Fresh Covid-19 outbreaks around the globe, low bond yields, record stimulus from the US Federal Reserve, and a weakening US dollar have all driven investors into gold, with a number of the strategies dominating July’s top performing funds.

July saw the price of the yellow metal rally over 13 per cent in US dollar terms and it continues to break all-time highs, showing no signs of stopping having risen almost 30 per cent year-to-date.

As many investors anticipate gold to break the $2,000 an ounce mark, precious metal funds have also benefited from the strong rally in silver which rose by 33 per cent to $24/ounce in July.

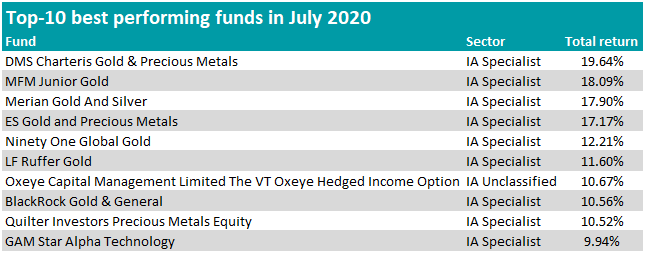

As such, eight of the top-10 performing funds of July have been gold and precious metal funds, according to data from FE Analytics.

The best performer was the £32m DMS Charteris Gold & Precious Metals fund run by Ian Williams, who attributes the performance to its high allocation to silver miners, and preference towards miners in the mid-cap space over large-cap mining stocks.

The £648m Merian Gold and Silver fund, run by Ned Naylor-Leyland, also benefited from the rise in silver prices with a large allocation to miners.

“Is it any surprise that gold has had an excellent run recently?” said Ben Yearsley, investment consultant at Fairview Investing. “Quantitative easing has been on steroids in recent months, which could be inflationary at some point and may well have a debasing effect on currencies.

“Added to that is the lack of any yield on cash and government bonds and for once the opportunity cost of holding gold is nothing. Many are suggesting gold powers on to $2,500.”

Another notable fund was the £1.5bn Blackrock Gold & General fund, the largest fund in the list, co-managed by Evy Hambro and FE fundinfo Alpha Manager Tom Holl.

The £4.8m Oxeye Hedged Income Option fund – an option-writing and short volatility strategy insuring portfolios against large market moves in either direction – was a non-precious metal fund making the top-10, with a 10.67 per cent return.

As was the £26.4m GAM Star Alpha Technology fund which benefited from a surge in tech stocks after a strong earnings season in July, making 9.94 per cent.

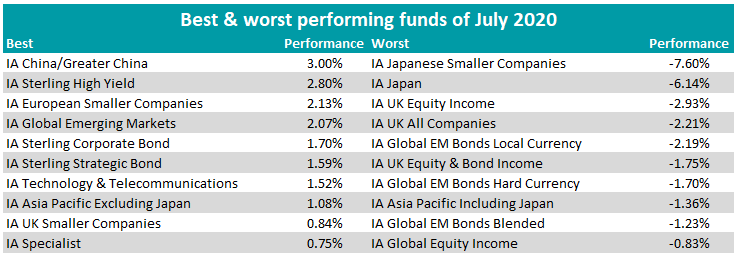

Despite tensions growing between the US and China, the IA China/Greater China sector was the best performing peer group, where the average fund made a 3 per cent return.

Fairview’s Yearsley said: “Despite a more muted return from China last month, it is clearly benefiting from being first in and first out of Covid 19.

“From an investment perspective I think Asia is well placed; lower debt levels, attractive valuations, and a better Covid response generally make for a good combination for longer term investors.”

Indeed, there were several actively managed funds in the sector posting strong returns, including the £46m New Capital China Equity fund which returned 9.78 per cent and the £1.3bn Allianz China A-Shares fund which returned 8.75 per cent for the month of July.

A notable trend amongst the sectors was the performance of bond funds which were at the top end of peer groups for the month, as fixed income payments continued to stream towards investors in a market directly supported by the US Federal Reserve.

The average IA Sterling High Yield fund returned 2.8 per cent, and the IA Sterling Corporate bond and IA Sterling Strategic bond peer groups also posted strong returns of 1.7 and 1.59 per cent respectively.

European small-cap strategies also performed well, with the average fund in the IA European Smaller companies returning 2.13 per cent in the month. While funds in the IA Global Emerging Markets sector benefited from strong performance in large geographic weightings in China and Brazil.

At the other end of the table were Japanese, UK equity and property fund sectors.

Some of the worst performing funds of July were Japanese strategies, with the IA Japanese Smaller Companies and IA Japan sectors down by 7.6 per cent and 6.14 per cent, with Yearsley highlighting a ‘double whammy’ of falling markets and rising sterling hitting these strategies.

Emerging markets bond sectors were also at the bottom end hurt by the deteriorating credit quality of developing countries perceived as less able to weather the economic damage caused by lockdowns.

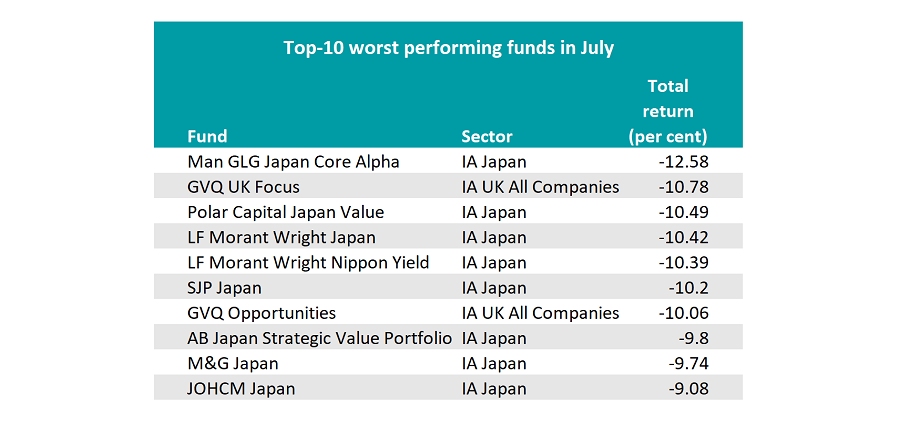

Given the poor performance of Japanese sectors in July, it’s little surprise to find eight of the top-10 worst-performing strategies were from the sector.

The £1.3bn Man GLG Japan Core Alpha fund was the worst performer of the month, posting a 12.58 per cent loss.

It was joined at the bottom by a number of other peers, some with a greater value focus, as the Topix benchmark made a 7.81 per cent loss in sterling terms.

The only non-Japanese equity funds in the top-10 worst performers were two UK equity strategies from GVQ – GVQ UK Focus and GVQ Opportunities down by 10.78 and 10.06 per cent respectively.

Both are managed by Alpha Manager Jamie Seaton and colleague Oliver Bazin and invest in undervalued UK companies using private equity valuation techniques to deliver performance over the medium term.