Having ‘skin in the game’ is prized in fund management, as wins and losses are mutually shared between managers and their investors.

Gabrielle Boyle has taken that to heart, revealing that all her wealth and that of her family is invested in the £545m Trojan Global Equity fund she manages.

Below, she reveals why the concentrated 28-stock portfolio meets all her needs and those of her family, who are also fully committed to the strategy.

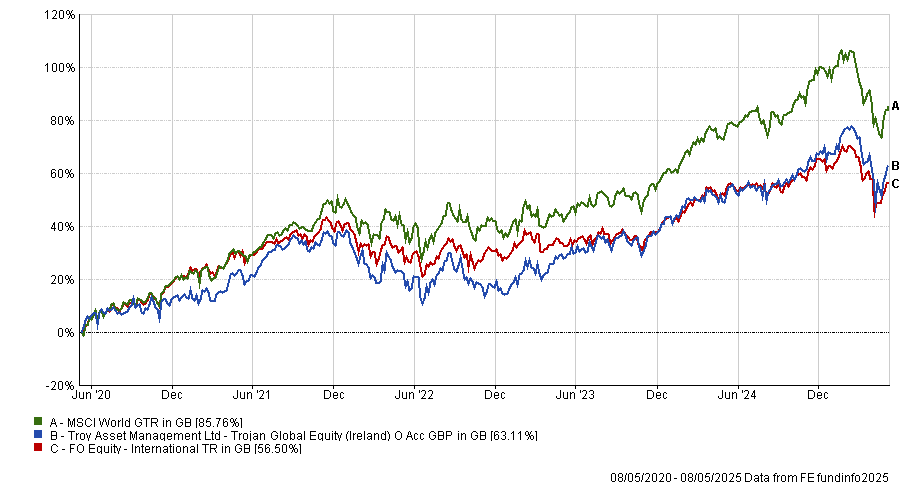

This has served them well so far, with the fund generating an average return of about 12% annually since inception in March 2006 and ranking in the first quartile of its peers over the past one, three and 10 years (and second quartile over five).

Performance of fund against index and sector over 1yr

Source: FE Analytics

Please describe your philosophy

Troy’s ethos is to protect and grow our investors’ capital. While this principle still holds, the Trojan Global Equity fund differs in that it is fully invested in global equities.

The portfolio is built on the premise that equity markets tend to underestimate the longevity and the compounding power of really rare and special businesses that can grow at high rates of return overtime. What we try to do is find those companies, not pay too much for them and then let them do the work for us, benefitting from the compounding of their earnings and cashflows over time.

What does that mean in practice?

We actively avoid fragile businesses, companies that are very capital intensive or have low margins. Instead, we prefer resilient companies that have high barriers to entry, clearly demonstrated competitive advantages and are highly financially productive, with high operating margins and very high pre-cashflow rates.

Throughout my career, the defining feature has been technological change, so we want companies that embrace change by reinvesting consistently in innovation.

How has the strategy evolved over time?

Historically, we owned companies that were slower-growing and more capital intensive. In the early days of the strategy, for example, we would have had significant exposure to consumer staples companies and we would have said that some of these companies, for example Colgate, were a poster child of what we aim to do.

Over time, the bar for what good looks like has risen and we have found better opportunities in companies such as Visa, Alphabet and Microsoft, which are unbelievably profitable, have been growing at very high rates and have got very high free cashflow margins. That's been a key part of the evolution of the of the fund.

Are these companies more expensive to buy?

We place a lot of importance on not paying too much for these companies – it goes back to our heritage at Troy, where we don't want to expose our investors to huge amounts of valuation risk.

We are not paying a significant premium for high financial productivity and high growth rate. The free cashflow yield of our companies, which is what we tend to focus on as a valuation metric, is higher than the average company in the index.

What were your best and worst calls of the past year?

It’s been a ‘last will be first’ situation – some of our stocks, which were disappointing last year, have been fantastic this year.

As a case in point, Heineken was disappointing last year but it's been one of our best performing shares this year, with a base contribution of 0.8 percentage points (pp) over the year-to-date and 0.3pp over 12 months.

Healthcare companies have been a driver of returns over the past couple of years and in a relative sense, they've been really very resilient this year.

In terms of what has hurt, it’s no surprise that some of our technology names, including Alphabet, Adobe and Microsoft, have sold off along with the broader sell-off in technology, with Alphabet losing the most year to date (-1.4pp). Diageo has also been a drag (-0.4pp).

Why should investors pick this fund?

The reason why my family and I have all our money in this fund is because it generates consistent capital growth over the long term without taking undue risk.

It's a buy-and-hold fund and you will go through periods of volatility, but if you're prepared to take a long-term investment horizon, you should expect to get a very good return without having to stress too much.

Is all your money truly only invested in the 28 stocks you own in this fund?

We obviously have a house and all of that and we have some money invested in Troy, and but by far and away, the majority of our financial assets are invested in this fund; 28 stocks is all you need.

What do you do outside of work?

I have four children, so that keeps me busy. But my favourite hobby is riding horses – I particularly like cross-country jumping. I'm a trustee of a charity called South-East Rural Charitable Trust, where we raise money for local charitable causes by going out on a Saturday and jumping hedges and other natural obstacles across the beautiful Sussex countryside.