The Covid-19 pandemic has only increased the number of value opportunities in Japanese markets, according to AVI Japan Opportunities Trust portfolio manager Joe Bauernfreund, who says that many of the corporate trends at work in the market before the coronavirus struck have continued to play out.

Among the early wave of countries hit by the coronavirus, Japan has witnessed a very small death toll of 985 (as at 21 July), which is particularly low for a country with an older population.

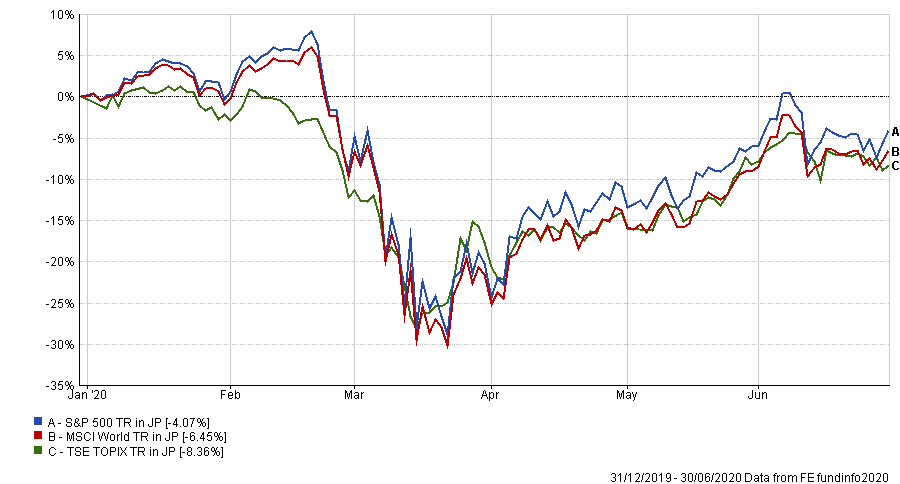

However, Japanese companies have not been unaffected by the pandemic with the Japanese Topix benchmark down 8.36 per cent year-to-date – in Japanese yen terms – compared with a 6.45 per cent fall for the MSCI World index and a 4.07 per cent drop for the S&P 500.

Performance of Topix vs MSC World & S&P 500 YTD in Japanese yen

Source: FE Analytics

Nevertheless, Japanese companies were well prepared for this crisis, the manager noted, highlighting the strong national savings culture.

“There is no corporate debt problem in Japan as it was so scarred by their own bubble bursting, businesses spent the following 20 to 30 years accumulating cash for a rainy day,” said Bauernfreund.

However, he said there needs to be a healthier balance between hoarding cash and maximising shareholder return.

It is one of the issues that prime minister Shinzo Abe has sought to tackle as part of his package of economic and corporate reforms – so-called ‘Abenomics’ – which aim to improve foreign investor sentiment towards an economy that has lagged other developed markets.

The recent fall in the Topix has served to underline the value opportunities in the Japanese market, according to the manager.

“We have been focusing on fundamental valuation metrics, which is important at a time when markets are panicking,” he said. “Particularly in small-cap names, you tend to get panic conspiring with less liquid stocks.”

One undervalued company, said Bauernfreund, is global elevator and escalator manufacturer Fujitec which makes up 9.5 per cent of the AVI Japan Opportunities Trust.

“It has a very attractive business model and revenue is secured by long term maintenance contracts,” the manager said.

Another undervalued asset is conglomerate SoftBank, which make up 5 per cent of the Japanese equity strategy.

The company made a big write-down of its investment in shared workspace company WeWork and has faced fresh scrutiny over its investment in German payments provider Wirecard, but Bauernfreund said investors could be overlooking more positive investments.

“The real story behind SoftBank is the substantial stake they hold in Alibaba,” said Bauernfreund. “It is currently trading at a discount wider than 50 per cent value of its assets, in March that discount ballooned out to around 75 per cent.”

Given the small-cap bias of the AVI Japan Opportunity Trust, Bauernfreund has also been finding a number of investment opportunities lower down the market-cap scale.

“There are a number of smaller companies with resilient operations that have been unaffected by lockdown,” he explained, adding that some companies have been marked down by investors even though profits have grown year-in, year-out.

And with investors increasingly focusing on high growth markets in China and the US, such opportunities are at risk of being overlooked.

“You can imagine that in the small-cap sector it’s doubly overlooked,” he added.

Nevertheless, the portfolio manager said negative attitudes towards Japan are outdated and investors could be missing out on some attractive opportunities.

“The reality is there are some great companies and remarkable valuations, combined attractive dividend yields,” he concluded. “Japan’s valuations stand out from the rest of the world and despite the global pandemic, that gap has only grown this year.”

Performance of trust vs sector over 3yrs

Source: FE Analytics

Over three years AVI Japan Opportunity Trust has made a total return of 5.21 per cent against a 4.44 per cent gain for the average IT Japanese Smaller Companies peer.

The £137.5m trust is 4 per cent geared, and is trading at a 1.6 per cent discount to net asset value (NAV). The management fee is 1 per cent of the trust’s market cap or NAV, whichever is lower.