is that the government breaks or renegotiates the contracts or nationalises the assets; while this is still unlikely, the chances of it happening appear to have risen because of the coronavirus crisis.

A more likely risk for infrastructure, in her view, is that the operators of the assets come into financial difficulties and the cost to the trust to run the assets increases, squeezing net cash flows.

Conor Finn, investment fund analyst at Liberum, said that, aside from infrastructure and renewable energy infrastructure strategies, he considers social housing REITs to be another source of “long-term, uninterrupted income”.

“Following recent acquisitions, Civitas Social Housing has achieved full dividend cover on a forward-looking basis and we expect an increase to a cover of 1.08 years by Q1 2022,” he said.

“The portfolio produces a long-term, inflation-linked income stream from specialist supported housing. Civitas is focused on accommodation for individuals with care needs that are moderate to high. Rental payments from housing associations are funded from housing benefit. Rent collection in the sector has been unaffected by the Covid-19 crisis, unlike other real estate sectors.”

Performance of Civitas Social Housing vs sector over 2020

Source: FE Analytics

He added that Civitas Social Housing’s income stream should be uncorrelated with the wider market, as shown by its positive returns in 2020 while the FTSE All Share fell into a sharp bear market.

“There is an acute shortage of supported housing in the UK and demand is projected to rise as a result of an expanding and ageing population, medical improvements and healthcare policy,” he said.

But Finn conceded that, like infrastructure, there are some risks specific to this kind of investment. He pointed out that the regulator has been critical of the social housing sector and has highlighted issues at a number of housing associations; however, Civitas has led several initiatives to improve professionalism and the long-term sustainability of the sector.

The Association of Investment Companies’ Annabel Brodie-Smith finished: “Despite a number of countries beginning to emerge from lockdown, the environment for many businesses remains extremely challenging, putting pressure on company dividends. Investment companies investing in alternative assets such as infrastructure or social housing could be worth considering for income-seeking investors.

“Investment companies are an ideal way to invest in these assets, which are hard to buy and sell. Their closed-ended structure means managers can focus purely on performance and there is no risk of fire sales and suspensions. Investing in alternative assets does come with different risks to investing in mainstream equities, so it's important that investors do their research and speak to a financial adviser if they are in any doubt.”