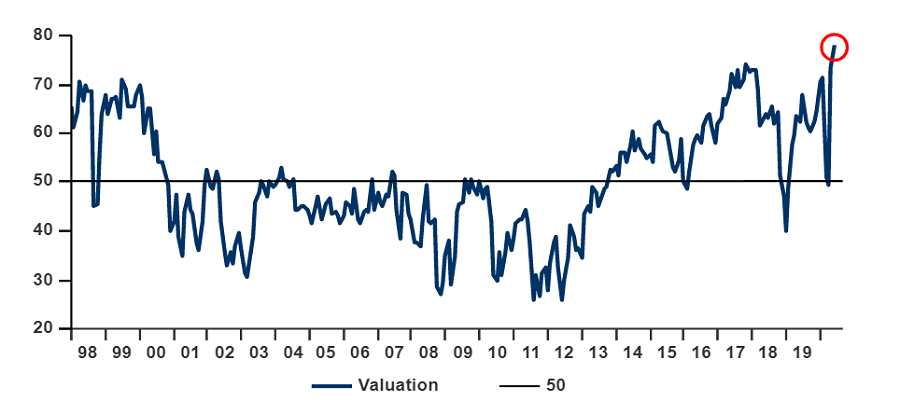

The number of fund managers who believe the surging stock market is looking expensive amid the coronavirus crisis has reached its highest level on record, a closely watched survey shows.

After their heavy falls in February as the coronavirus pandemic spread around the world, stock markets have rebounded in spectacular fashion with the MSCI AC World index climbing 23 per cent since its low point on 23 March.

Although many markets remain below where they started 2020, the latest edition of the Bank of America Global Fund Manager Survey found a net 78 per cent of asset allocators believe equities are now ‘overvalued’. This is the highest reading the bank’s valuation indicator since records started in 1998.

Equity over-valuation composite indicator

Source: BofA Global Fund Manager Survey, Bloomberg

The survey – which polled 190 fund managers running a total of $560bn between 5 and 11 June – did find some signs of growing confidence among investors.

For example, some 35 per cent of respondents think the global economy will get stronger over the coming 12 months. This is the highest reading on this indicator in 25 years.

In addition, more fund managers have increased the amount of risk they are taking in portfolios while the equity allocation rose 22 percentage points. Having been underweight, this takes funds to a net 6 per cent overweight on stocks and marks the first time they have been overweight since February.

At the same time, the average cash balance fell from 5.7 per cent to 4.7 per cent, which is around its 10-year average, as money was put to work after the coronavirus crash. Institutional investors such as pension funds and insurance companies appear to be the ones putting money into the market while retail funds still have more than 5 per cent of their portfolios sat in cash.

However, Bank of America added that asset allocators on the whole still appear to be more bearish than bullish despite a recent improvement in sentiment.

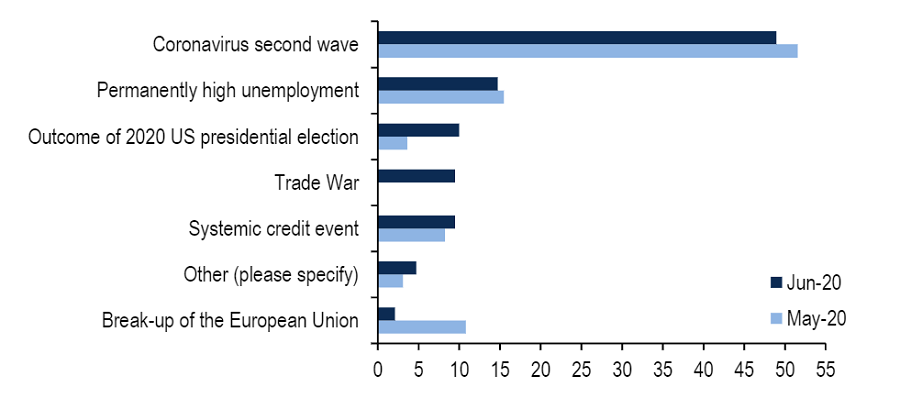

Fund managers’ biggest tail risks

Source: BofA Global Fund Manager Survey

As might be expected, a second wave of coronavirus is the tail risk that most fund managers are worried about at the moment, with 49 per cent citing this as their biggest worry.

This is far ahead of other concerns, such as permanently high unemployment (15 per cent), the outcome of the US presidential election (10 per cent) and the US/China trade war (9 per cent).

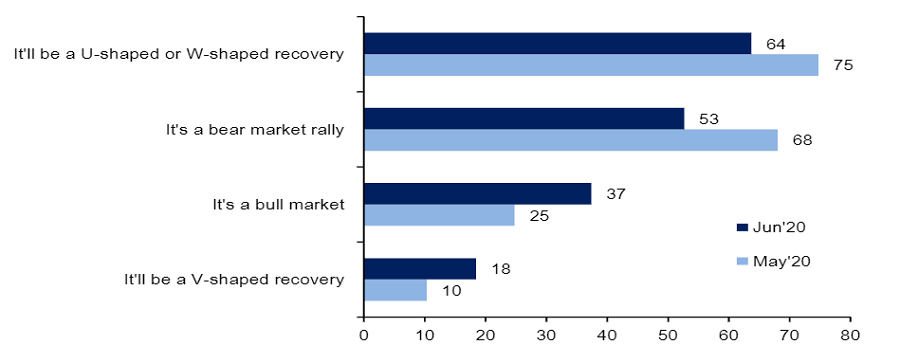

The worry about a second wave of the pandemic and the risk that economies could be forced back into lockdown later in the year mean that just under two-thirds of investors think the coronavirus recovery will take a U or W shape. Only 18 per cent are expecting it to be V-shaped.

Some 37 per cent of managers also think the recent surge in stock markets could be the start of a new bull market – although many more (53 per cent) are writing it off as a bear market rally.

Investors still more bearish than bullish

Source: BofA Global Fund Manager Survey

Their outlook for future returns also looks subdued. Two-thirds of the poll’s respondents believe the next decade will yield an annualised global equity return of between 0 and 5 per cent, with the weighted average return being 3.4 per cent.

In terms of positioning, this leaves fund managers with a big overweight to cash and smaller overweights to commodities and stocks. They are underweight bonds and real estate.

The US is the biggest overweight when it comes to regional equity allocations. A net 22 per cent of asset allocators are overweight US equities, which has led the recent rally and has unveiled a massive level of monetary and fiscal stimulus to tackle the coronavirus crisis.

Fund managers are overweight emerging market and European equities but are slightly underweight Japan. The UK remains the area that investors are avoiding by a significant margin, with funds running a net 29 per cent underweight.

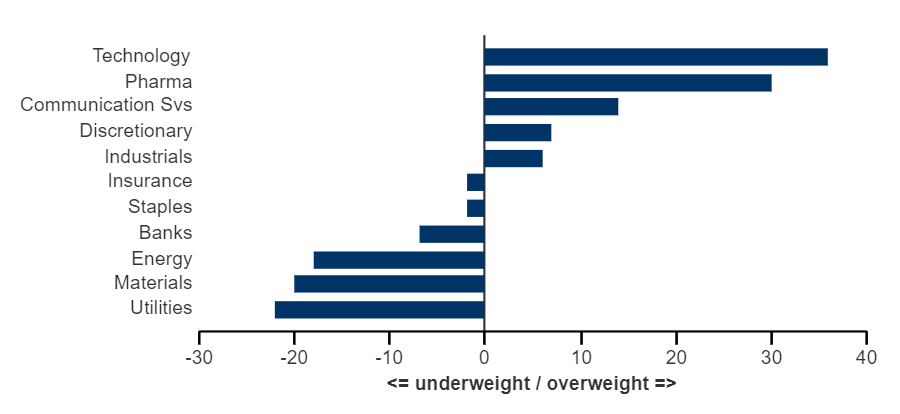

Global sector sentiment (% saying overweight - % saying underweight)

Source: BofA Global Fund Manager Survey

On a sector basis, technology, pharmaceuticals and communications remain the top three overweights in June although managers decreased their net exposure to these areas. Long US tech is also seen as the most crowded trade by fund managers (followed by long cash, long US treasuries and long gold).

Funds also moderated their underweights in materials and energy while reducing exposure to utilities – making it the most underweighted equity sector.