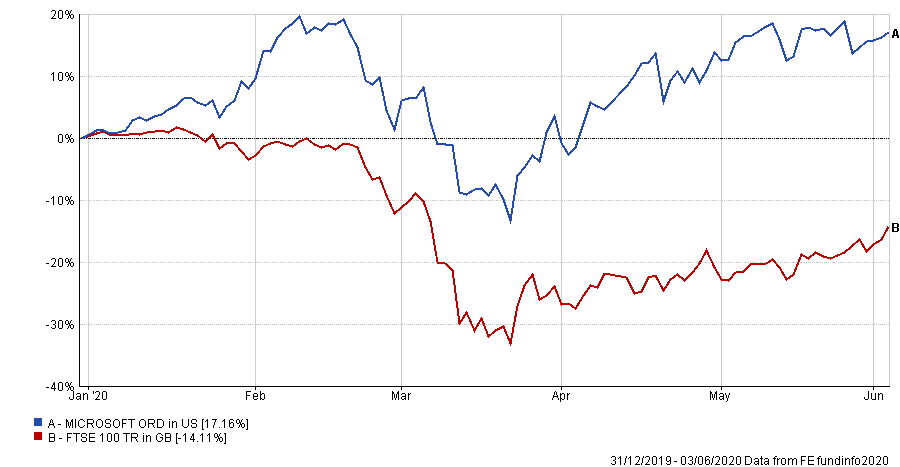

Covid-19 has been disastrous for some industries, even affecting the stalwarts of traditional defensive stocks. However, as Microsoft continues to thrive under these conditions, is it inconceivable that it could eventually surpass the market cap of the entire FTSE 100?

Analysts at ValuAnalysis have examined this very issue and argue that a small group of companies are pulling away from their peers but none with more precision and relentlessness than Microsoft, which has all the components in place to keep rising in value.

Performance of Microsoft vs FTSE 100 over 2020

Source: FE Analytics

A new paradigm for market segmentation

“The 2020 pandemic is leaving a trail of confusion among market watchers. The traditional market segmentations, be it growth, value, cyclical or defensive are exposing their meaninglessness conspicuously,” noted the ValuAnalysis team.

They have identified four stages of performance divergence, ranging from the industries hit directly by social distancing such as travel and hospitality to those that directly benefit, like electronic gaming and digital economy implementors. In between there are a combination of indirectly hit sectors and resilient businesses within healthcare, staples and technology.

“The idea that the consequences of the crisis might be brushed away in a couple of quarters is baffling,” they outlined. “The uncertainty at corporate level for planning, the re-thinking of property investment for downtown corporate locations are so deeply disruptive.”

In the time of decelerating growth, the new market segmentation will be characterised by those who can protect their operating assets and sustain their level of economic rent. Combined, unfortunately, with those who can’t.

Microsoft the steady winner

“If Amazon is the hare of a post-Covid economy, then Microsoft is the tortoise,” the analysts remarked.

Referring to its relentless consolidation and dominance in the corporate world, they noted that the market capitalisation of Microsoft, at $1.4tn, is just behind the market value of the entire FTSE100, at $1.6trn.

“Corporations produce value through growth, economic rent and capital employed, which are combined to produce free cash flow, which is valued in an ambient cost of capital to produce a market value,” they continued.

Covid-19 has been unique, as usually cyclical businesses will see their growth rate stutter temporarily. However, in these times they are experiencing a sustained structural challenge to the value of their operating assets and crucially to the sustainable level of their rent and growth rate.

“Only a handful of exceptional, ‘antifragile’ companies like Microsoft see these components unaffected, actually enhanced,” ValuAnalysis said. “They are likely to command a seemingly ‘inexplicable’ valuation multiple eventually.”

Economic rent

Economic rent refers to the yield that investors are able to extract from their normalised invested capital and is essentially the ratio of operating free cash flow to replacement value. The analysts at ValuAnalysis assess economic rent on its level, dynamics and sustainability.

In its research, the firm excluded low renting businesses in our universe, meaning that it sample of 300 global stocks has a rent of 12 per cent, which is much higher than the broader market.

“The level of Microsoft’s rent is phenomenally high, more than twice the sample average and more than four times the cost of capital,” they said, highlighting the tech stock’s economic rent of 29 per cent.

“Whilst theory suggests that a high rent is vulnerable because it attracts more competition, a high rent level, even if fading, is valuable because it allows the company to accrue value at a high clip either to reinvest in its competitive advantage or in growth.”

In terms of dynamics, Microsoft’s rent has actually been increasing over the past couple of years on the back of factors such as its rapidly growing Azure cloud business.

The sustainability of Microsoft’s rent is increasingly strengthened due to its exposure to secular trends such as the digitalisation of processes, increased working from home and accelerated migration to the cloud from legacy systems. This results in increased competitive advantage and more sustainable economic rent.

“Two years of digitalisation have taken place in two months,” said Microsoft chief executive officer Satya Nadella.

Growth

Whilst other businesses have seen rising costs and decreased productivity, Microsoft’s three main business segments remain relatively insulated: businesses processes, cloud and personal computing.

“Microsoft is exposed positively to the tectonic shifts that are shaking the corporate world, pre- and even more so post-Covid,” the analysts said.

Technology spend as a percentage of GDP is projected to double over the next decade. Over that time frame, the team at ValuAnalysis have factored that GDP growth would average 2.5 per cent globally.

This culminates in a 10.7 per cent annual average growth rate for Microsoft’s markets. Moving GDP growth to 4 per cent means the figure becomes 12.3 per cent.

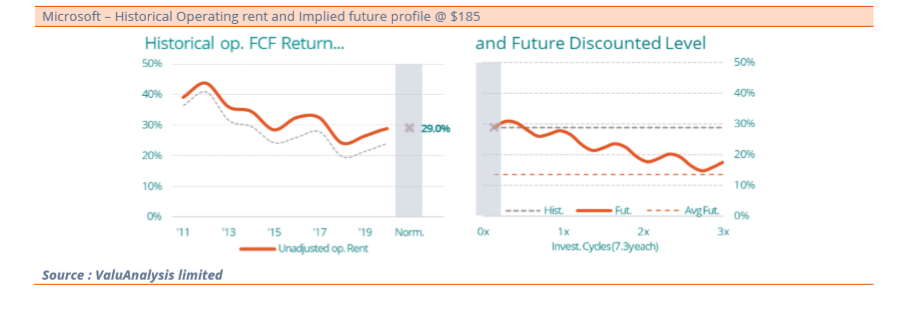

The potential model of future growth and rent is outlined below, using an 8 per cent average growth rate over the next decade, producing the implied profile of rent, with shares trading at $185.

Microsoft – historical operating rent and implied future profile $185

Source: ValuAnalysis Limited

“Whilst the left-hand chart simply shows the historical profile, the right-hand chart plots the future profile of rent derived from the current market value. Technically, it is an inverse discounted cash flow (DCF). At 8 per cent average trend growth until 2030,” ValuAnalysis’ team outlined.

Investors also expect a significant fade in line with historical trends and new corporate behaviour fostered by Covid-19.

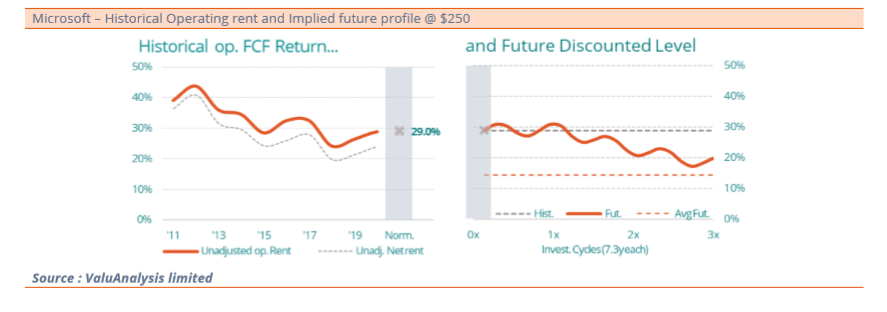

In the simulation below, trend growth is increased to 10 per cent on average for the next four years, and 9.6 per cent for the next decade.

The analysts have changed the rent profile as shown on the right-hand chart, allowing for a more accurate sustainable rent around current levels, before fading.

Microsoft – historical operating rent and implied future profile $250

Source: ValuAnalysis Limited

The average rent of the next four years comes out at 29.1 per cent, and 28.5 per cent for the next 10 years.

“After that, as the chart makes clear, the fade is more pronounced, at 4.4 per cent per annum. This relatively benign profile corresponds to a share price of $250, some 35 per cent more than the current share price,” they noted.

This would, of course, mean that Microsoft would be larger than the whole FTSE 100, unless the UK market was also able to pull off a similar level of growth over the coming years.

“Like a tortoise, Microsoft may well take its time to reach that point. Investors are still sceptical, it seems, that it might even ever get there,” ValuAnalysis finished. “Yet history and luck have gifted the company with exceptionally benign tail winds in an environment of hurricanes leading sometimes to devastation.”