While the parting of ways between Invesco and Neil Woodford protégé Mark Barnett might have been long overdue in some people’s eyes, there are still a number of investors left holding the well-known funds that he oversaw.

Following a review of the UK equity offering, new Invesco chief investment officer Stephanie Butcher announced Barnett would leave the asset manager after 24 years, handing over the flagship Invesco Income and Invesco High Income strategies to new managers.

The departure followed disappointing performance of the income strategies as the manager stood by bets on a domestic recovery – after years of Brexit uncertainty – and his value style remained out-of-favour.

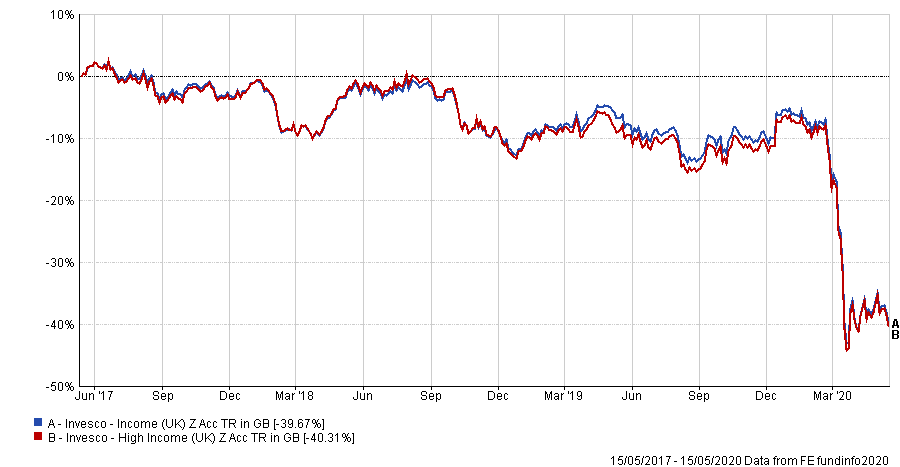

Over the past three years, Invesco Income has made a loss of 39.67 per cent, while Invesco High Income is down by 40.31 per cent.

Performance of funds over 3yrs

Source: FE Analytics

James Goldstone and Ciaran Mallon will take over the Invesco Income and Invesco High Income funds.

Tom Sparke, (pictured) investment manager at GDIM Discretionary Fund Managers, said taking over the mantle from the UK’s most famous fund manager was “never going to be easy” for Barnett.

“The funds, despite a sizable reduction when Neil Woodford left, were still very large and this therefore constrained the investment strategies that could be pursued by anyone taking them on,” he explained.

“From working closely alongside his former mentor for some time, it is not a surprise that the style did not change drastically, but the funds suffered from similar biases and larger weights to some key areas.”

Rob Morgan, pensions and investment analyst at Charles Stanley Direct, said the funds would likely see a major overhaul to “rebuild and redefine” Invesco’s UK equity income range.

“While that is no bad thing necessarily I would prefer the certainty of an alternative fund where the style and philosophy are already familiar,” he added.

Morgan said that while it would be tempting for investors to opt instead for a top-performing alternative like the £3.2bn Evenlode Incomed fund, such a switch would mean a complete change in style from value-orientated areas to “better quality and more expensive cash compounding type stocks”.

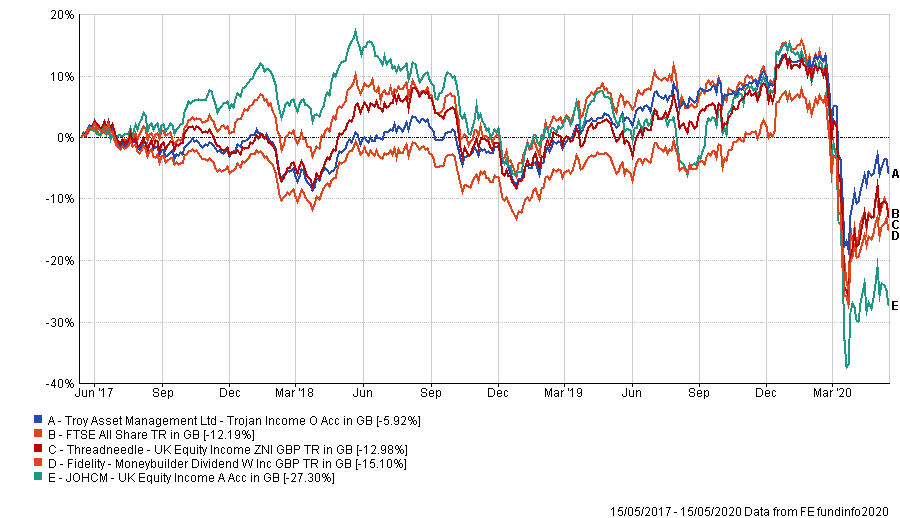

“A more like-for-like swap would be JOHCM UK Equity Income,” said Morgan (pictured). “This shares some similarities with Barnett’s strategy as it incorporates a more contrarian UK domestically focused portfolio and there is a decent longer-term record of the managers’ stock selection adding value.”

The £1.8bn fund is managed by James Lowen and Clive Beagles who abide by a strict dividend yield discipline, emphasising higher-yielding stocks and “a naturally contrarian style”, according to JO Hambro Capital Management. Unlike many of its peers, it also has significant holdings in the mid- and small-cap sector. Over three years the fund has made a loss – in total return terms – of 27.3 per cent, compared with a 12.19 per cent fall for the FTSE All Share. It has an historic yield of 7.06 per cent.

Morgan added: “It has had a tough time this year but there may be greater potential for a rebound on better economic news compared with more defensive options in the sector.”

Performance of funds vs index over 3yrs

Source: FE Analytics

Source: FE Analytics

GDIM’s Sparke said that investors in Barnett’s funds looking for something similar should consider the Fidelity MoneyBuilder Dividend fund overseen by Michael Clark and Rupert Gifford, “which is run on a comparable mandate but is much smaller in size”.

The £575.2m fund targets income and long-term capital growth. It is biased towards larger companies able to withstand tough economic times, generate high cash flows to fund future growth and pay out increasing dividends over time; or, ‘safety of income at a reasonable price’.

Over three years, Fidelity MoneyBuilder Dividend has made a loss of 15.1 per cent. It has a historic yield of 6.09 per cent.

For investors looking for something different, Sparke said they should consider Trojan Income – a well-regarded, high-conviction strategy overseen by FE fundinfo Alpha Manager Francis Brooke and co-managers Hugo Ure and Blake Hutchins. It has made a loss of 5.92 per cent over three years and has a yield of 4.19 per cent.

Adrian Lowcock, head of personal investing at platform Willis Owen, said alternatives such as Richard Colwell’s Threadneedle UK Equity Income strategy might be a good bet.

“Colwell is one of the best-known specialists in this sector,” he explained. “He has the flexibility to invest in both growth and value style ideas to meet his objective of capital return along with a steady income.

“The primary focus is on stock selection and Colwell holds a blend of high-quality companies with strong cash generation and out-of-favour companies with recovery potential, some of which may not currently pay a dividend.”

Lowcock added: “The fund is unconstrained but is predominantly invested in large blue-chip companies although Colwell will take significant sector bets against the index to match his thematic views.”

Threadneedle UK Equity Income has made a loss of 12.98 per cent over the past three years and has a historic yield of 5.5 per cent.