The Alternative Investment Market (AIM) celebrates its 25th anniversary this June having grown from just 10 companies to around 850 names, with more than 3.800 having raised over £115bn during that time.

The junior market of the London Stock Exchange, AIM was launched in 1995 to provide a market for smaller, earlier stage companies, giving them access to funding to fuel their growth.

Looking back over those past 25 years FundCalibre managing director Darius McDermott said that the so-called “millennial” market has had a disappointing run of returns.

Despite a few “gem stocks”, such as clothing giants ASOS and Boohoo or premium drink mixer manufacturer Fever-Tree, “overall, the AIM stock market has been disappointing for investors,” McDermott said.

“It has returned 18.1 per cent, with dividends reinvested,” he explained. “That’s just 0.7 per cent a year. In comparison, the FTSE All Share has returned 319 per cent - or 6.1 per cent per year.

“This is because while the AIM index has a lot of stocks with great potential, it’s had more than its fair share of duds and many companies that have failed to make a profit.

McDermott added: “Careful stockpicking has been crucial to making decent returns over the past quarter of a century.”

Although the quality of the companies listed has improved over recent years, the FundCalibre managing director added, with better regulation and market policing by nominated advisers (Nomads).

One of the more remarkable things about the AIM market however has been its performance in the coronavirus crisis recovery stage, according to McDermott.

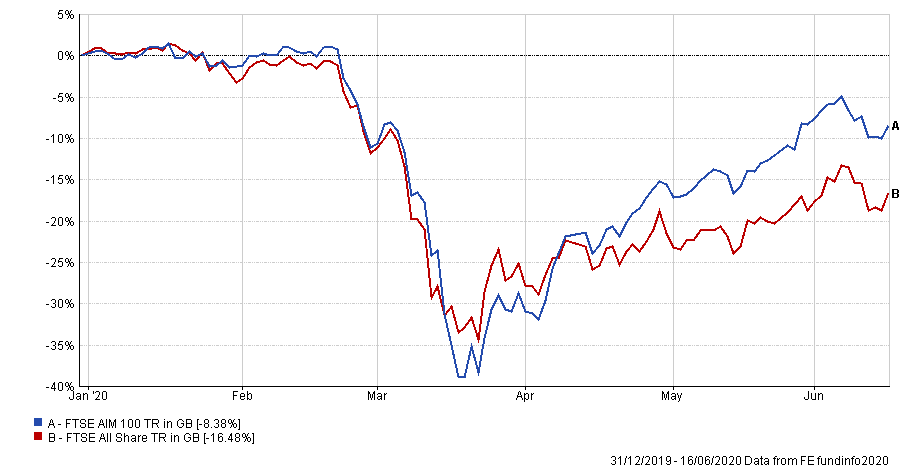

Falling further than the FTSE All Share index in the initial March sell-off the AIM market rallied much faster, now down 8.38 per cent year-to-date compared with the FTSE All Share’s 16.48 per cent loss.

Performance of indices YTD

Source: FE Analytics

This McDermott said is mainly due to the fact that the AIM index is highly diversified, whereas the FTSE All Share has major overweights in oil, mines, airlines and travel and leisure companies – all things that have taken a massive hit during the pandemic and haven’t yet recovered.

Also, the fact that the junior market is overweight to structural growth companies, which have rallied harder than value stocks.

“While standards have improved, this is still a market I think better left to the professionals. It’s an exciting area of the market, but fraught with danger and in-depth research is imperative,” McDermott said.

Below, the FundCalibre managing director highlights managers and funds that he believes have proved “adept” in picking stocks in the sector.

LF Gresham House UK Micro Cap

First is £239.1m LF Gresham House UK Micro Cap fund, which is run by a company that is also listed on the AIM market.

Calling this a “genuine UK micro-cap fund”, FundCalibre analysts noted that managers Ken Wotton and Brendan Gulston running “a very different portfolio to anything else in the sector”, investing just over two-thirds of its portfolio in the space.

Investing in what is considered a riskier market, the LF Gresham House UK Micro Cap fund has displayed the lowest volatility compared with its peers in the IA UK Smaller Companies sector since its launch in 2005, at 13.61 per cent.

It’s been a top-quartile performer over one-, three-, five- and 10-year periods (to 17 June) but seen performance slip more recently.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Looking over three years, the five FE fundinfo Crown-rated fund has made a total return of 22.60 per cent, besting the IA UK Smaller Companies sector (3.78 per cent). It has an ongoing charges figure (OCF) of 0.98 per cent.

Liontrust UK Micro Cap

Run by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, alongside Matthew Tonge and Victoria Stevens, the team run their ‘proven’ Economic Advantage investment process– laid out in their much lauded £1.1bn Liontrust UK Smaller Companies and £5.5bn Liontrust Special Situations funds – for micro caps in the Liontrust UK Micro Cap fund. It has holds over 80 per cent of its portfolio in AIM stocks.

“It’s rare for a smaller companies fund to have such a well-defined and disciplined framework,” FundCalibre analysts noted.

“The alignment with management, focus on capital-light businesses which can scale quickly, and emphasis on company meetings are all very sensible. The team’s track record with other funds that use this process is outstanding.”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The five FE fundinfo Crown-rated fund has , has made the IA UK Smaller Companies sector’s best returns over three years, and is up by 32.42 per cent.

In comparison the average peer was up by 3.78 per cent and the FTSE Small Cap index lost 12.43 per cent. The £80.1m fund runs an OCF of 1.39 per cent.

TB Amati UK Smaller Companies

The £365.4m TB Amati UK Smaller Companies fund is overseen by veteran small-cap investor Dr. Paul Jourdan along with David Stevenson and Anna Macdonald who run a portfolio of 65-70 stocks focused on structural growth.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

It has made a total return of 24.35 per cent over three years, outperforming the IA UK Smaller Companies sector (3.78 per cent) and Numis Smaller Companies plus AIM (excluding investment companies) index loss of 9.17 per cent.

The five FE fundinfo Crown-rated fund has an OCF of 0.89 per cent.

Unicorn UK Smaller Companies

McDermott’s final fund pick is the £43.4m Unicorn UK Smaller Companies fund, which FundCalibre describes as “a small, flexible fund with a solid investment process and a highly competent team”.

Running a concentrated portfolio of around 40 holdings, the fund is managed by Simon Moon who looks for companies which are profitable at the time of investment and have a lasting competitive advantage, combined with both strong management and balance sheets.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over the past three years the fund has made a loss of 2.66 per cent, underperforming against the IA UK Smaller Companies (3.78 per cent) but outperforming the Numis Smaller Companies plus AIM (excluding investment companies) index loss of 9.17 per cent. It has an OCF of 0.87 per cent.