The Covid-19 pandemic has focused a lot of attention on the healthcare sector as authorities around the world seek out ways to treat patients suffering from the virus and find some kind of vaccine to control the spread.

As such, FundCalibre managing director Darrius McDermott highlights six fund picks to tap into this theme.

AXA Framlington American Growth

McDermott’s first pick the £605.8m AXA Framlington American Growth, which has more than 20 per cent of its portfolio dedicated to healthcare stocks.

Run by Stephen Kelly and deputy manager David Shaw, the managers “believe companies need to be able to innovate and change behaviour to become market leaders,” the FundCalibre director said.

The fund – as the name suggests – invests in growth focused, mid-cap companies, which can lend itself to more cyclicality and more volatility than its large-cap focused peers, according to FundCalibre. And investors should note that this heavy style bias may struggle in some periods.

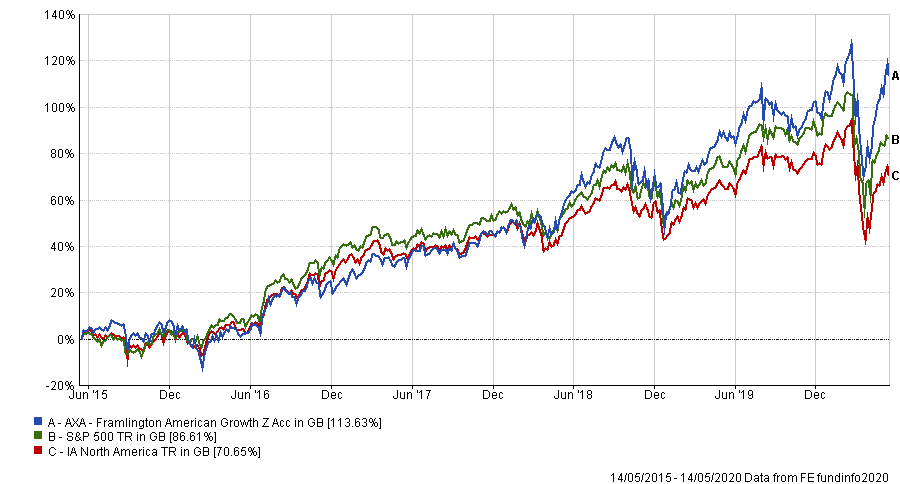

Performance of fund vs sector & index over 5yrs

Source: FE Analytics

The four FE fundinfo Crown-rated fund has top quartile performance across all time frames and over the past five years has made a total return of 113.63 per cent, an outperformance of its IA North American peer group (70.65 per cent) and S&P 500 benchmark (86.61 per cent). It has an ongoing charges figure (OCF) of 0.82 per cent.

Janus Henderson European Selected Opportunities

The second recommendation by McDermott is for the £1.6bn Janus Henderson European Selected Opportunities fund, co-managed by John Bennett and Tom O’Hara.

The fund currently has a 22.59 per cent allocation to the healthcare sector – the second largest sector allocation after industrials at 23.86 per cent.

Investing in 40-50 mega- and large-cap holdings of companies valued at more than £1bn, the team behind Janus Henderson European Selected Opportunities aim to add value by identifying sector themes and combining it with company analysis, concentrating on under-researched companies where the most value can be found.

According to FundCalibre, ’investing in change’ is a crucial part of the contrarian investment process with Bennett and O’Hara.

Over the past five years , the fund has made a total return of 25.28 per cent, better than its IA Europe Excluding UK peers (22.01 per cent) and FTSE World Europe ex UK index (24.66 per cent). It has an OCF of 0.84 per cent.

Marlborough Multi-Cap Growth

“The UK is perhaps surprisingly full of wide-ranging healthcare-related opportunities, and this multi-cap fund takes full advantage of this,” said McDermott, highlighting the £234.2m Marlborough Multi-Cap Growth fund.

FE fundinfo Alpha Manager Richard Hallett, aims to invest in the leading companies within each ‘growing industry’ and as such has just over 20 per cent of the portfolio invested in healthcare specifically, with holdings such as AstraZeneca, Dechra Pharmaceuticals and Craneware among its top-10 holdings .

Being a multi-cap fund, it’s able to invest in riskier small-cap companies, consequently making it riskier than its average UK peer, according to analysts at FundCalibre. However, manager Hallett offsets this risk by limiting the maximum holding of any one stock to 4 per cent, keeping the fund diversified.

Performance of fund vs sector & index over 5yrs

Source: FE Analytics

Over five years, Marlborough Multi-Cap Growth is the IA UK All Companies top-performing fund out of 226 in the IA UK All Companies sector with a long-enough track record, having made a total return of 36.31 per cent. In comparison the FTSE All Share made a return of just 0.66 per cent and the average IA UK All Companies sector peer made a loss of 0.53 per cent. It has an OCF of 0.80 per cent.

Morgan Stanley Global Brands

Next up is the £1.2bn Morgan Stanley Global Brands fund which has an eight-strong management team including FE fundinfo Alpha Manager William Lock, whose mantra – “don’t lose money” – has paid off recently, according to McDermott, having fallen less than the peer group during the February/March sell-off in markets.

The concentrated portfolio of 20-40 holdings, includes a 20.98 per cent allocation to healthcare services.

The team look for high-quality companies with defendable and visible future earnings, according to FundCalibre, which allow them to give attractive returns to shareholders and reinvest in their business to stay ahead.

Performance of fund vs sector & index over 5yrs

Source: FE Analytics

The five FE fundinfo Crown rated Morgan Stanley Global Brands fund has made a total return of 100.68 per cent over five years, outperforming the MSCI World index (57.66 per cent) and IA Global peer group (45.45 per cent). It has an OCF of 0.96 per cent.

Stewart Investors Asia Pacific Leaders

The penultimate fund pick is FE fundinfo Alpha Manager David Gait and deputy manager Sashi Reddy’s Stewart Investors Asia Pacific Leaders fund, which has a significant overweight to healthcare, according to McDermott.

While the MSCI AC Asia Pacific ex Japan index has just a 5.4 per cent weighting in healthcare companies, the £5.8bn fund has 18.10 per cent of its portfolio invested in the sector.

Investing in around 50 large- and mid-cap companies the fund has a concentrated approach, with around 40 per cent of its value made up by just its top-10 holdings.

According to FundCalibre, the fund invests in quality sustainable companies over a long period and has a strong valuation discipline, typically outperforming in falling markets.

Over the past five years it has made a total return of 38.27 per cent, besting the MSCI AC Asia Pacific ex Japan index (36.34 per cent).

It has an OCF of 0.88 per cent.

Polar Capital Global Healthcare Trust

McDermott’s final pick is a pure healthcare play, the Polar Capital Global Healthcare Trust, which focuses on companies in four sub-sectors: pharmaceuticals, biotechnology, medical technology and healthcare services.

Managed by Gareth Powell and James Douglas the co-manager said in discussion with FundCalibre: “The long-term impact on healthcare from this pandemic could be significant and points to a positive outlook for the sector on a one-to-five-year view,” said managers Gareth Powell and James Douglas. “Healthcare infrastructure will be reviewed after this and will likely pull forward a significant period of investment.

“New technologies are also likely to be embraced at a much faster pace to drive change in the future delivery of care.”

The management team split the trust into two sides, growth and innovation with 90/10 split. The bigger growth portion is made up of the large-cap holdings, with the latter populated by medium and smaller companies that have the potential for greater growth in the long run.

Over five years, the £323m Polar Capital Global Healthcare Trust has made a total return of 44.44 per cent, an underperformance of the seven-strong IT Biotechnology & Healthcare sector (52.93 per cent) and the MSCI ACWI/Healthcare benchmark (71.59 per cent)

The trust is 10 per cent geared, has an ongoing charge of 1.13 per cent and is trading at a 6.4 per cent discount to net asset value (NAV), as at 18 May.