Investors put a total of £11.2bn into UK retail funds during the second quarter of the year, greater than total inflows for the whole of 2019, according to the latest data from the Investment Association (IA).

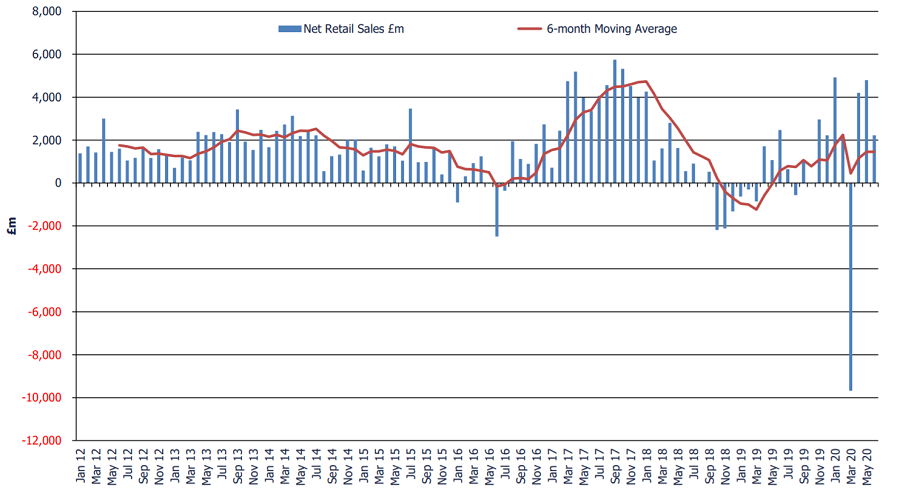

UK asset managers recorded a third consecutive month of positive net retail sales – after the record outflow of £9.7bn in March – in June, collecting £2.2bn in inflows.

The total for the second quarter was greater than net retail sales of £9.8bn recorded during full-year 2019 and meant that the total figure for the first half of 2020 stood at £8.7bn.

Net retail sales

Source: IA

Chris Cummings, chief executive of the IA, said: “Following the highest ever monthly outflow in March, the second quarter of 2020 saw savers invest more than they did throughout the whole of 2019.

“Sales rebounded strongly from April through to June to reach £11.2bn for the quarter, eclipsing 2019’s annual total of £9.8bn.”

The most popular sector during June was the IA Global sector, which captured inflows of £930m on top of the £2bn invested in the sector during May and June.

Adrian Lowcock, head of personal investing at investment platform Willis Owen, said: “The global sector continues to attract investors as funds in this space have focused on growth stocks and technology giants, wherever they may be listed.

“In a world of low interest rates, companies that offer above-trend growth look increasingly attractive and momentum in markets, supported by quantitative easing, is behind the biggest companies getting even bigger.”

However, UK equity funds remeained out of favour during the month with outflows of £1.1bn, including a £662m outflow from IA UK All Companies, £327m leaving IA UK Equity Income and £68m of net redemptions from the IA UK Smaller Companies sector.

“This could be down to a combination of factors – the UK lacks exposure to the big secular growth technology companies that have led the rally since lockdown and has a bias towards value stocks, particularly those areas most affected by this crisis,” noted Lowcock.

“With fear of the virus still high and regional lockdowns continuing, the confidence in the economic recovery has waned.”

Bond funds too were popular taking in £2.1bn in June, led by an £868m inflow to the IA Global Bonds sector.

Appetite for passive strategies also remains high with a £2.1bn net inflow during June, with total funds under management reaching £230bn and 18 per cent of the industry total – a new high.

Meanwhile, responsible investment funds continued to attract inflows of £669m in June 2020, with funds under management standing at £33bn at the end of June and accounting for 2.6 per cent of total funds under management – also a new high since the reclassification of the sector by the IA.

Cummings concluded: “With coronavirus infection rates now rising globally post-lockdown and US real GDP having contracted 32.9 per cent in Q2 – the highest ever fall – the outlook for fund flows for the second half of 2020 remains uncertain.”